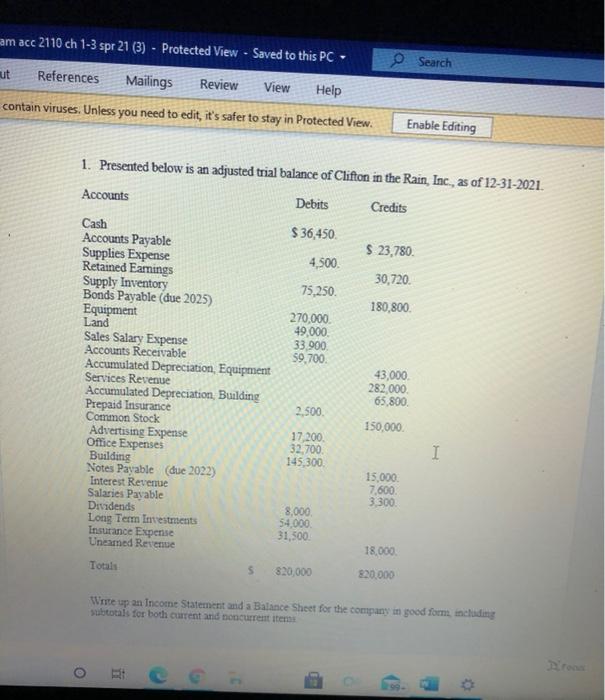

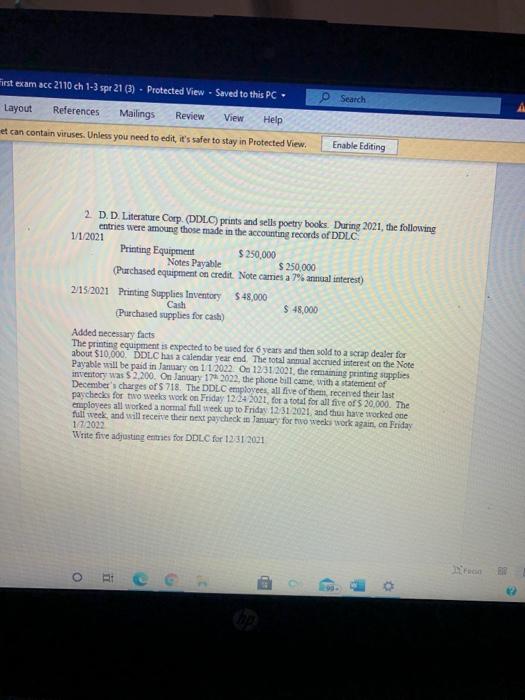

am acc 2110 ch 1-3 spr 21 (3) - Protected View - Saved to this PC Search ut References Mailings Review View Help contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 1. Presented below is an adjusted trial balance of Clifton in the Rain, Inc., as of 12-31-2021. Debits Credits Accounts $ 36,450 $ 23,780 4,500 30,720. 75,250 180,800. 270,000 49,000 33.900 59.700 Cash Accounts Payable Supplies Expense Retained Eamings Supply Inventory Bonds Payable due 2025) Equipment Land Sales Salary Expense Accounts Receivable Accumulated Depreciation Equipment Services Revenue Accumulated Depreciation Building Prepaid Insurance Common Stock Advertising Expense Office Expenses Building Notes Payable (due 2022) Interest Revenue Salaries Payable Dividends Long Term Investments Insurance Expense Uneamed Revenue 43,000 282,000 65,800 2,500 150,000 17,200 32,700 145,300 I 15,000 7,600 3.300 8,000 54,000 31,500 18,000 Total S 820.000 820.000 Write up an Income Statement and a Balance Sheet for the company in good form, including subtotals for both current and noncurrent items o Drona First exam acc 2110 ch 1-3 spr 21 (3) - Protected View - Saved to this PC. Search Layout References Mailings Review View Help et can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing 2. D.D. Literature Corp. (DDLC) prints and sells poetry books. During 2021, the following entries were among those made in the accounting records of DDLC. 1/1/2021 Printing Equipment $ 250,000 Notes Payable $ 250,000 (Puchased equipment on credit. Note carries anual interest) 2/15/2021 Printing Supplies Inventory $48,000 Cash $ 48,000 Purchased supplies for cash) Added necessary facts The printing equipment is expected to be used for 6 years and then sold to a scap dealer for about $10,000 DDLC has a calendar year end The total al acened interest on the Note Payable will be paid in January 11 2022 On 1231 2001, the remaining gunting supplies inventory was $2,200. On January 17 2021, the phone bill came with a statement of December's charges of 5 718. The DDLC emploves all five of them recensed their last paychecks for two weeks work on Friday 1224 2021, for a total for all five of $ 20,000. The employees all worked a normal full week up to Friday 12:31.2021 and thus have worked one full week and will receive their best paycheck in January for two weeks work again on Friday 172022 Write five adjusting entries for DDLC for 12312021 BB a