Answered step by step

Verified Expert Solution

Question

1 Approved Answer

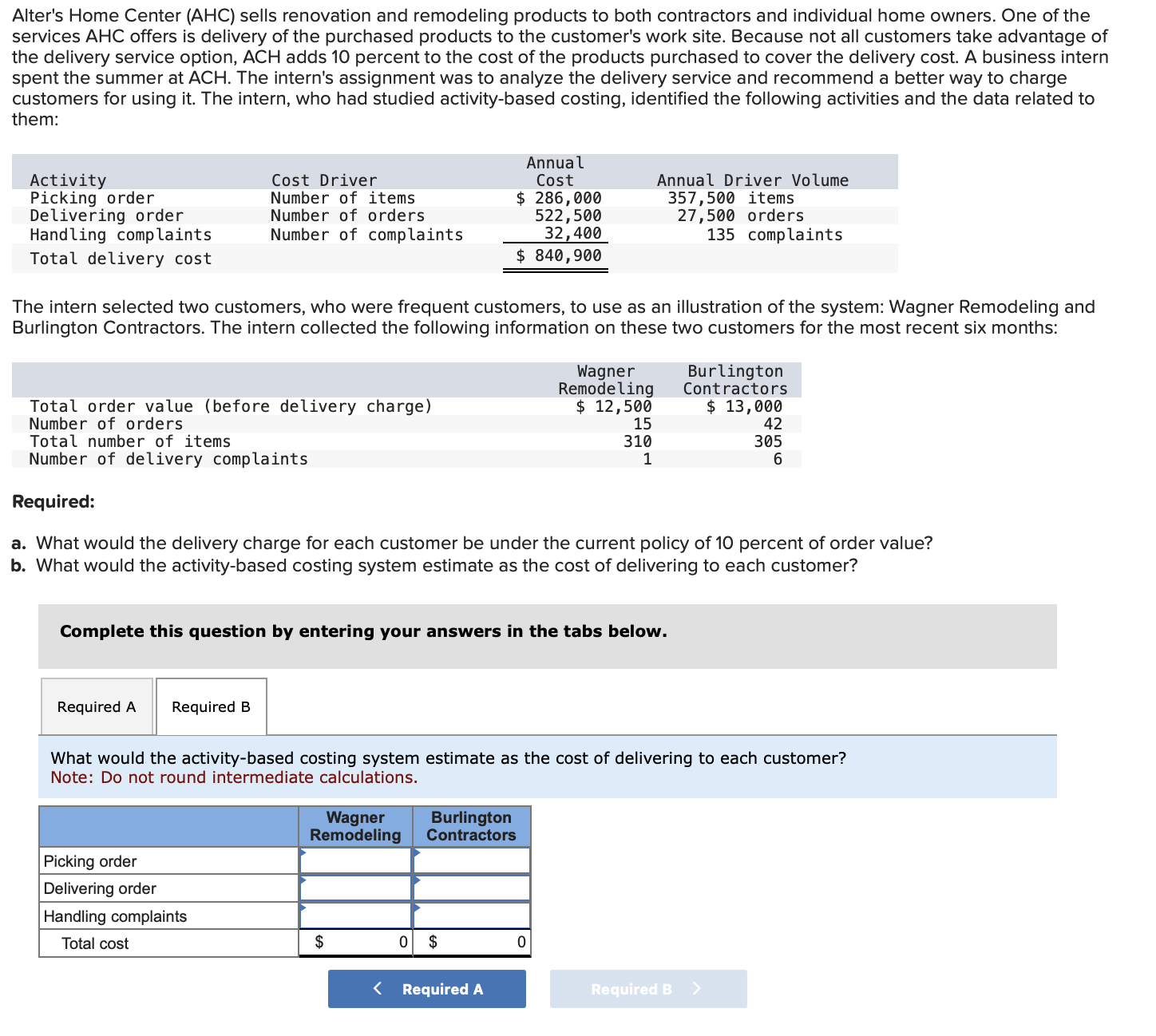

Alter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery

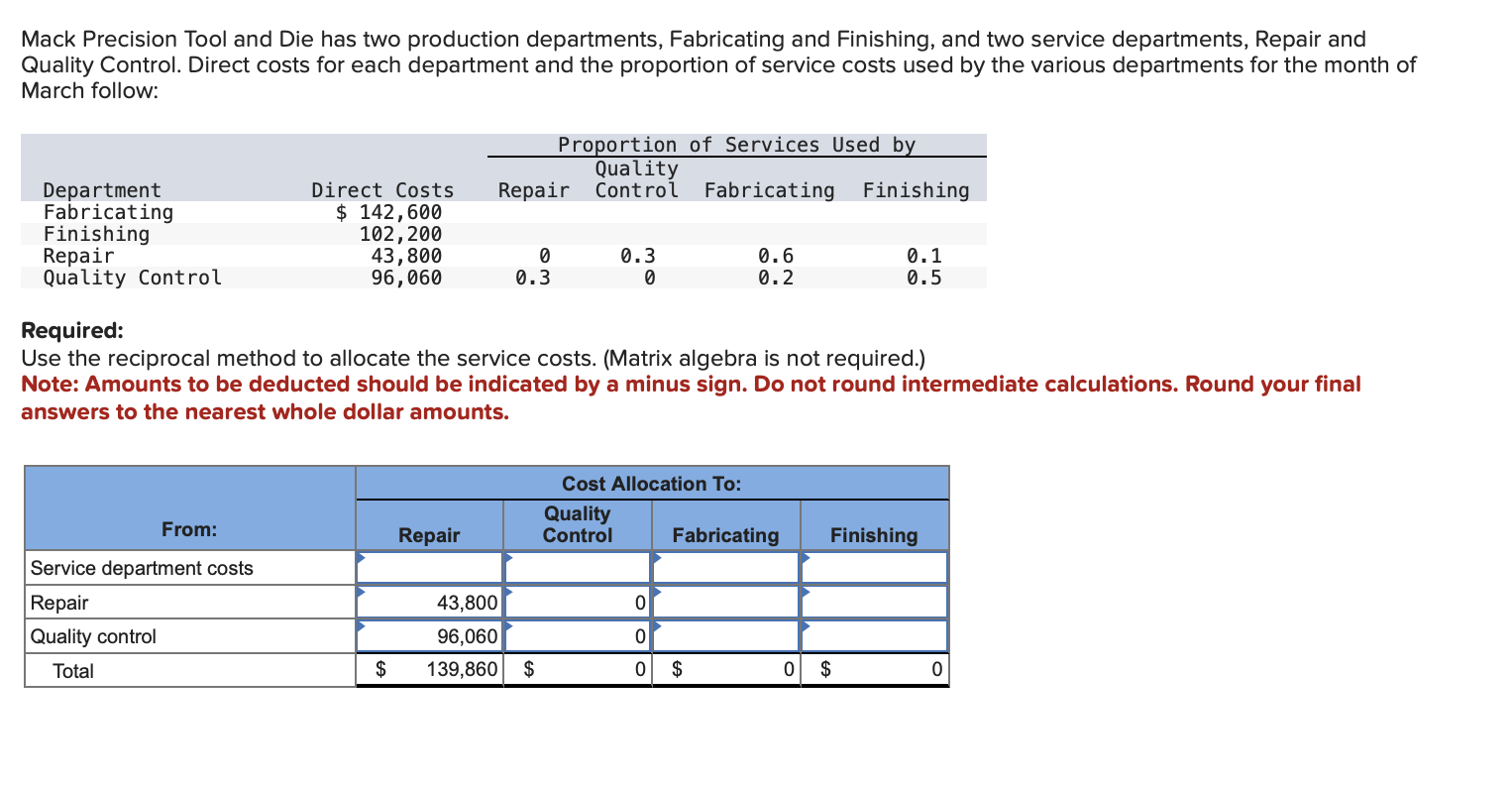

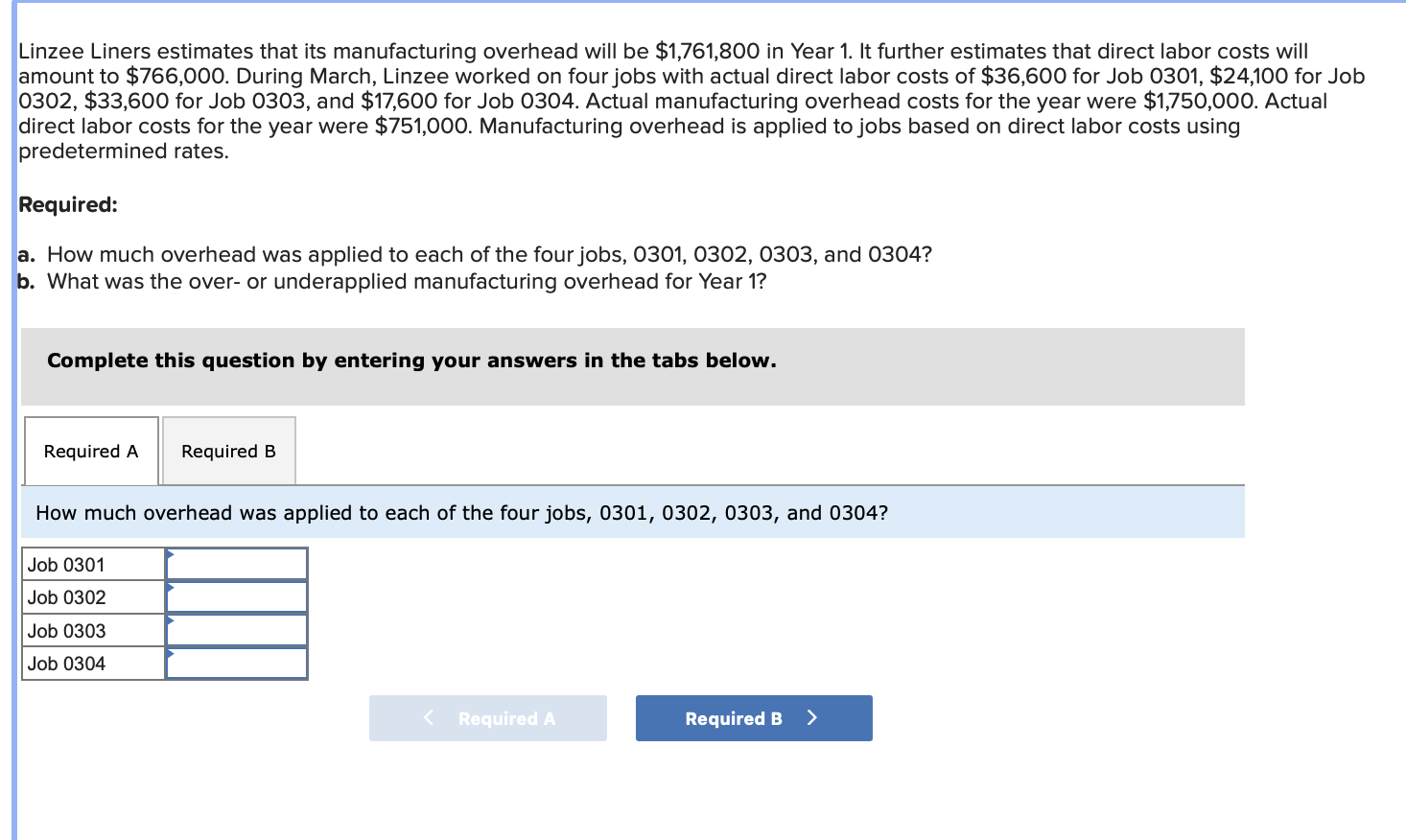

Alter's Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery of the purchased products to the customer's work site. Because not all customers take advantage of the delivery service option, ACH adds 10 percent to the cost of the products purchased to cover the delivery cost. A business intern spent the summer at ACH. The intern's assignment was to analyze the delivery service and recommend a better way to charge customers for using it. The intern, who had studied activity-based costing, identified the following activities and the data related to them: Activity Picking order Delivering order Handling complaints Total delivery cost Cost Driver Number of items Number of orders Number of complaints Annual Cost $ 286,000 522,500 32,400 $ 840,900 Annual Driver Volume 357,500 items 27,500 orders 135 complaints The intern selected two customers, who were frequent customers, to use as an illustration of the system: Wagner Remodeling and Burlington Contractors. The intern collected the following information on these two customers for the most recent six months: Total order value (before delivery charge) Number of orders Total number of items Number of delivery complaints Required: Wagner Remodeling $ 12,500 15 310 1 Burlington Contractors $13,000 42 305 6 a. What would the delivery charge for each customer be under the current policy of 10 percent of order value? b. What would the activity-based costing system estimate as the cost of delivering to each customer? Complete this question by entering your answers in the tabs below. Required A Required B What would the activity-based costing system estimate as the cost of delivering to each customer? Note: Do not round intermediate calculations. Wagner Burlington Remodeling Contractors Picking order Delivering order Handling complaints Total cost $ 0 $ 0 < Required A Required B > Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Proportion of Services Used by Quality Direct Costs Repair Control Fabricating Finishing Fabricating $ 142,600 Finishing 102,200 Repair Quality Control 43,800 96,060 0 0.3 0.3 0 0.6 0.2 0.1 0.5 Required: Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amounts. From: Repair Service department costs Repair Quality control Total Cost Allocation To: Quality Control Fabricating Finishing 43,800 0 96,060 0 $ 139,860 $ 0 $ 0 $ 0 Linzee Liners estimates that its manufacturing overhead will be $1,761,800 in Year 1. It further estimates that direct labor costs will amount to $766,000. During March, Linzee worked on four jobs with actual direct labor costs of $36,600 for Job 0301, $24,100 for Job 0302, $33,600 for Job 0303, and $17,600 for Job 0304. Actual manufacturing overhead costs for the year were $1,750,000. Actual direct labor costs for the year were $751,000. Manufacturing overhead is applied to jobs based on direct labor costs using predetermined rates. Required: a. How much overhead was applied to each of the four jobs, 0301, 0302, 0303, and 0304? b. What was the over- or underapplied manufacturing overhead for Year 1? Complete this question by entering your answers in the tabs below. Required A Required B How much overhead was applied to each of the four jobs, 0301, 0302, 0303, and 0304? Job 0301 Job 0302 Job 0303 Job 0304

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started