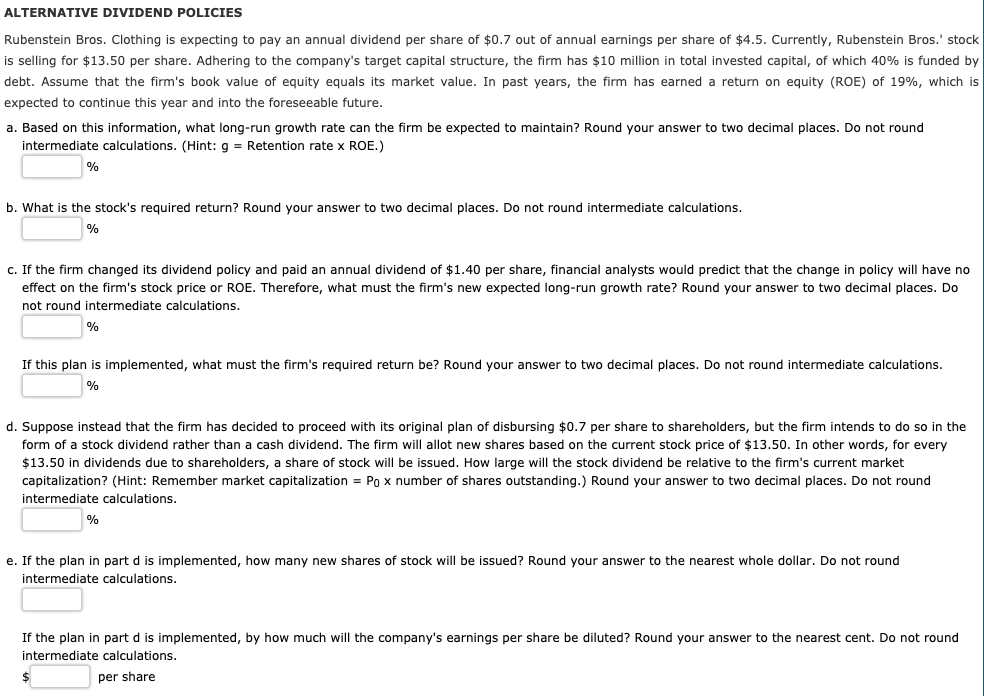

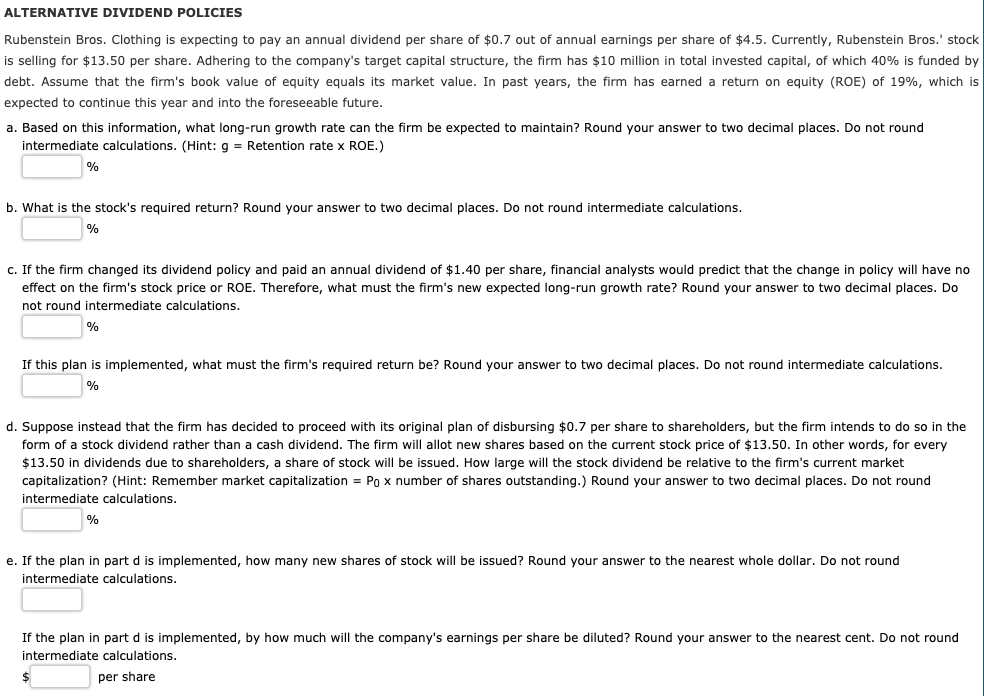

ALTERNATIVE DIVIDEND POLICIES Rubenstein Bros. Clothing is expecting to pay an annual dividend per share of $0.7 out of annual earnings per share of $4.5. Currently, Rubenstein Bros.' stock is selling for $13.50 per share. Adhering to the company's target capital structure, the firm has $10 million in total invested capital, of which 40% is funded by debt. Assume that the firm's book value of equity equals its market value. In past years, the firm has earned a return on equity (ROE) of 19%, which is expected to continue this year and into the foreseeable future. a. Based on this information, what long-run growth rate can the firm be expected to maintain? Round your answer to two decimal places. Do not round intermediate calculations. (Hint: g = Retention rate x ROE.) % b. What is the stock's required return? Round your answer to two decimal places. Do not round intermediate calculations. % C. If the firm changed its dividend policy and paid an annual dividend of $1.40 per share, financial analysts would predict that the change in policy will have no effect on the firm's stock price or ROE. Therefore, what must the firm's new expected long-run growth rate? Round your answer to two decimal places. Do not round intermediate calculations. % If this plan is implemented, what must the firm's required return be? Round your answer to two decimal places. Do not round intermediate calculations. % d. Suppose instead that the firm has decided to proceed with its original plan of disbursing $0.7 per share to shareholders, but the firm intends to do so in the form of a stock dividend rather than a cash dividend. The firm will allot new shares based on the current stock price of $13.50. In other words, for every $13.50 in ivider due to shareholders, a share of stock will be issue large will the stock dend relative to the firm's current mark capitalization? (Hint: Remember market capitalization = Po x number of shares outstanding.) Round your answer to two decimal places. Do not round intermediate calculations. % e. If the plan in part d is implemented, how many new shares of stock will be issued? Round your answer to the nearest whole dollar. Do not round intermediate calculations. If the plan in part d is implemented, by how much will the company's earnings per share be diluted? Round your answer to the nearest cent. Do not round intermediate calculations. $ per share