Answered step by step

Verified Expert Solution

Question

1 Approved Answer

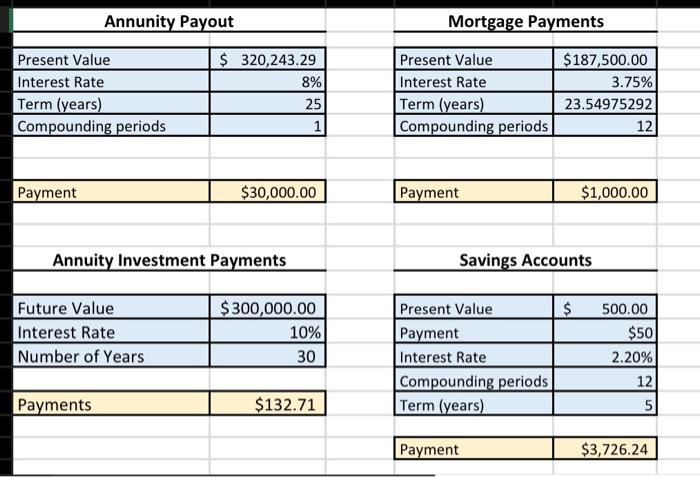

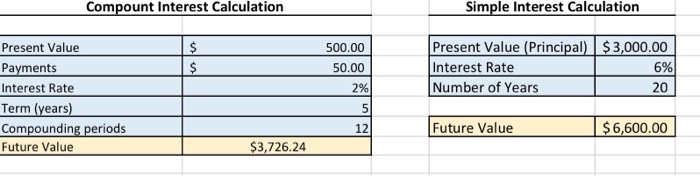

am having a hard time plugging these into excel- our professor wants us to USE excel to grab the answer- the excel sheet i have

am having a hard time plugging these into excel- our professor wants us to USE excel to grab the answer- the excel sheet i have given is what they prvide us and we are suppose to plug the #'s in to get the answers- however I must be doing something wrong..

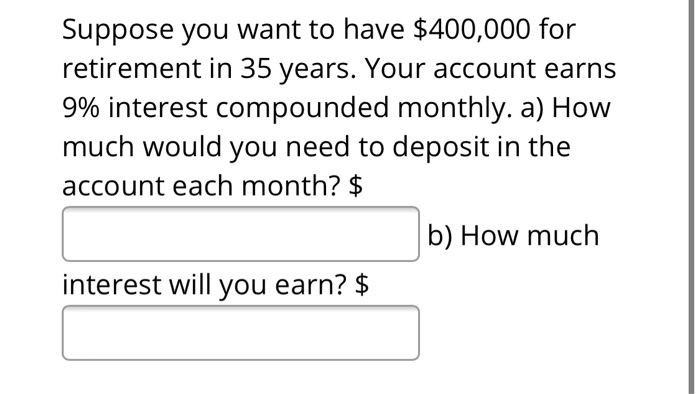

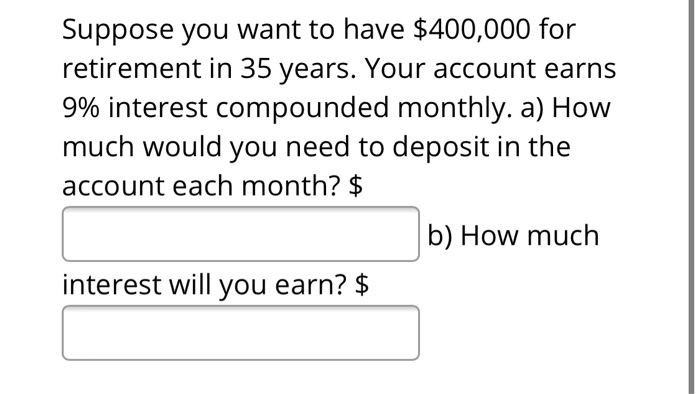

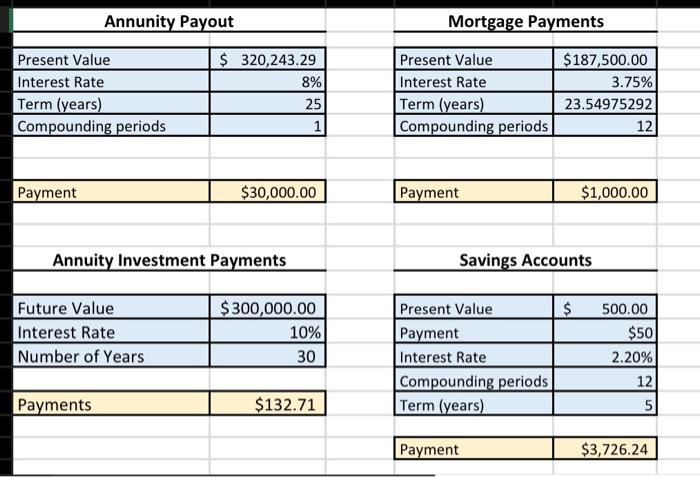

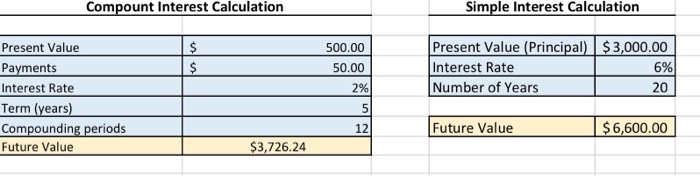

Suppose you want to have $400,000 for retirement in 35 years. Your account earns 9% interest compounded monthly. a) How much would you need to deposit in the account each month? $ b) How much interest will you earn? $ Annunity Payout Mortgage Payments Present Value Interest Rate Term (years) Compounding periods $ 320,243.29 8% 25 1 Present Value Interest Rate Term (years) Compounding periods $187,500.00 3.75% 23.54975292 12 Payment $30,000.00 Payment $1,000.00 Annuity Investment Payments Savings Accounts $ Future Value Interest Rate Number of Years $ 300,000.00 10% 30 Present Value Payment Interest Rate Compounding periods Term (years) 500.00 $50 2.20% 12 Payments $132.71 5 Payment $3,726.24 Compount Interest Calculation Simple Interest Calculation 500.00 $ $ 50.00 Present Value (Principal) $3,000.00 Interest Rate 6% Number of Years 20 2% Present Value Payments Interest Rate Term (years) Compounding periods Future Value 5 12 Future Value $6,600.00 $3,726.24 i have the answers figured out but I do not have the excel part- can someone please help me figure out where to plug in the numbers into what calculators?! thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started