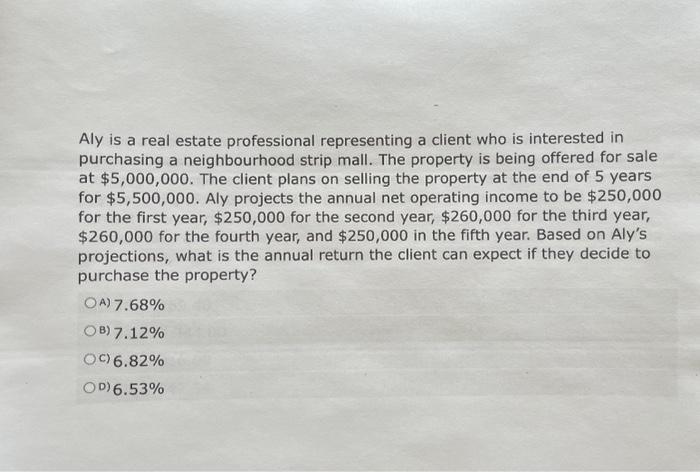

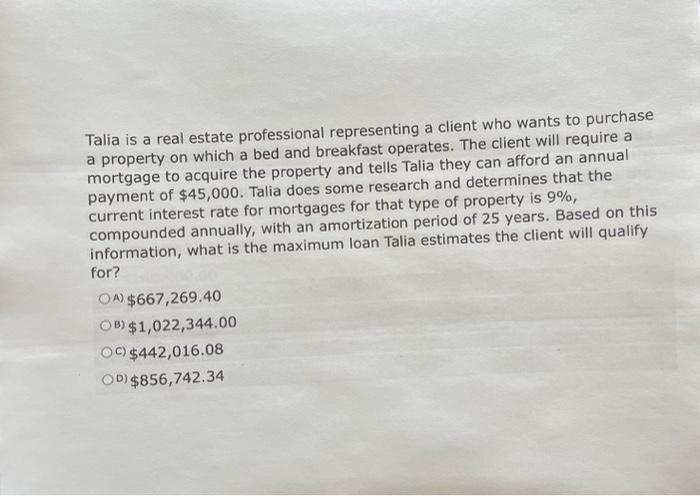

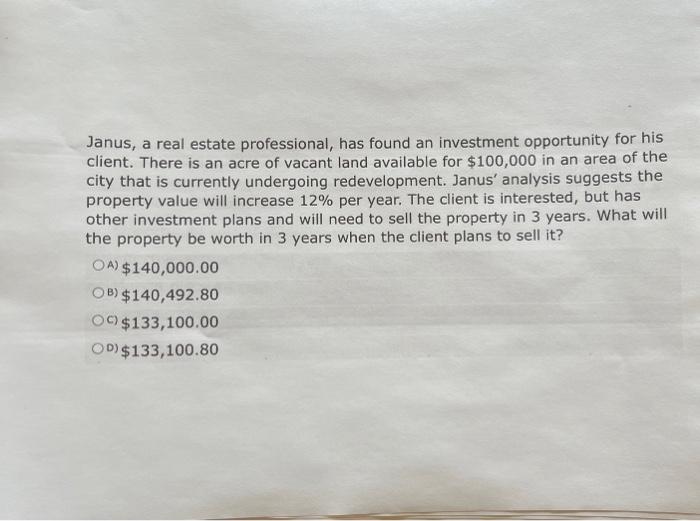

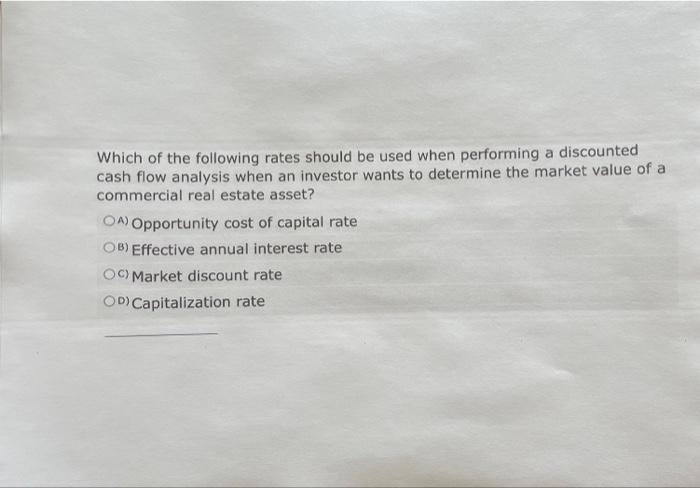

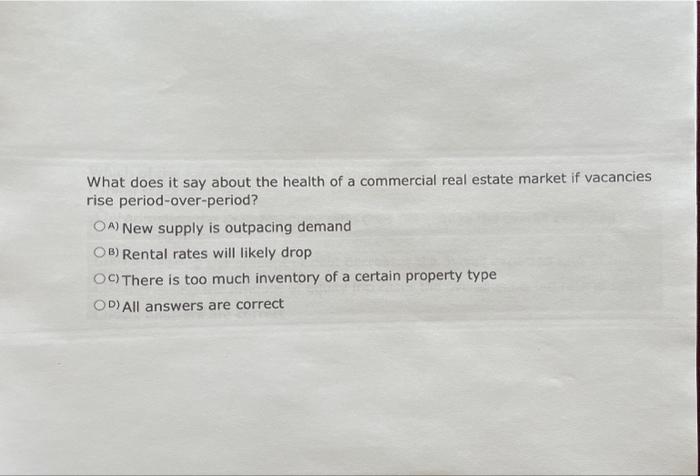

Aly is a real estate professional representing a client who is interested in purchasing a neighbourhood strip mall. The property is being offered for sale at $5,000,000. The client plans on selling the property at the end of 5 years for $5,500,000. Aly projects the annual net operating income to be $250,000 for the first year, $250,000 for the second year, $260,000 for the third year, $260,000 for the fourth year, and $250,000 in the fifth year. Based on Aly's projections, what is the annual return the client can expect if they decide to purchase the property? A) 7.68% B) 7.12% C) 6.82% D) 6.53% Talia is a real estate professional representing a client who wants to purchase a property on which a bed and breakfast operates. The client will require a mortgage to acquire the property and tells Talia they can afford an annual payment of $45,000. Talia does some research and determines that the current interest rate for mortgages for that type of property is 9%, compounded annually, with an amortization period of 25 years. Based on this information, what is the maximum loan Talia estimates the client will qualify for? A) $667,269.40 B) $1,022,344,00 C) $442,016.08 D) $856,742.34 Janus, a real estate professional, has found an investment opportunity for his client. There is an acre of vacant land available for $100,000 in an area of the city that is currently undergoing redevelopment. Janus' analysis suggests the property value will increase 12% per year. The client is interested, but has other investment plans and will need to sell the property in 3 years. What will the property be worth in 3 years when the client plans to sell it? A) $140,000.00 B) $140,492.80 C) $133,100.00 D) $133,100.80 Which of the following rates should be used when performing a discounted cash flow analysis when an investor wants to determine the market value of a commercial real estate asset? A) Opportunity cost of capital rate B) Effective annual interest rate C) Market discount rate D) Capitalization rate What does it say about the health of a commercial real estate market if vacancies rise period-over-period? A) New supply is outpacing demand B) Rental rates will likely drop C) There is too much inventory of a certain property type D) All answers are correct