Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Altice USA Inc. (ATUS) is a publicly-traded cable television provider headquartered in New York City. Currently, Altice's market capitalization is $20 billion and its

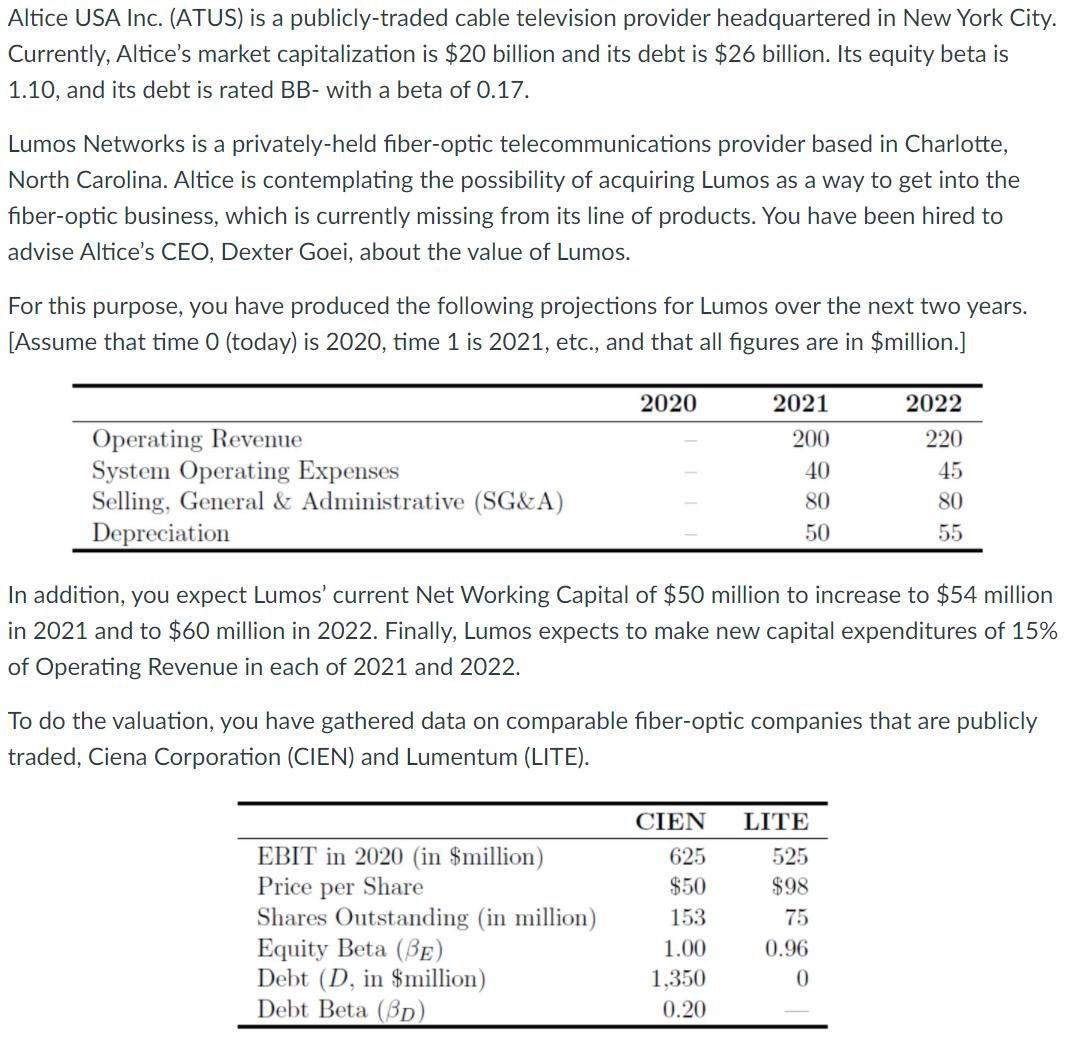

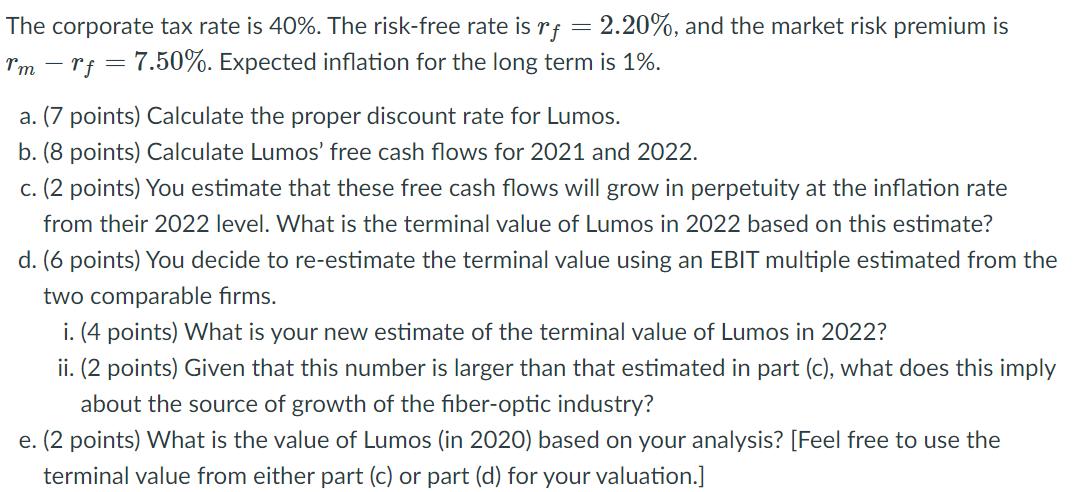

Altice USA Inc. (ATUS) is a publicly-traded cable television provider headquartered in New York City. Currently, Altice's market capitalization is $20 billion and its debt is $26 billion. Its equity beta is 1.10, and its debt is rated BB- with a beta of 0.17. Lumos Networks is a privately-held fiber-optic telecommunications provider based in Charlotte, North Carolina. Altice is contemplating the possibility of acquiring Lumos as a way to get into the fiber-optic business, which is currently missing from its line of products. You have been hired to advise Altice's CEO, Dexter Goei, about the value of Lumos. For this purpose, you have produced the following projections for Lumos over the next two years. [Assume that time 0 (today) is 2020, time 1 is 2021, etc., and that all figures are in $million.] Operating Revenue System Operating Expenses Selling, General & Administrative (SG&A) Depreciation 2020 EBIT in 2020 (in $million) Price per Share Shares Outstanding (in million) 2021 200 40 80 50 In addition, you expect Lumos' current Net Working Capital of $50 million to increase to $54 million in 2021 and to $60 million in 2022. Finally, Lumos expects to make new capital expenditures of 15% of Operating Revenue in each of 2021 and 2022. Equity Beta (BE) Debt (D, in $million) Debt Beta (BD) To do the valuation, you have gathered data on comparable fiber-optic companies that are publicly traded, Ciena Corporation (CIEN) and Lumentum (LITE). 2022 220 45 80 55 CIEN LITE 625 525 $50 $98 153 75 1.00 0.96 1,350 0 0.20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the proper discount rate for Lumos we can use the following formula rE r Erm rf where rE is the cost of equity r is the riskfree rate E is the equity beta and rm rf is the market risk p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started