Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amana Ltd is a family-owned tourist business located in England which sells souvenirs to tourists. They have several locations in tourist hotspots across England

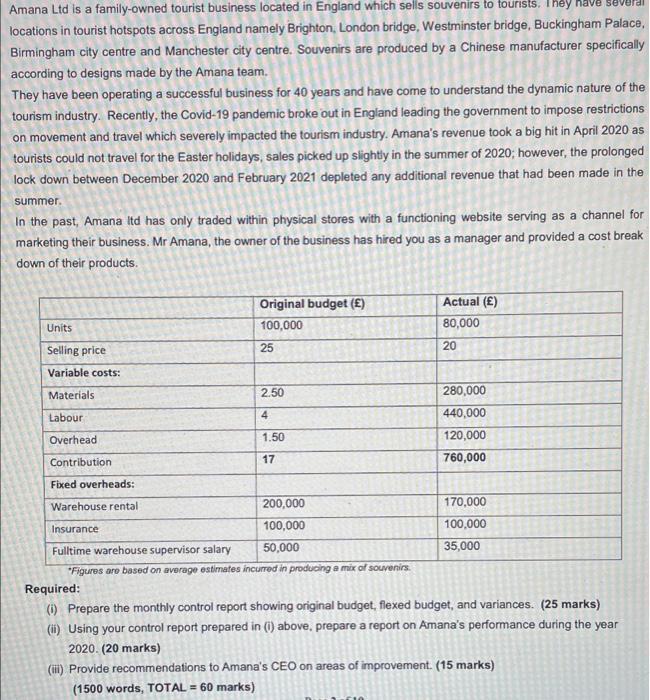

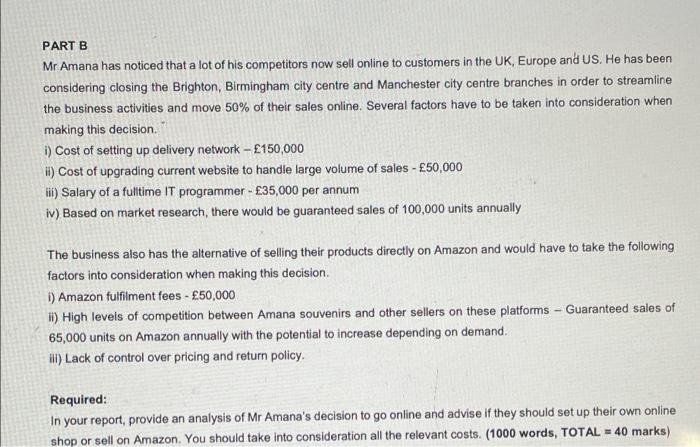

Amana Ltd is a family-owned tourist business located in England which sells souvenirs to tourists. They have several locations in tourist hotspots across England namely Brighton, London bridge, Westminster bridge, Buckingham Palace, Birmingham city centre and Manchester city centre. Souvenirs are produced by a Chinese manufacturer specifically according to designs made by the Amana team. They have been operating a successful business for 40 years and have come to understand the dynamic nature of the tourism industry. Recently, the Covid-19 pandemic broke out in England leading the government to impose restrictions on movement and travel which severely impacted the tourism industry. Amana's revenue took a big hit in April 2020 as tourists could not travel for the Easter holidays, sales picked up slightly in the summer of 2020; however, the prolonged lock down between December 2020 and February 2021 depleted any additional revenue that had been made in the summer. In the past, Amana Itd has only traded within physical stores with a functioning website serving as a channel for marketing their business. Mr Amana, the owner of the business has hired you as a manager and provided a cost break down of their products. Original budget () Actual () 100,000 80,000 Units Selling price 25 20 Variable costs: 2.50 280,000 Materials 4. 440,000 Labour Overhead 1.50 120,000 Contribution 17 760,000 Fixed overheads: Warehouse rental 200,000 170,000 100,000 100,000 Insurance Fulltime warehouse supervisor salary 50,000 35,000 "Figures are based on average estimates incured in producing a mix of souvenirs. Required: () Prepare the monthly control report showing original budget, flexed budget, and variances. (25 marks) (i) Using your control report prepared in (i) above, prepare a report on Amana's performance during the year 2020. (20 marks) (i) Provide recommendations to Amana's CEO on areas of improvement. (15 marks) (1500 words, TOTAL = 60 marks) PART B Mr Amana has noticed that a lot of his competitors now sell online to customers in the UK, Europe and US. He has been considering closing the Brighton, Birmingham city centre and Manchester city centre branches in order to streamline the business activities and move 50% of their sales online. Several factors have to be taken into consideration when making this decision. i) Cost of setting up delivery network - 150,000 i) Cost of upgrading current website to handle large volume of sales - 50,000 i) Salary of a fulltime IT programmer - 35,000 per annum iv) Based on market research, there would be guaranteed sales of 100,000 units annually The business also has the alternative of selling their products directly on Amazon and would have to take the following factors into consideration when making this decision. i) Amazon fulfilment fees - 50,000 i) High levels of competition between Amana souvenirs and other sellers on these platforms - Guaranteed sales of 65,000 units on Amazon annually with the potential to increase depending on demand. Hi) Lack of control over pricing and return policy. Required: In your report, provide an analysis of Mr Amana's decision to go online and advise if they should set up their own online shop or sell on Amazon. You should take into consideration all the relevant costs. (1000 words, TOTAL = 40 marks)

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answers i Flexed budget Actual variance Units 80000 80000 Sales 2000000 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started