Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Get It Right, CPAs, has been retained to review its client's corporate formation calculations for 20XX. Maria, Roger, and Novak created Grassroots Tennis, Inc.

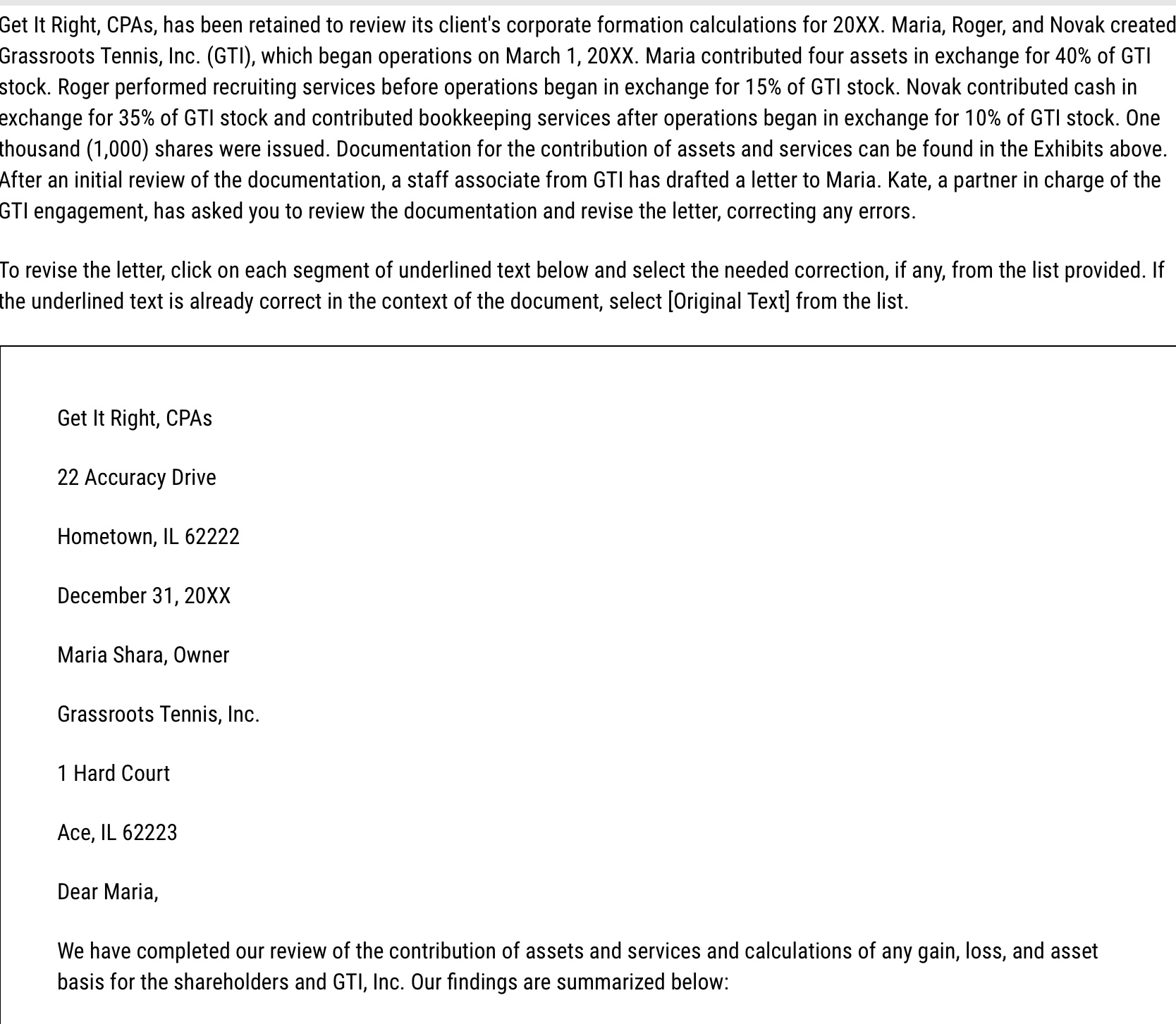

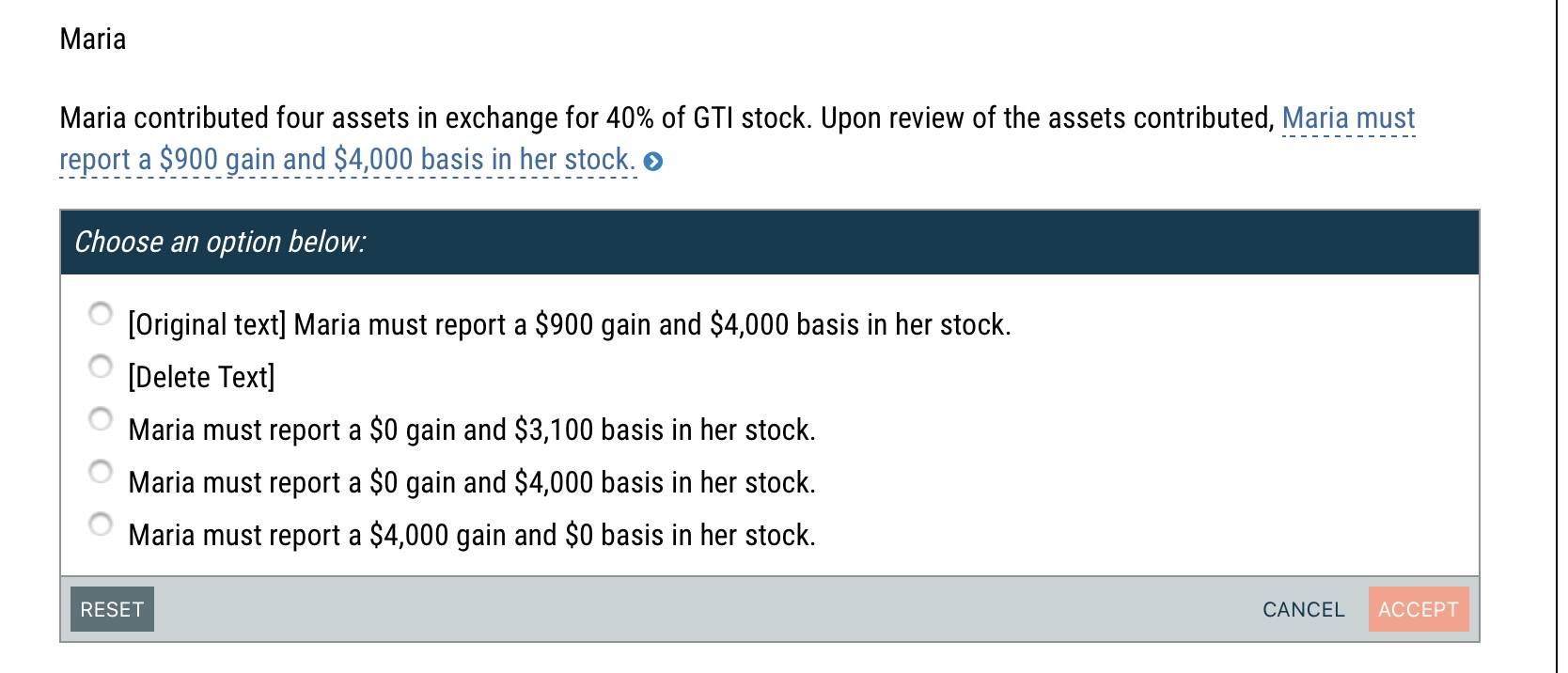

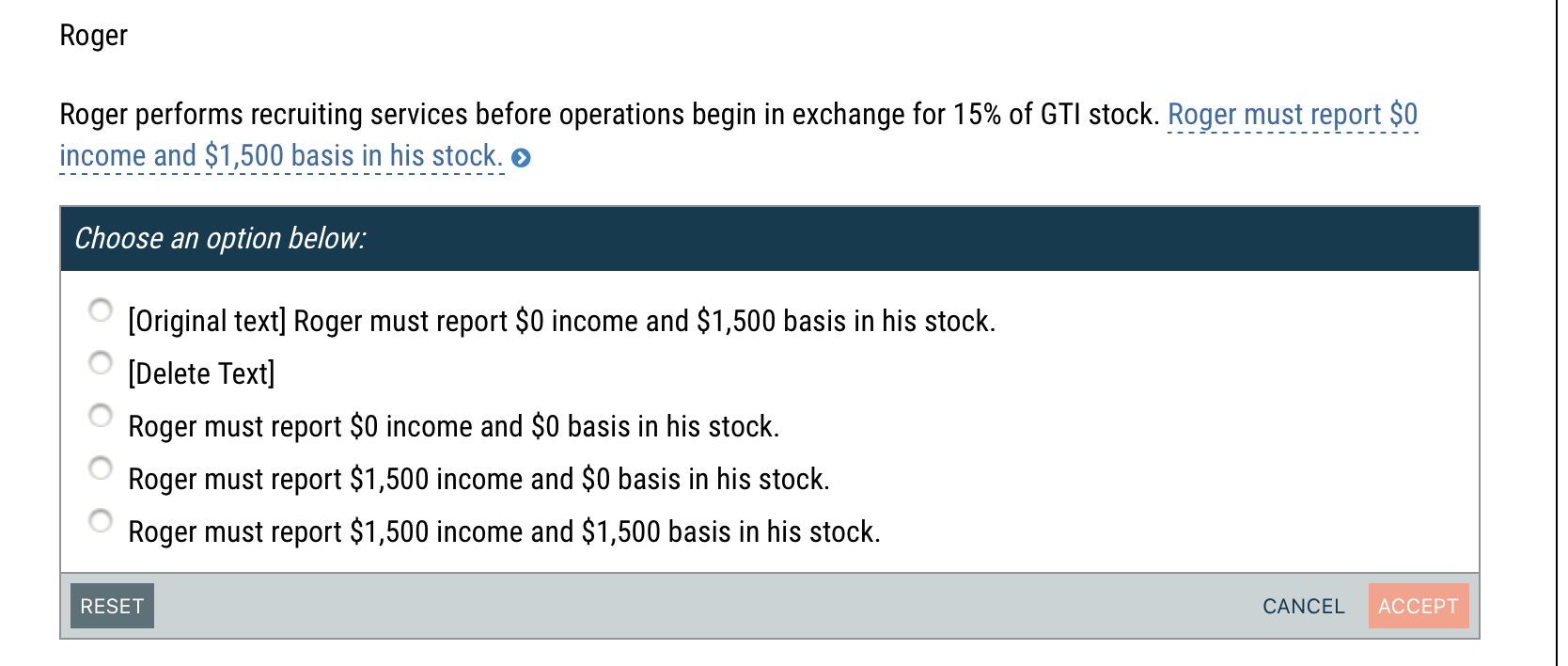

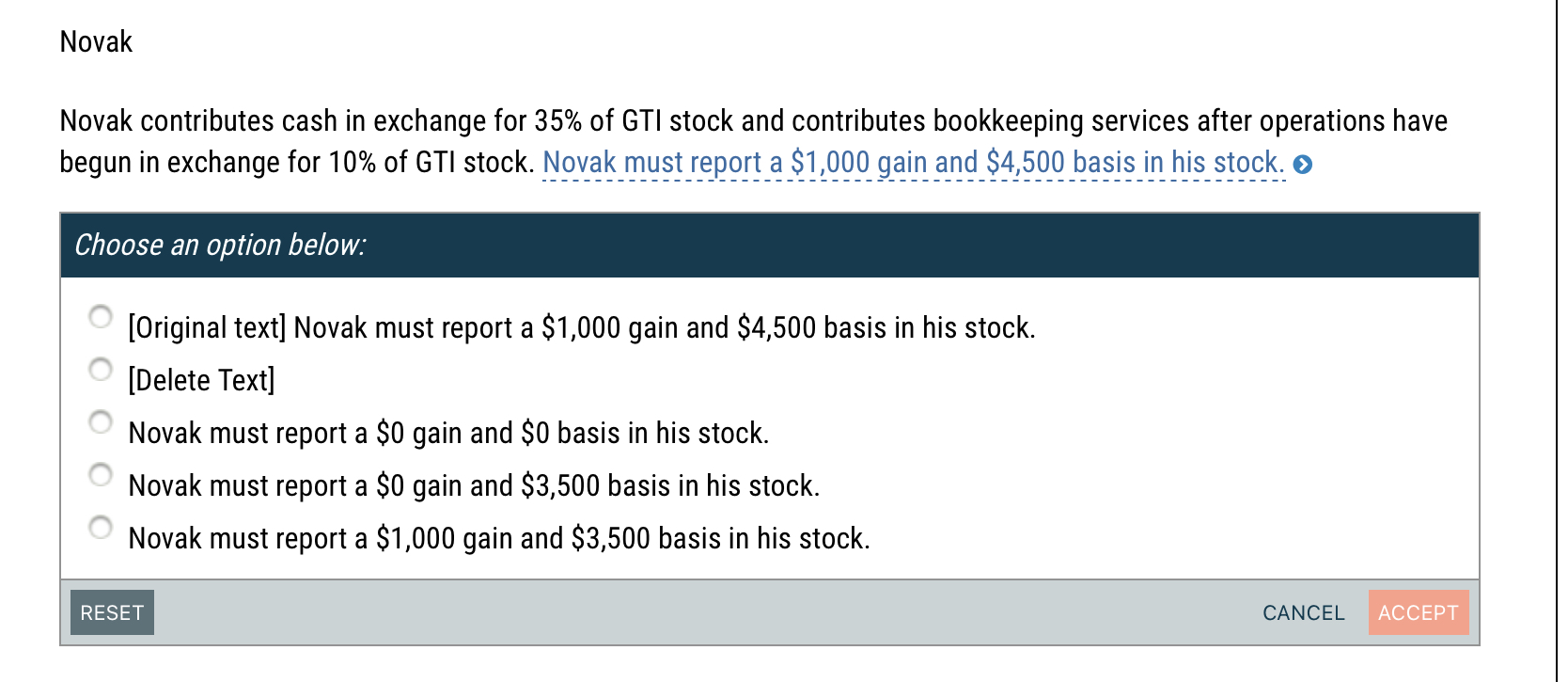

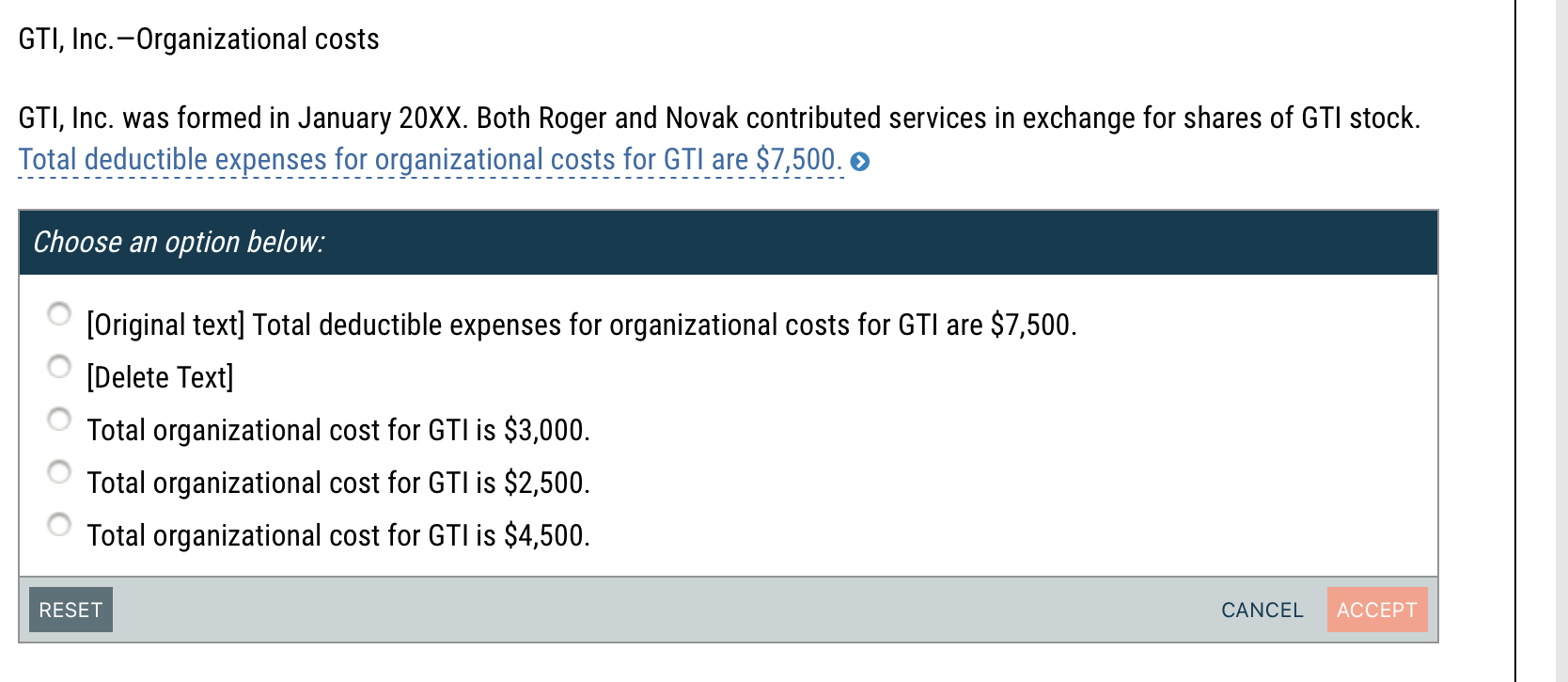

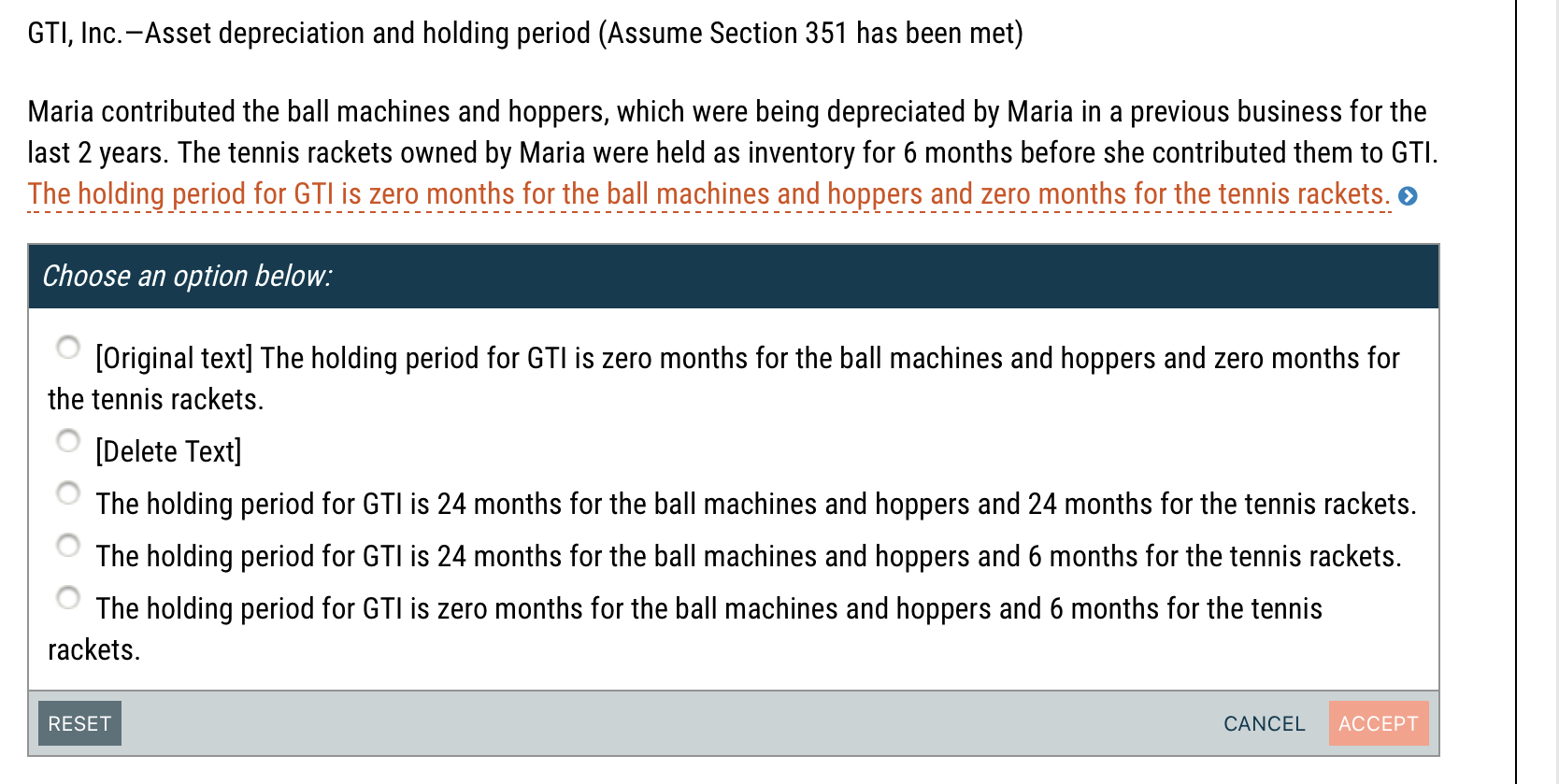

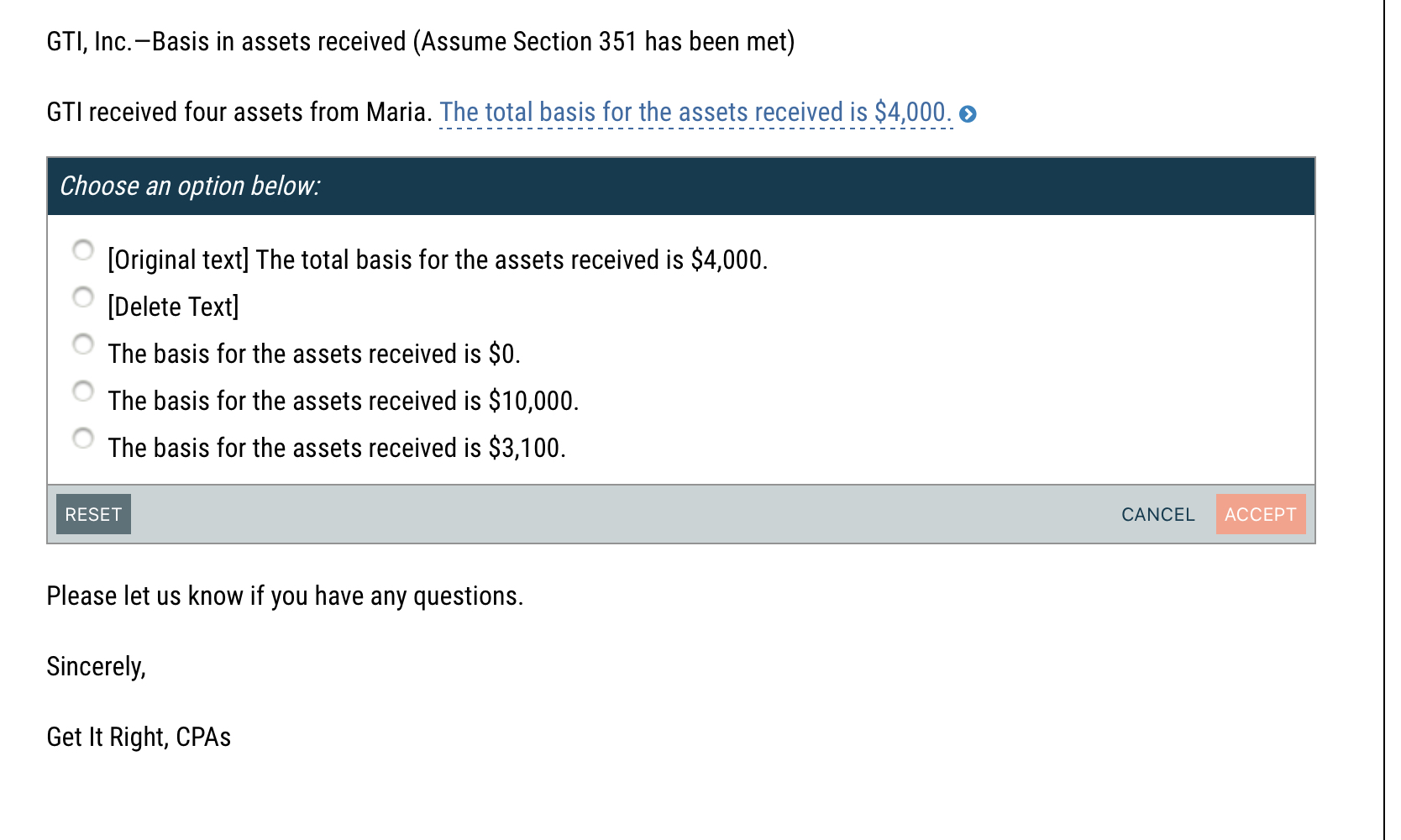

Get It Right, CPAs, has been retained to review its client's corporate formation calculations for 20XX. Maria, Roger, and Novak created Grassroots Tennis, Inc. (GTI), which began operations on March 1, 20XX. Maria contributed four assets in exchange for 40% of GTI stock. Roger performed recruiting services before operations began in exchange for 15% of GTI stock. Novak contributed cash in exchange for 35% of GTI stock and contributed bookkeeping services after operations began in exchange for 10% of GTI stock. One thousand (1,000) shares were issued. Documentation for the contribution of assets and services can be found in the Exhibits above. After an initial review of the documentation, a staff associate from GTI has drafted a letter to Maria. Kate, a partner in charge of the GTI engagement, has asked you to review the documentation and revise the letter, correcting any errors. To revise the letter, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text] from the list. Get It Right, CPAS 22 Accuracy Drive Hometown, IL 62222 December 31, 20XX Maria Shara, Owner Grassroots Tennis, Inc. 1 Hard Court Ace, IL 62223 Dear Maria, We have completed our review of the contribution of assets and services and calculations of any gain, loss, and asset basis for the shareholders and GTI, Inc. Our findings are summarized below: Maria Maria contributed four assets in exchange for 40% of GTI stock. Upon review of the assets contributed, Maria must report a $900 gain and $4,000 basis in her stock. Choose an option below: [Original text] Maria must report a $900 gain and $4,000 basis in her stock. [Delete Text] Maria must report a $0 gain and $3,100 basis in her stock. Maria must report a $0 gain and $4,000 basis in her stock. Maria must report a $4,000 gain and $0 basis in her stock. RESET CANCEL ACCEPT Roger Roger performs recruiting services before operations begin in exchange for 15% of GTI stock. Roger must report $0 income and $1,500 basis in his stock. > Choose an option below: [Original text] Roger must report $0 income and $1,500 basis in his stock. [Delete Text] Roger must report $0 income and $0 basis in his stock. Roger must report $1,500 income and $0 basis in his stock. Roger must report $1,500 income and $1,500 basis in his stock. RESET CANCEL ACCEPT Novak Novak contributes cash in exchange for 35% of GTI stock and contributes bookkeeping services after operations have begun in exchange for 10% of GTI stock. Novak must report a $1,000 gain and $4,500 basis in his stock. Choose an option below: [Original text] Novak must report a $1,000 gain and $4,500 basis in his stock. [Delete Text] Novak must report a $0 gain and $0 basis in his stock. Novak must report a $0 gain and $3,500 basis in his stock. Novak must report a $1,000 gain and $3,500 basis in his stock. RESET CANCEL ACCEPT GTI, Inc.-Organizational costs GTI, Inc. was formed in January 20XX. Both Roger and Novak contributed services in exchange for shares of GTI stock. Total deductible expenses for organizational costs for GTI are $7,500. Choose an option below: [Original text] Total deductible expenses for organizational costs for GTI are $7,500. [Delete Text] Total organizational cost for GTI is $3,000. Total organizational cost for GTI is $2,500. Total organizational cost for GTI is $4,500. RESET CANCEL ACCEPT GTI, Inc.-Asset depreciation and holding period (Assume Section 351 has been met) Maria contributed the ball machines and hoppers, which were being depreciated by Maria in a previous business for the last 2 years. The tennis rackets owned by Maria were held as inventory for 6 months before she contributed them to GTI. The holding period for GTI is zero months for the ball machines and hoppers and zero months for the tennis rackets. Choose an option below: [Original text] The holding period for GTI is zero months for the ball machines and hoppers and zero months for the tennis rackets. [Delete Text] The holding period for GTI is 24 months for the ball machines and hoppers and 24 months for the tennis rackets. The holding period for GTI is 24 months for the ball machines and hoppers and 6 months for the tennis rackets. The holding period for GTI is zero months for the ball machines and hoppers and 6 months for the tennis rackets. RESET CANCEL ACCEPT GTI, Inc.-Basis in assets received (Assume Section 351 has been met) GTI received four assets from Maria. The total basis for the assets received is $4,000. > Choose an option below: [Original text] The total basis for the assets received is $4,000. [Delete Text] The basis for the assets received is $0. The basis for the assets received is $10,000. The basis for the assets received is $3,100. RESET Please let us know if you have any questions. Sincerely, Get It Right, CPAS CANCEL ACCEPT

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 In the original text it correctly states that Maria contributed four assets in exchange for 40 of GTI Grassroots Tennis Inc stock This me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started