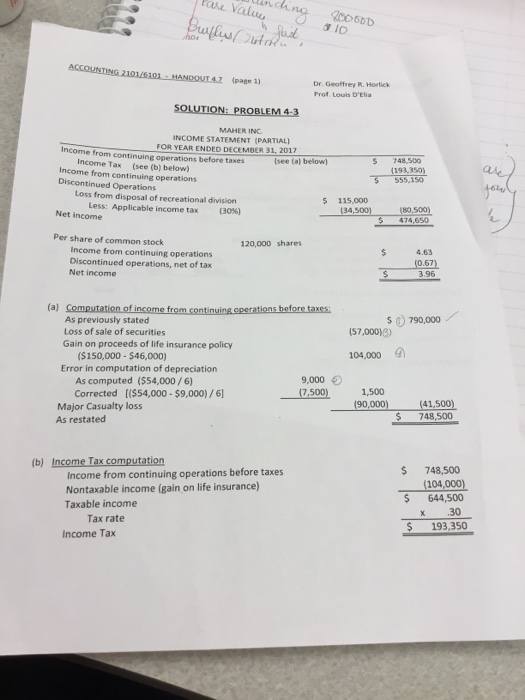

alu 40066D (page 1) Dr. Geoffrey R. Horlick Prof. Louis D'Eia SOLUTION: PROBLEM 4-3 MAHER INC INCOME STATEMENT (PARTIAL) FOR YEAR ENDED DECEMBER 31. 2017 ncome from continuing operations before taxes (see (a) below) S 748,500 Income Tax (see (b) below) Income from continuing operations Discontinued Operations 5 555,150 Loss from disposal of recreational division $ 115,00o 34.500) (80,500) 74,650 Less: Applicable income tax (30%) Net income Per share of common stock 120,000 shares 4.63 Income from continuing operations Discontinued operations, net of tax Net income 3.96 (a) Computation of income from continuing operations before taxes As previously stated Loss of sale of securities Gain on proceeds of life insurance policy (57,000) 104,000 ($150,000 $46,000) Error in computation of depreciation 9,000 As computed ($54,000/6) Corrected [($54,000 $9,000)/6 1,500 Major Casualty loss As restated 90,000)(41.500) $ 748,500 (b) Income Tax computation Income from continuing operations before taxes Nontaxable income (gain on life insurance) Taxable income $ 748,500 (104,000) 644,500 x 30 $ 193,350 Tax rate Income Tax alu 40066D (page 1) Dr. Geoffrey R. Horlick Prof. Louis D'Eia SOLUTION: PROBLEM 4-3 MAHER INC INCOME STATEMENT (PARTIAL) FOR YEAR ENDED DECEMBER 31. 2017 ncome from continuing operations before taxes (see (a) below) S 748,500 Income Tax (see (b) below) Income from continuing operations Discontinued Operations 5 555,150 Loss from disposal of recreational division $ 115,00o 34.500) (80,500) 74,650 Less: Applicable income tax (30%) Net income Per share of common stock 120,000 shares 4.63 Income from continuing operations Discontinued operations, net of tax Net income 3.96 (a) Computation of income from continuing operations before taxes As previously stated Loss of sale of securities Gain on proceeds of life insurance policy (57,000) 104,000 ($150,000 $46,000) Error in computation of depreciation 9,000 As computed ($54,000/6) Corrected [($54,000 $9,000)/6 1,500 Major Casualty loss As restated 90,000)(41.500) $ 748,500 (b) Income Tax computation Income from continuing operations before taxes Nontaxable income (gain on life insurance) Taxable income $ 748,500 (104,000) 644,500 x 30 $ 193,350 Tax rate Income Tax