Question

Alternatively, we can use the CAPM method to compute the cost of equity. iv) Data for the companys monthly historical prices during the 5-year period

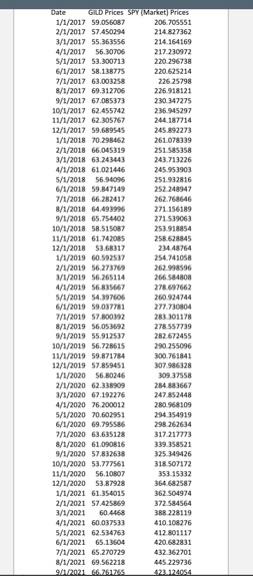

Alternatively, we can use the CAPM method to compute the cost of equity. iv) Data for the companys monthly historical prices during the 5-year period 01/01/2017- 12/31/2021 and the S&P500 ETF (ticker: SPY)1 monthly historical prices during the same period are already provided (originally from yahoo finance). Using the adjusted closing price for both series, calculate the monthly returns for the company and the S&P500. Show a snapshot of your work in this part (5-10 lines, not the entire series) in the appendix.

v) Calculate the variance of the market returns, covariance between market and the company. Then, calculate the companys beta.

vi) Use the CAPM formula to calculate the cost of equity. Assume that the riskless rate of 2% and the average market return of 8%. We can compare the costs of equity obtained using two different approaches and determine what to do with them.

vii) In many cases, we use the CAPM cost of equity. However, we may also take the average of the two values (cost of equities from (iii) and (vi)). What is the averaged cost of equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started