Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It was late October 2006 when Brad MacDougall, account manager at the Canadian Commercial Bank (CCB) in Baron, Ontario, reviewed a loan request for

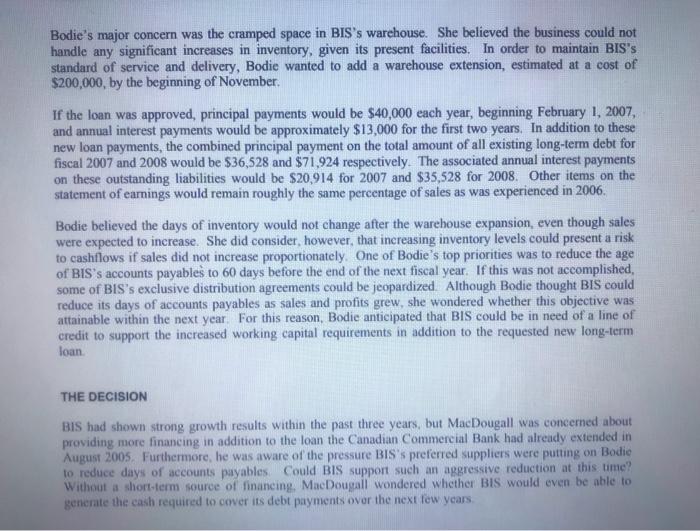

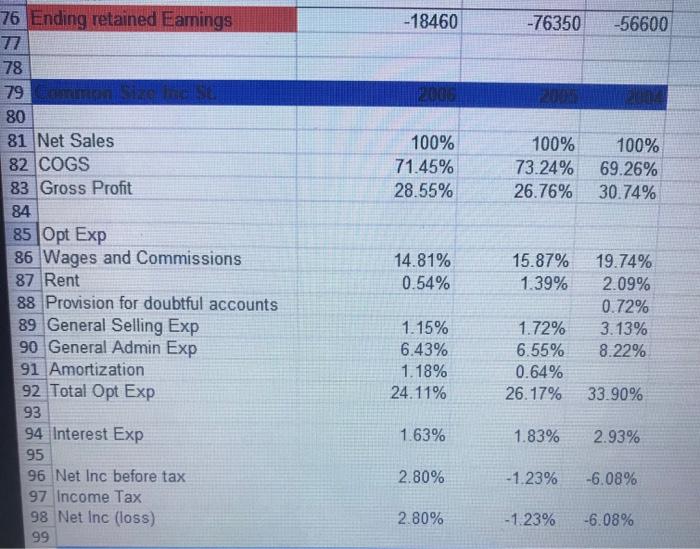

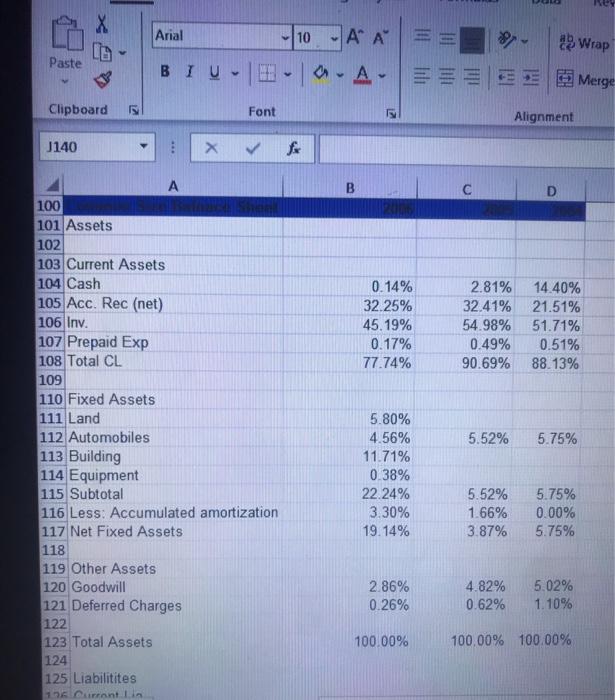

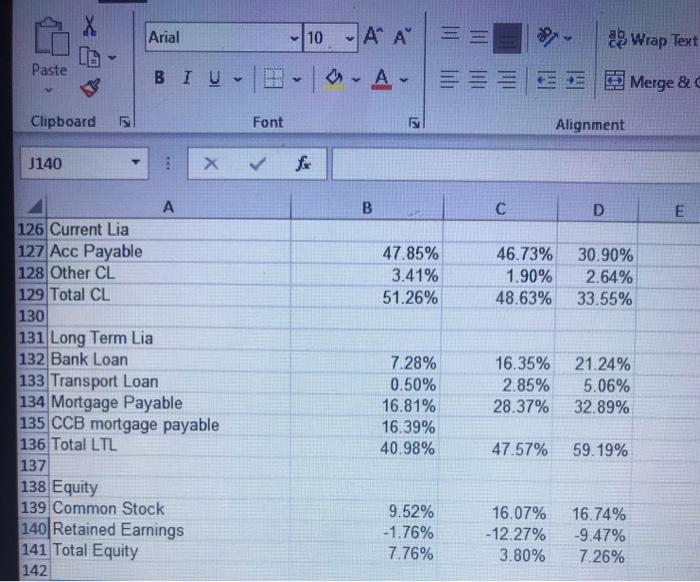

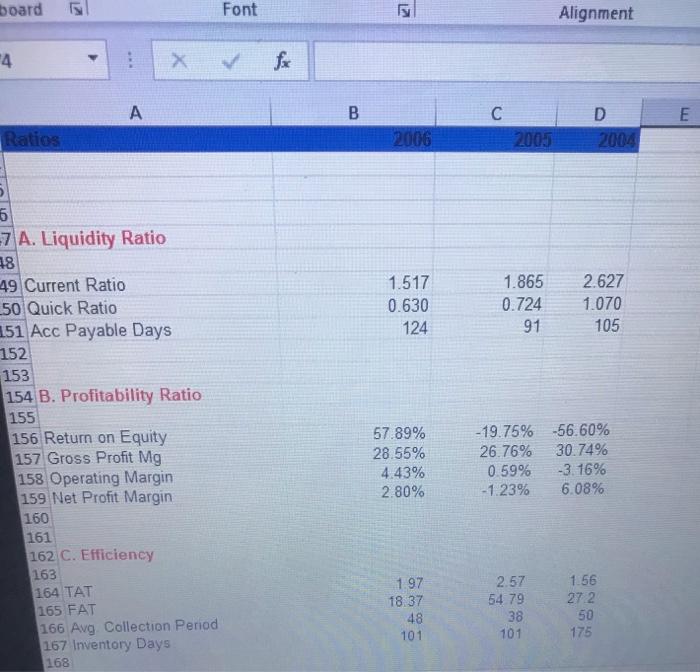

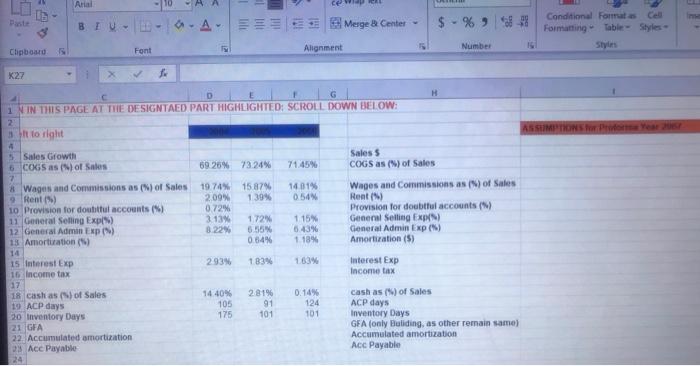

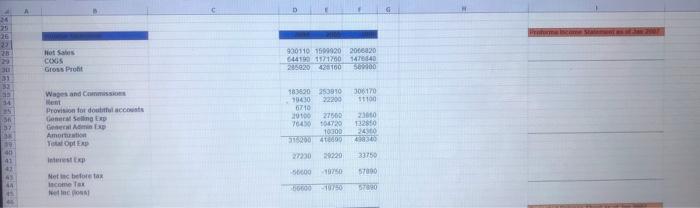

It was late October 2006 when Brad MacDougall, account manager at the Canadian Commercial Bank (CCB) in Baron, Ontario, reviewed a loan request for $200,000 from Liz Bodie. As owner of Bodie Industrial Supply Inc. (BIS), a distributor of commercial-grade tools, parts and equipment, Bodie requested the long-term loan to cover construction costs associated with a major expansion to BIS's warehouse. BIS was currently operating without a line of credit, and MacDougall wondered whether the business could generate enough cash to cover its expenses, including the new loan payments. MacDougall had to be thorough in his analysis because he knew Bodie was relying on financing from the bank for the expansion. COMPANY BACKGROUND In 2003, Liz Bodie purchased the business from its previous owner and changed the company's name to reflect its new ownership, Prior to acquiring the business, Bodie had worked for a variety of different companies, including one of BIS's current metropolitan-based competitors. During those years, it was Bodie's long-term ambition to operate her own business. Her first entrepreneurial venture was a franchised retail hardware store that she operated for several years before selling it to acquire BIS. Drawing on her work experience, Bodie expanded BIS into a full-service distributor of top-line, brand name, new and used certified machine tools, maintenance parts and related equipment for the construction, utility and farming markets. The company strove to uphold its reputation as the single source for all industrial equipment needs. Although BIS conducted business country-wide, BIS's hometown of Barron, approximately 100 kilometres northeast of a large metropolitan city, was currently the largest and fastest growing industrial centre in its region with a population of 135,000. BIS's customers were primarily the industrial maintenance departments of medium- to large-sized corporations in the manufacturing, commercial construction and engineering industries. BIS also attracted some high- margin retail business from farming communities and summer cottage trade in the surrounding area. Bodie was pleased with BIS's progress since she had purchased it and had experienced considerable success in growing sales. The business's success was such that in August 2005, BIS purchased its rented 9B06N021 Page 2 facilities when the landlord offered the property at what Bodie regarded as "a very attractive price." MacDougall had arranged the loan for the land and building purchase. The loan was currently in good standing with all payments up to date. BIS's success continued, and by June 2006, monthly sales volumes averaged more than $200,000. (See Exhibits I to 5 for historical financial data, cash flow statements, and selected company and industry financial ratios.) Bodie was also proud of the company's reputation for dependability and integrity. She believed her success was due largely to the personalized service and engineering advice she offered BIS's customers. Bodie also noted that an important factor in attracting new customers and building lasting relationships was BIS's success in obtaining exclusive rights to offer the products of some top-line brand-name manufacturers. She also believed that maintaining good supplier relations with those manufacturers who granted BIS exclusivity was a key element to future success. THE COMPETITION Until late 2005, BIS had been the only distributor of machine tools, parts and equipment in Barron. Minimal competition had come from salespeople operating from out-of-town warehouses, but in the fall of 2005, a new distributor opened in downtown Barron. Bodie believed that the new competitor would compete directly with only a small portion of her business because of BIS's exclusive brand distribution rights and complete line of specialized products. Additionally, this new distributor had not yet earned a reputation comparable to that of BIS for dependable service. Although not necessarily considered a direct threat, the entrance of big-box retailers did increase competition among Canadian wholesalers and retailers alike. Big-box retailers competing within the home improvement, construction and building maintenance industries, such as Home Depot, RONA and Lowes, opened stores from 3,500 square metres to 15,000 square metres in size. Not only did these retailers offer lower prices, but they also provided a wide variety of products for retail and commercial consumers. At present, there were three major retailers in Barron with a fourth scheduled to open in the coming months. Although these retailers did not carry specialized, large and commercial-grade industrial equipment, they did offer a wide selection of construction supplies typically used by many of BIS's smaller, higher margin accounts. Bodie was still uncertain how and to what extent mass retailers and wholesalers could influence the business Bodie believed a more eminent threat was the rapid growth of Internet-based selling. Many of BIS's competitors now had websites with online ordering and e-commerce capabilities that provided added convenience and quicker service to customers looking to order general use supplies. Online selling also reduced the need for customers to do business with a local supplier, potentially vastly increasing BIS's pool of competition. Although BIS did currently have a company website, it was purely informational. FINANCIAL PROJECTIONS FOR EXPANSION Although market information was limited, Bodie thought that BIS had about 35 per cent of the machine tool and equipment market in Barron and the surrounding region. Given the existing market potential, she believed sales could not increase beyond $4 million without expanding BIS's geographical market. For the next two years, she projected sales at $2.8 million for the year ending January 31, 2007, and $3.2 million for the year ending January 31, 2008. Appears as CC8 mortgage payable on the balance sheet secured by land and building Bodie's major concern was the cramped space in BIS's warehouse. She believed the business could not handle any significant increases in inventory, given its present facilities. In order to maintain BIS's standard of service and delivery, Bodie wanted to add a warehouse extension, estimated at a cost of $200,000, by the beginning of November. If the loan was approved, principal payments would be $40,000 each year, beginning February 1, 2007, and annual interest payments would be approximately $13,000 for the first two years. In addition to these new loan payments, the combined principal payment on the total amount of all existing long-term debt for fiscal 2007 and 2008 would be $36,528 and $71,924 respectively. The associated annual interest payments on these outstanding liabilities would be $20,914 for 2007 and $35,528 for 2008. Other items on the statement of earnings would remain roughly the same percentage of sales as was experienced in 2006. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before the end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. THE DECISION BIS had shown strong growth results within the past three years, but MacDougall was concerned about providing more financing in addition to the loan the Canadian Commercial Bank had already extended in August 2005, Furthermore, he was aware of the pressure BIS's preferred suppliers were putting on Bodie to reduce days of accounts payables. Could BIS support such an aggressive reduction at this time? Without a short-term source of financing, MacDougall wwondered whether BIS would even be able to generate the cash required to cover its debt payments ovor the next few years. 76 Ending retained Eamings -18460 -76350 -56600 77 78 79 80 81 Net Sales 82 COGS 83 Gross Profit 100% 100% 100% 71.45% 73.24% 69.26% 28.55% 26.76% 30.74% 84 85 Opt Exp 86 Wages and Commissions 87 Rent 88 Provision for doubtful accounts 89 General Selling Exp 90 General Admin Exp 91 Amortization 92 Total Opt Exp 14.81% 15.87% 19.74% 0.54% 1.39% 2.09% 0.72% 1.15% 1.72% 3.13% 6.43% 6.55% 0.64% 8.22% 1.18% 24.11% 26.17% 33.90% 93 94 Interest Exp 1.63% 1.83% 2.93% 95 96 Net Inc before tax 97 Income Tax 98 Net Inc (loss) 2.80% -1.23% -6.08% 2.80% -1.23% -6.08% 99 Rey Arial 10 A A Wrap Paste BIU-|.A-|=E Merge Clipboard Font Alignment J140 100 101 Assets 102 103 Current Assets 104 Cash 105 Acc. Rec (net) 106 Inv. 107 Prepaid Exp 108 Total CL 109 110 Fixed Assets 111 Land 112 Automobiles 113 Building 114 Equipment 115 Subtotal 116 Less: Accumulated amortization 117 Net Fixed Assets 118 119 Other Assets 120 Goodwill 121 Deferred Charges 122 123 Total Assets 124 125 Liabilitites 0.14% 2.81% 14.40% 32.25% 32.41% 21.51% 45.19% 54.98% 51.71% 0.17% 0.49% 0.51% 77.74% 90.69% 88.13% 5.80% 4.56% 11.71% 5.52% 5.75% 0.38% 22.24% 5.52% 1.66% 5.75% 3.30% 19.14% 0.00% 5.75% 3.87% 2.86% 4.82% 5.02% 0.26% 0.62% 1.10% 100.00% 100,00% 100.00% 126 Curront Lin Arial -A A Wrap Text v10 Paste BIU- |A-|=EE E Merge & C Clipboard Font Alignment J140 A D. 126 Current Lia 127 Acc Payable 128 Other CL 129 Total CL 130 131 Long Term Lia 132 Bank Loan 133 Transport Loan 134 Mortgage Payable 135 CCB mortgage payable 136 Total LTL 137 138 Equity 139 Common Stock 140 Retained Earnings 141 Total Equity 142 47.85% 46.73% 30.90% 2.64% 33.55% 3.41% 1.90% 51.26% 48.63% 7.28% 16.35% 21.24% 0.50% 2.85% 5.06% 16.81% 28.37% 32.89% 16.39% 40.98% 47.57% 59.19% 9.52% 16.07% -1.76% 7.76% 16.74% -9.47% 7. 26% -12.27% 3.80% board Font Alignment 4 fx A C D Ratios 2006 2005 2004 7 A. Liquidity Ratio 18 49 Current Ratio 50 Quick Ratio 151 Acc Payable Days 152 153 154 B. Profitability Ratio 155 156 Retu 157 Gross Profit Mg 158 Operating Margin 159 Net Profit Margin 160 161 162 C. Efficiency 163 164 TAT 165 FAT 166 Avg Collection Period 167 Inventory Days 1.517 1.865 2.627 0.630 0.724 1.070 124 91 105 -19.75% -56.60% 30.74% on Equity 57.89% 26.76% 28.55% 4.43% 2.80% 0.59% -1.23% -3.16% 6.08% 1.56 197 18.37 2.57 54 79 27.2 50 175 48 38 101 101 168 Arial Conditional Format as Cell $ - % 9 Inse - A- EEEE Merge a Center - Paste BIU Formatting Table Styles Alignment Number Styles Chpboard Font K27 1 N IN THIS PAGE AT THE DESIGNTAED PART HIGHLIGHTED: SCROLL DOWN BELOW: ASSUMPTIONS for Prodora Year 206 st to right 5 Sales Growth 6 COGS as (N) of Sales 7. Sales $ COGS as (%) of Sales 69 26% 73.24% 71.45% 8 Wages and Commissions as (%) of Sales 9 Rent () 10 Provision for doubttul accounts (%) 11 General Selling Expl%) 12 General Ader 13 Amortization (%) Wages and Commissions as (N) of Sales Rent () Provision for doubttul accounts (%) General Selling Exp(N) General Admin Exp (%) Amortization (S) 14.01% 0.54% 19 74% 1587% 2.09% 1.39% 0.72% 3.13% 8.22% 172% 6.55% 0.64% 1.15% 6.43% 1. 18% Exp (N) 14 15 Interest Exp 16 Income tax 17 18 cash as (S) of Sales 19 ACP days 20 Inventory Days 21 GFA 22. Accumulated amortization 23 Acc Payable 24 Interest Exp Income tax 293% 183% 163% cash as () of Sales ACP days Inventory Days GEA (only Buliding, as other remain same) Accumulated amortization Acc Payable 281% 91 14 40% 0.14% 105 175 124 101 101 24 25 26 Income Statanent Not Sales COGS Gross Proht 930110 159020 200ea20 644190 1171760 147640 20020 42160 Wages and Conmissons Ment Provision tor doutttl accousts General Selling Exp General Admin Exp Amortuation Yotal Opt Exp 183620 253910 70430 306170 11100 22200 6710 20100 27560 7640 104720 10300 230 13280 240 Interest Exp 27230 2220 33750 Net inc before tax ecome Tax Net ec ona 19750 57000 50750 57890

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started