Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Although Stark's book value at the acquisition date was $341,000, the fair value of its trademarks was assessed to be $14,000 more than their carrying

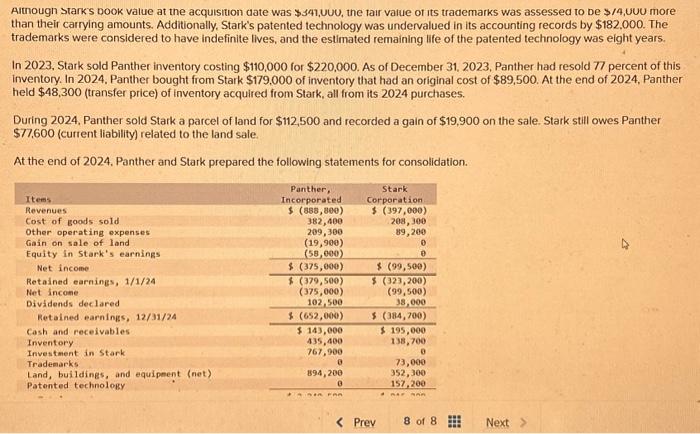

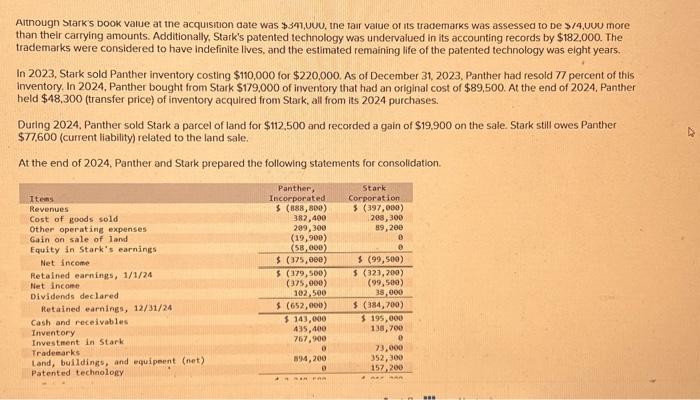

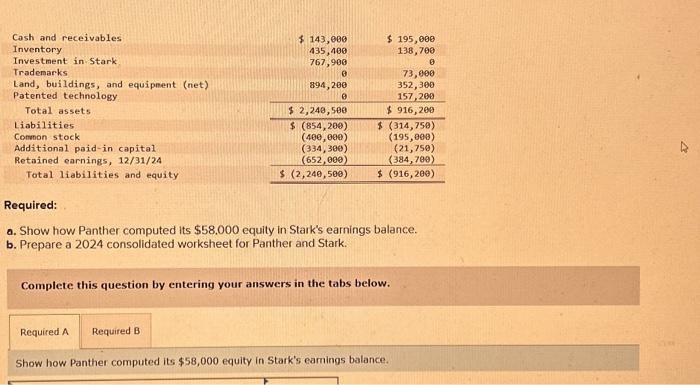

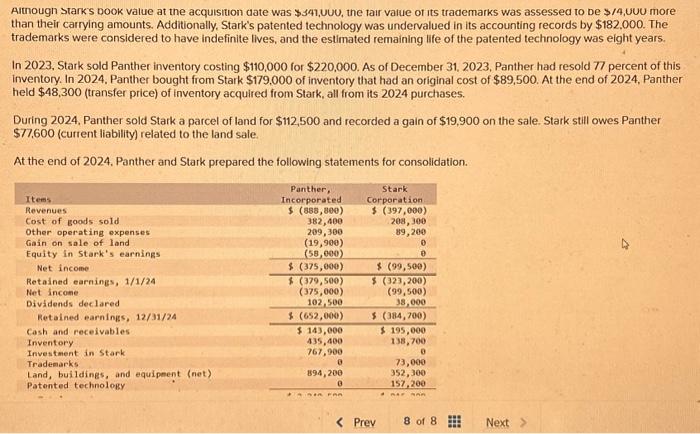

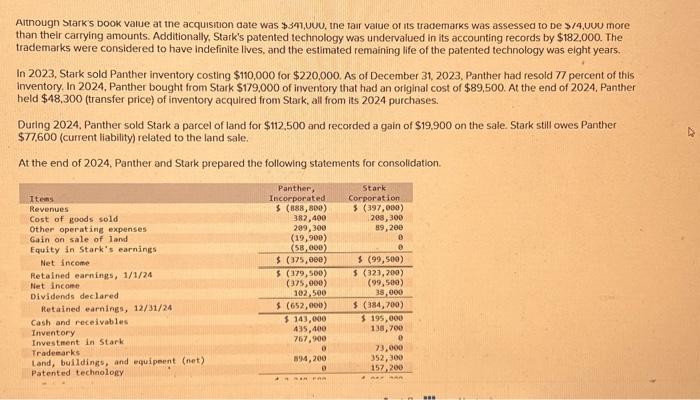

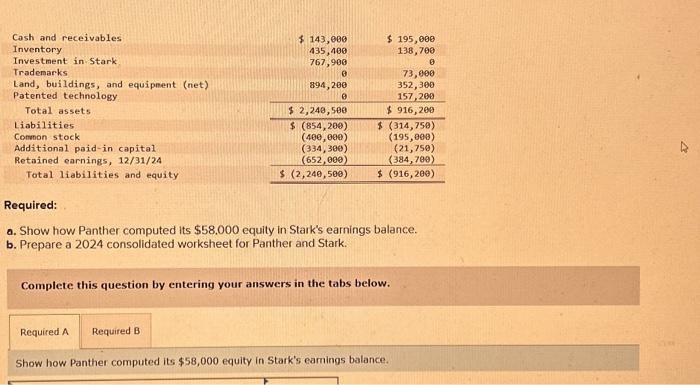

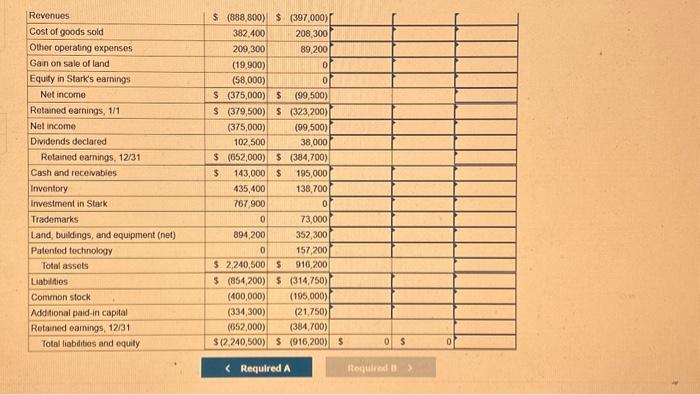

Although Stark's book value at the acquisition date was $341,000, the fair value of its trademarks was assessed to be $14,000 more than their carrying amounts. Additionally, Stark's patented technology was undervalued in its accounting records by $182,000. The trademarks were considered to have indefinite lives, and the estimated remaining life of the patented technology was eight years. In 2023, Stark sold Panther inventory costing $110,000 for $220,000. As of December 31, 2023, Panther had resold 77 percent of this inventory. In 2024, Panther bought from Stark $179,000 of inventory that had an original cost of $89,500. At the end of 2024, Panther held $48,300 (transfer price) of inventory acquired from Stark, all from its 2024 purchases. During 2024, Panther sold Stark a parcel of land for $112,500 and recorded a gain of $19,900 on the sale. Stark still owes Panther $77,600 (current liability) related to the land sale. At the end of 2024, Panther and Stark prepared the following statements for consolidation. Stark Corporation $ (397,000) 208,300 89, 200 Items Revenues Cost of goods sold Other operating expenses Gain on sale of land Equity in Stark's earnings Net income Retained earnings, 1/1/24 Net income Dividends declared Retained earnings, 12/31/24 Cash and receivables Inventory Investment in Stark Trademarks Land, buildings, and equipment (net) Patented technology Panther, Incorporated $ (888,800) 382,400 209,300 (19,900) (58,000) $ (375,000) $ (379,500) (375,000) 102,500 $ (652,000) $ 143,000 435,400 767,900 0 894, 200 0 $ (99,500) $ (323,200) (99,500) 38,000 $ (384,700) $ 195,000 138,700

Aithougn starks Dook value at the acquisition date was $341,, the fair value of its trademarks was assessed to be $/4,U0U more than their carrying amounts. Additionally, Stark's patented technology was undervalued in its accounting records by $182,000. The trademarks were considered to have indefinite lives, and the estimated remaining life of the patented technology was eight years. In 2023, Stark sold Panther inventory costing $110,000 for $220,000. As of December 31, 2023, Panther had resold 77 percent of this inventory. In 2024. Panther bought from Stark $179,000 of inventory that had an original cost of $89,500. At the end of 2024, Panther held $48,300 (transfer price) of inventory acquired from Stark, all from its 2024 purchases. During 2024, Panther sold Stark a parcel of land for $112,500 and recorded a gain of $19,900 on the sale. Stark still owes Panther $77,600 (current liability) related to the land sale. At the end of 2024. Panther and Stark prepared the following statements for consolidation. a. Show how Panther computed its $58.000 equity in Stark's earnings balance. b. Prepare a 2024 consolidated worksheet for Panther and Stark. Complete this question by entering your answers in the tabs below. Show how Panther computed its $58,000 equity in Stark's earnings balance. Aitnougn starks Dook value at the acquisition date was $371, UuU, the farr value of its trademarks was assessed to be $/4, UuU more than their carrying amounts. Additionally, Stark's patented technology was undervalued in its accounting records by $182,000. The trademarks were considered to have indefinite lives, and the estimated remaining life of the patented technology was eight years. In 2023, Stark sold Panther inventory costing $110,000 for $220,000. As of December 31, 2023. Panther had resold 77 percent of this inventory. In 2024, Panther bought from Stark $179,000 of inventory that had an original cost of $89,500. At the end of 2024, Panther held $48,300 (transfer price) of inventory acquired from Stark, all from its 2024 purchases. During 2024. Panther sold Stark a parcel of land for $112,500 and recorded a gain of $19,900 on the sale. Stark still owes Panther $77,600 (current liability) related to the land sale. At the end of 2024, Panther and Stark prepared the following statements for consolidation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started