Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AMA AMA 128 Destion 9: A company has been making to order for a customer, but the customer has since one into liquidation, and there

AMA

AMA

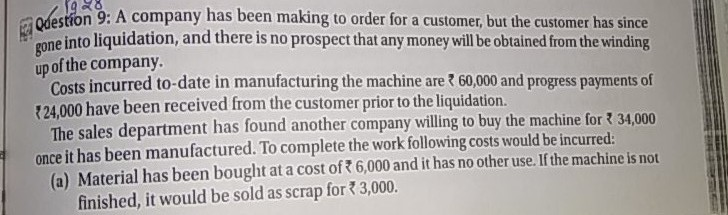

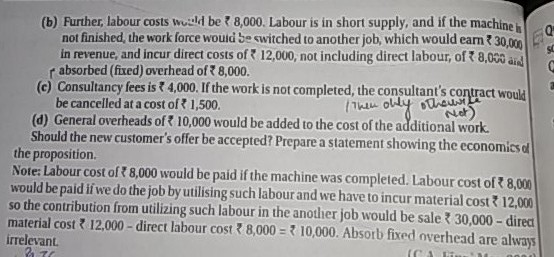

128 Destion 9: A company has been making to order for a customer, but the customer has since one into liquidation, and there is no prospect that any money will be obtained from the winding up of the company. Costs incurred to-date in manufacturing the machine are? 60,000 and progress payments of 124.000 have been received from the customer prior to the liquidation. The sales department has found another company willing to buy the machine for 34.000 once it has been manufactured. To complete the work following costs would be incurred: (a) Material has been bought at a cost of 6,000 and it has no other use. If the machine is not finished, it would be sold as scrap for 3,000. (b) Further, labour costs would be 8,000. Labour is in short supply, and if the machine not finished, the work force would be switched to another job, which would eam 30,000 in revenue, and incur direct costs of 12,000, not including direct labour, of 8,000 and absorbed (fixed) overhead of 8,000. (c) Consultancy fees is 4,000. If the work is not completed, the consultant's contract would be cancelled at a cost of 1,500. Then only other (d) General overheads of 10,000 would be added to the cost of the additional work Net) Should the new customer's offer be accepted? Prepare a statement showing the economissa the proposition. Note: Labour cost of 8,000 would be paid if the machine was completed. Labour cost of 8,000 would be paid if we do the job by utilising such labour and we have to incur material cost 12,000 so the contribution from utilizing such labour in the another job would be sale 30,000 - dired material cost 12,000 - direct labour cost 8,000 = 10,000. Absorb fixed overhead are always irrelevant 27Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started