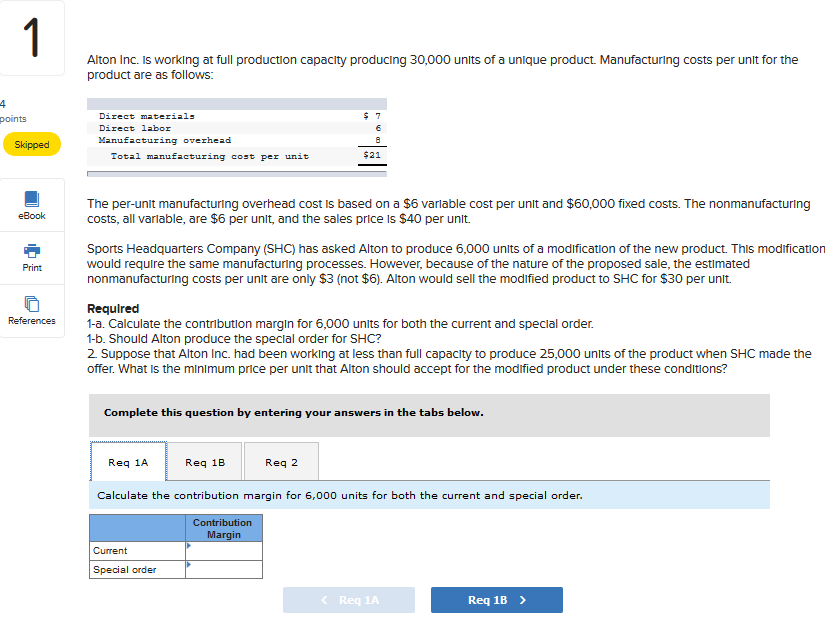

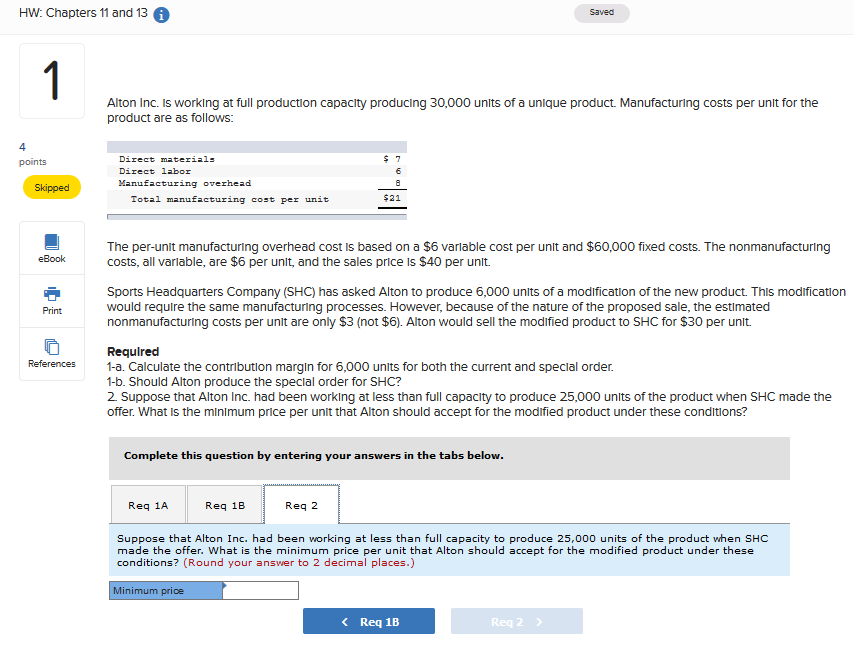

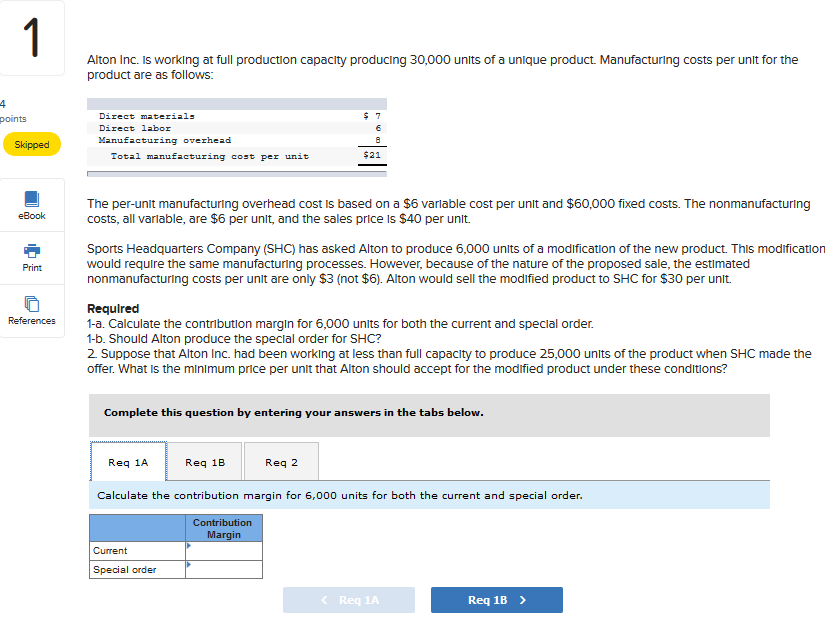

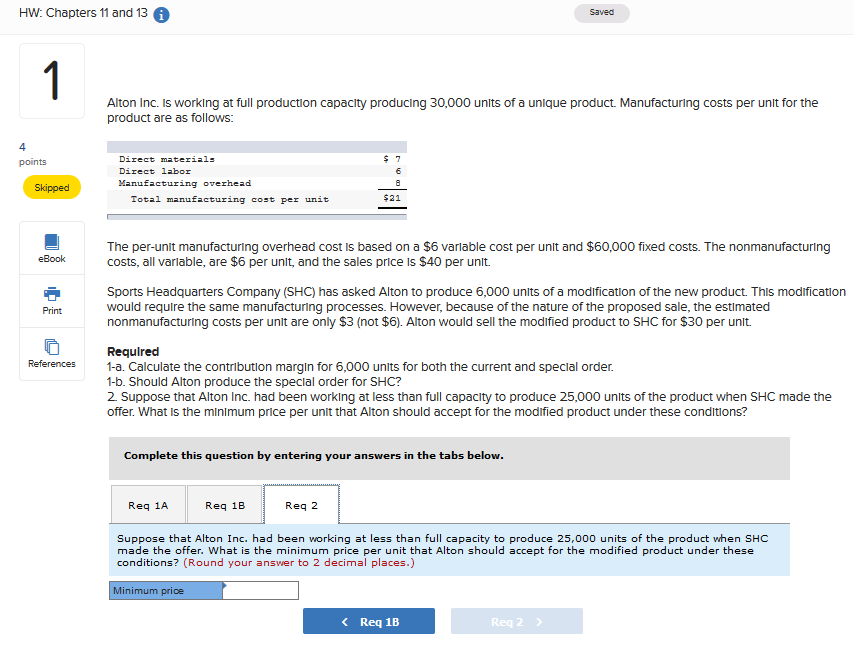

Alton Inc. Is worklng at full production capacity producing 30,000 units of a unique product. Manufacturing costs per unit for the product are as follows: Direct material Direct labor Manufacturing oints Skipped Total manufacturing cost per unit 21 The per-unit manufacturing overhead cost is based on a $6 varlable cost per unit and $60,000 fixed costs. The nonmanufacturing costs, all varlable, are $6 per unlt, and the sales price is $40 per unit. eBook Sports Headquarters Company (SHC) has asked Alton to produce 6,000 units of a modification of the new product. This modification would require the same manufacturing processes. However, because of the nature of the proposed sale, the estimated nonmanufacturing costs per unit are only $3 (not $6). Alton would sell the modified product to SHC for $30 per unlt Print Requlred References 1-a. Calculate the contribution margin for 6,000 units for both the current and special order 1-b. Should Alton produce the special order for SHC? 2 Suppose that Alton Inc. had been working at less than full capacity to produce 25,000 units of the product when SHC made the offer. What is the minimum price per unit that Alton should accept for the modified product under these conditions? Complete this question by entering your answers in the tabs below Req 1A Req 1B Req 2 Calculate the contribution margin for 6,000 units for both the current and special order Current Special order Req 1A HW: Chapters 11 and 13 Saved Alton Inc. Is worklng at full production capacity producing 30,000 units of a unique product. Manufacturing costs per unit for the product are as follows: 4 Direct materi1 Direct labor Manufacturing points Skipped Total manufacturing cost per unit $21 The per-unit manufacturing overhead cost Iis based on a $6 vantable cost per unit and $60,000 fixed costs. The nonmanufacturing eBook costs, all varlable, are $6 per unlt, and the sales price is $40 per unit. Sports Headquarters Company (SHC) has asked Alton to produce 6,000 units of a modification of the new product. This modification would require the same manufacturing processes. However, because of the nature of the proposed sale, the estimated nonmanufacturing costs per unit are only $3 (not $6). Alton would sell the modified product to SHC for $30 per unlt Print Requlred References 1-a. Calculate the contribution margin for 6,000 units for both the current and special order 1-b. Should Alton produce the speclal order for SHC? 2 Suppose that Alton Inc. had been working at less than full capacity to produce 25,000 units of the product when SHC made the offer. What is the minimum price per unit that Alton should accept for the modified product under these conditions? Complete this question by entering your answers in the tabs below Req 1A Req 1B Req 2 Suppose that Alton Inc. had been working at less than full capacity to produce 25,000 units of the product when SHC made the offer. What is the minimum price per unit that Alton should accept for the modified product under these conditions? (Round your answer to 2 decimal places.) Minimum price Req 1B Req 2