Question

Amadeus Corporation is considering the issue of a new product to be added to its product mix. They hired you, a recent business graduate from

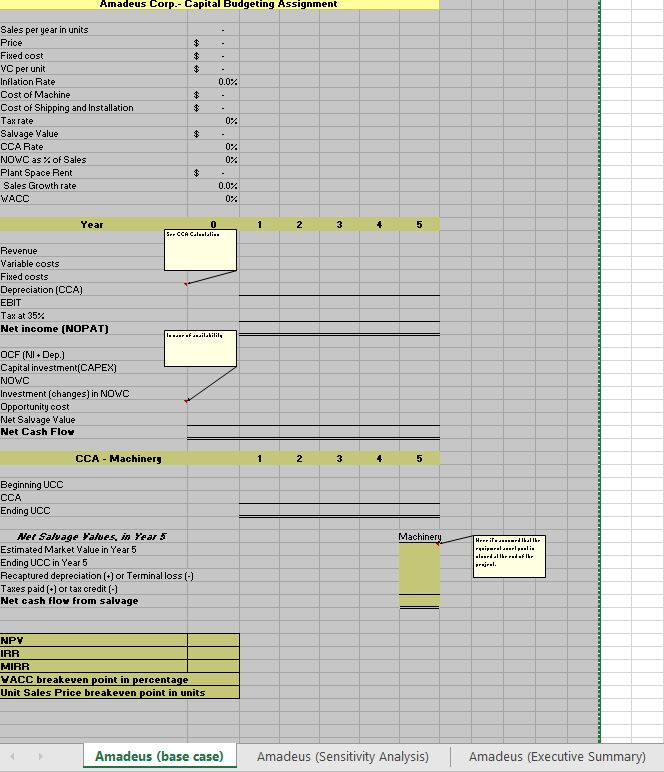

Amadeus Corporation is considering the issue of a new product to be added to its product mix. They hired you, a recent business graduate from MacEwan, for conducting the analysis. The production line would be set up in an unused space at the companys main plant. The plant space could be leased out to another firm at $15,000 per year starting from year 1. They should buy new machinery. The approximate cost of the machine would be $160,000, with another $16,000 in shipping and handling charges. It would also cost an additional $24,000 to install the equipment. The machinery has an economic life of 5 years and would be in Class 8 with a CCA rate of 35%. The machinery is expected to have a salvage value of $90,000 after 5 years of use. The new product line would generate incremental sales of 1,500 units per year for 5 years and they are expected to grow 4% per year. The cost per unit is estimated in $60 per unit in the first year. Each unit can be sold for $210 in the first year. The sales price and cost per unit are both expected to increase by 3 % per year due to inflation. The fixed costs are estimated to be $90,000 at the end of 1st year and would increase with inflation. To handle the new product line, the firms net operating working capital would be an amount equal to 17% of sales revenues. The firm tax rate is 35%. There are 1000 common shares outstanding with market price of $40 each. Also, they have 100 preferred shares with market value of $50. There are $50,000 long-term bond trading in market with an average price of $1,100 and 6 years to maturity, and 8% semi-annual coupon. Common shares of firm have a beta of 1.3. Risk free rate is 4% and expected market return is 16%. Preferred stock holder are receiving 1 dollar quarterly dividend. The project is considered by the financial department to be as risky as the company. The reinvestment risk is assumed to be 15%. Requirements 1. Using an Excel spreadsheet: Find the NPV, IRR and MIRR of the project by using the pro forma financial statement method to determine cash flows. Enter the input variables in cells of their own at the top of the spreadsheet (so it is easier to do sensitivity analysis calculations). Set up the necessary equations by referencing to the input variable cells. The spreadsheet must be formula driven; do not put any numbers in equations, only cell references. Use Excels built-in functions wherever possible (e.g. NPV and IRR functions). 2. Breakeven analysis At what WACC rate and Unit Sales price the project is going to break-even based on NPV method. 3. Sensitivity analysis Consider the following assumptions for the company and for each case individually calculate the NPV and include these analyses in your final recommendation. Perform sensitivity analysis on the unit sales, variable costs and the fixed cost for the project. Assume that each of these variables can vary from its base-case value by 15%. Summarize the results in a table (NPVs and IRRs for each sensitivity analysis). 4. Recommendation Use the results you obtained in the NPV, IRR, breakeven, sensitivity and scenario analysis above to write a one page report on your findings and recommend whether or not the company should proceed with the project. 5. Present this assignment in a professional way. It is your responsibility to communicate clearly to the marker. 6. Submit: (FOLLOW THESE INSTRUCTIONS STRICTLY): Worksheet 1, cover page with your names (all members of group). Worksheet 2, Excel spreadsheet showing base case NPV, IRR and MIRR and breakeven values (Requirements 1 and 2) Worksheet 3, sensitivity analysis along with a table showing the NPV for each sensitivity analysis Worksheet 4, Executive Summary of interpretation and recommendation (Requirement 4). Max. one page. You can complete this assignment in groups of up to 2 students Please list all group members names in the excel file you submit Please note that each group should submit only one Excel file Projects should be submitted by emailing assignment as an attachment THROUGH BLACKBOARD MAIL Submissions should INCLUDE ALL NAMES OF GROUP MEMBERS BOTH in the email and in the file names** **Appropriate naming for each of the files to be submitted with 2 members named Bob and Fred would be: Capital_Budgeting_Assignement_Fred_Bob.xls Amadeus Corp.- Capital Budgeting Assignment Sales per year in units - Price $- Fixed cost $- VC per unit $- Inflation Rate 0.0% Cost of Machine $- Cost of Shipping and Installation $- Tax rate 0% Salvage Value $- CCA Rate 0% NOWC as % of Sales 0% Plant Space Rent $- Sales Growth rate 0.0% WACC 0% Year 0 1 2 3 4 5 Revenue Variable costs Fixed costs Depreciation (CCA) EBIT Tax at 35% Net income (NOPAT) OCF (NI + Dep.) Capital investment(CAPEX) NOWC Investment (changes) in NOWC Opportunity cost Net Salvage Value Net Cash Flow CCA - Machinery 1 2 3 4 5 Beginning UCC CCA Ending UCC Net Salvage Values, in Year 5 Machinery Estimated Market Value in Year 5 Ending UCC in Year 5 Recaptured depreciation (+) or Terminal loss (-) Taxes paid (+) or tax credit (-) Net cash flow from salvage NPV IRR MIRR WACC breakeven point in percentage Unit Sales Price breakeven point in units

Amadeus Corporation is considering the issue of a new product to be added to its product mix. They hired you, a recent business graduate from MacEwan, for conducting the analysis. The production line would be set up in an unused space at the companys main plant. The plant space could be leased out to another firm at $15,000 per year starting from year 1. They should buy new machinery. The approximate cost of the machine would be $160,000, with another $16,000 in shipping and handling charges. It would also cost an additional $24,000 to install the equipment. The machinery has an economic life of 5 years and would be in Class 8 with a CCA rate of 35%. The machinery is expected to have a salvage value of $90,000 after 5 years of use. The new product line would generate incremental sales of 1,500 units per year for 5 years and they are expected to grow 4% per year. The cost per unit is estimated in $60 per unit in the first year. Each unit can be sold for $210 in the first year. The sales price and cost per unit are both expected to increase by 3 % per year due to inflation. The fixed costs are estimated to be $90,000 at the end of 1st year and would increase with inflation. To handle the new product line, the firms net operating working capital would be an amount equal to 17% of sales revenues. The firm tax rate is 35%. There are 1000 common shares outstanding with market price of $40 each. Also, they have 100 preferred shares with market value of $50. There are $50,000 long-term bond trading in market with an average price of $1,100 and 6 years to maturity, and 8% semi-annual coupon. Common shares of firm have a beta of 1.3. Risk free rate is 4% and expected market return is 16%. Preferred stock holder are receiving 1 dollar quarterly dividend. The project is considered by the financial department to be as risky as the company. The reinvestment risk is assumed to be 15%. Requirements 1. Using an Excel spreadsheet: Find the NPV, IRR and MIRR of the project by using the pro forma financial statement method to determine cash flows. Enter the input variables in cells of their own at the top of the spreadsheet (so it is easier to do sensitivity analysis calculations). Set up the necessary equations by referencing to the input variable cells. The spreadsheet must be formula driven; do not put any numbers in equations, only cell references. Use Excels built-in functions wherever possible (e.g. NPV and IRR functions). 2. Breakeven analysis At what WACC rate and Unit Sales price the project is going to break-even based on NPV method. 3. Sensitivity analysis Consider the following assumptions for the company and for each case individually calculate the NPV and include these analyses in your final recommendation. Perform sensitivity analysis on the unit sales, variable costs and the fixed cost for the project. Assume that each of these variables can vary from its base-case value by 15%. Summarize the results in a table (NPVs and IRRs for each sensitivity analysis). 4. Recommendation Use the results you obtained in the NPV, IRR, breakeven, sensitivity and scenario analysis above to write a one page report on your findings and recommend whether or not the company should proceed with the project. 5. Present this assignment in a professional way. It is your responsibility to communicate clearly to the marker. 6. Submit: (FOLLOW THESE INSTRUCTIONS STRICTLY): Worksheet 1, cover page with your names (all members of group). Worksheet 2, Excel spreadsheet showing base case NPV, IRR and MIRR and breakeven values (Requirements 1 and 2) Worksheet 3, sensitivity analysis along with a table showing the NPV for each sensitivity analysis Worksheet 4, Executive Summary of interpretation and recommendation (Requirement 4). Max. one page. You can complete this assignment in groups of up to 2 students Please list all group members names in the excel file you submit Please note that each group should submit only one Excel file Projects should be submitted by emailing assignment as an attachment THROUGH BLACKBOARD MAIL Submissions should INCLUDE ALL NAMES OF GROUP MEMBERS BOTH in the email and in the file names** **Appropriate naming for each of the files to be submitted with 2 members named Bob and Fred would be: Capital_Budgeting_Assignement_Fred_Bob.xls Amadeus Corp.- Capital Budgeting Assignment Sales per year in units - Price $- Fixed cost $- VC per unit $- Inflation Rate 0.0% Cost of Machine $- Cost of Shipping and Installation $- Tax rate 0% Salvage Value $- CCA Rate 0% NOWC as % of Sales 0% Plant Space Rent $- Sales Growth rate 0.0% WACC 0% Year 0 1 2 3 4 5 Revenue Variable costs Fixed costs Depreciation (CCA) EBIT Tax at 35% Net income (NOPAT) OCF (NI + Dep.) Capital investment(CAPEX) NOWC Investment (changes) in NOWC Opportunity cost Net Salvage Value Net Cash Flow CCA - Machinery 1 2 3 4 5 Beginning UCC CCA Ending UCC Net Salvage Values, in Year 5 Machinery Estimated Market Value in Year 5 Ending UCC in Year 5 Recaptured depreciation (+) or Terminal loss (-) Taxes paid (+) or tax credit (-) Net cash flow from salvage NPV IRR MIRR WACC breakeven point in percentage Unit Sales Price breakeven point in units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started