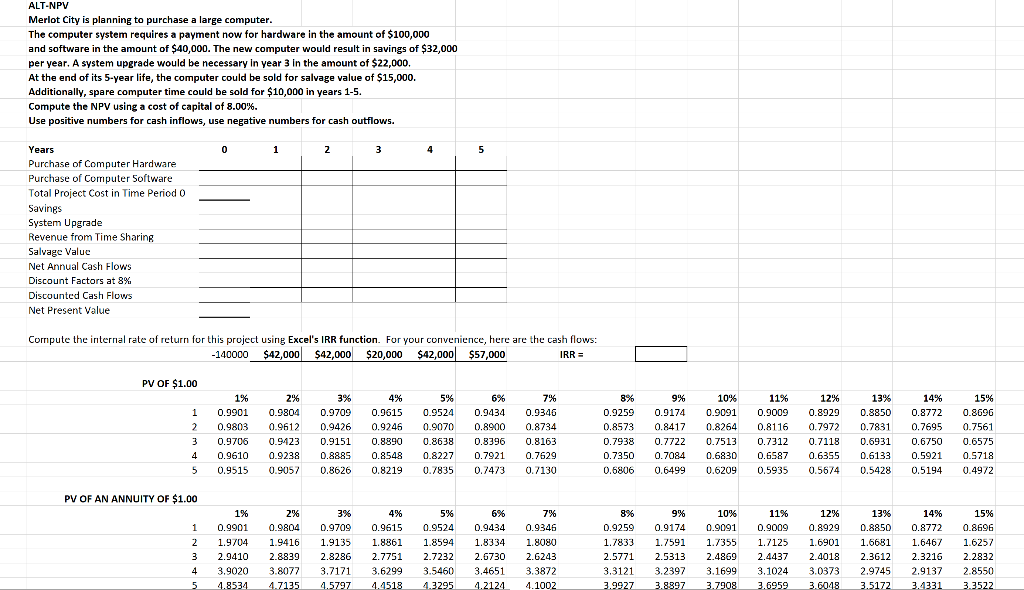

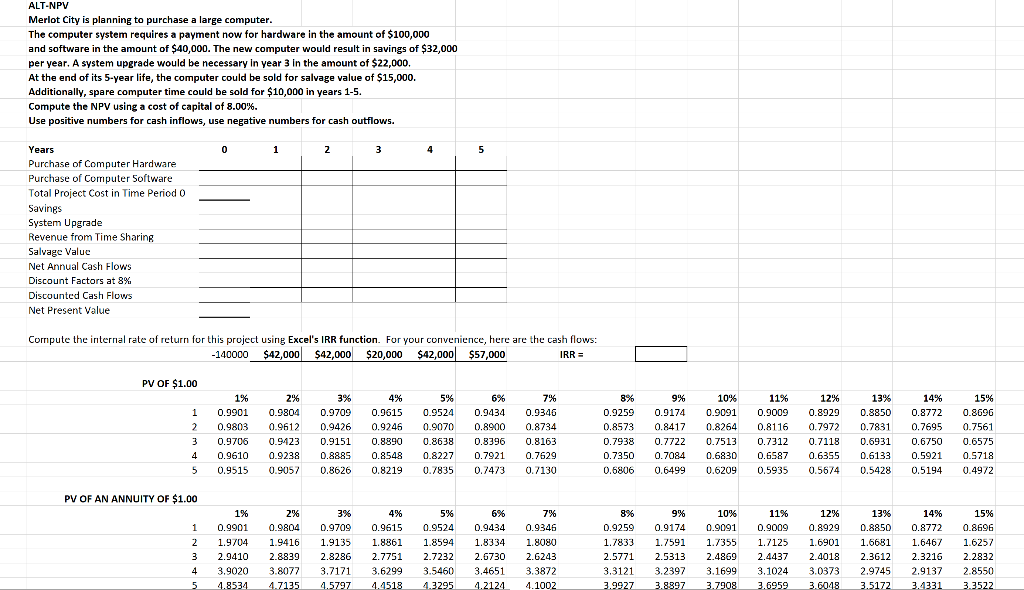

ALT-NPV Merlot City is planning to purchase a large computer. The computer system requires a payment now for hardware in the amount of $100,000 and software in the amount of $40,000. The new computer would result in savings of $32,000 per year. A system upgrade would be necessary in year 3 in the amount of $22,000, At the end of its 5-year life, the computer could be sold for salvage value of $15,000. Additionally, spare computer time could be sold for $10,000 in years 1-5. Compute the NPV using a cost of capital of 8.00%. Use positive numbers for cash inflows, use negative numbers for cash outflows. 0 1 2 3 4 5 Years Purchase of Computer Hardware Purchase of Computer Software Total Project Cost in Time Period O Savings System Upgrade Revenue from Time Sharing Salvage Value Net Annual Cash Flows Discount Factors at 8% Discounted Cash Flows Net Present Value Compute the internal rate of return for this project using Excel's IRR function. For your convenience, here are the cash flows: -140000 $42,000 $42,000 $20,000 $42,000 $57,000 IRR = PV OF $1.00 1 2 1% 0.9901 0.9803 0.9706 0.9610 0.9515 2% 0.9804 0.9612 0.9423 0.9238 0.9057 3% 0.9709 0.9426 0.9151 0.88.85 0.8626 4% 0.9615 0.9246 0.8890 0.8548 0.8219 5% 0.9524 0.9070 0.8638 0.8227 0.7835 6% 0.9434 0.8900 0.8396 0.7921 0.7473 7% 0.9346 0.8734 0.8163 0.7629 0.7130 89 0.9259 0.8573 0.7938 0.7350 0.6806 9% 0.9174 0.8417 0.7722 0.7084 0.6499 10% 0.9091 0.8264 0.7513 0.6830 0.6209 11% 0.9009 0.8116 0.7312 0.6587 0.5935 12% 0.8929 0.7972 0.7118 0.6355 0.5674 13% 0.8850 0.7831 0.6931 0.6133 0.5428 14% 0.8772 0.7695 0.6750 0.5921 0.5194 15% 0.8696 0.7561 0.6575 0.5718 0.4972 3 4 5 PV OF AN ANNUITY OF $1.00 4% 1% 0.9901 2% 0.9804 10% 0.9091 1 2 1.9704 2.9410 3.9020 4.8534 3% 0.9709 1.9135 2.8286 3.7171 4.5797 1.9416 2.8839 3.8077 4.7135 5% 0.9524 1.8594 2.7232 3.5460 4.3295 0.9615 1.8861 2.7751 3.6299 4.4518 620 0.9434 1.8334 2.6730 3,4651 4.2124 7% 0.9346 1.8080 2.6243 3.3872 4.1002 8% 0.9259 1.7833 2.5771 3.3121 3.9927 9% 0.9174 1.7591 2.5313 3.2397 3.8897 11% 0.9009 1.7125 2.4437 3.1024 3.6959 1.7355 2.4869 3.1699 3.7908 12% 0.8929 1.6901 2.4018 3.0373 3.6048 3 13% 0.8850 1.6681 2.3612 2.9745 3.5172 14% 0.8772 1.6467 2.3216 2.9137 3.4331 15% 0.8696 1.6257 2.2832 2.8550 3.3522 4 5