Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amazon Inc. sells only 2 products, X and Y. She sells 3 units of product X for each 2 units of product Y. Amazon's

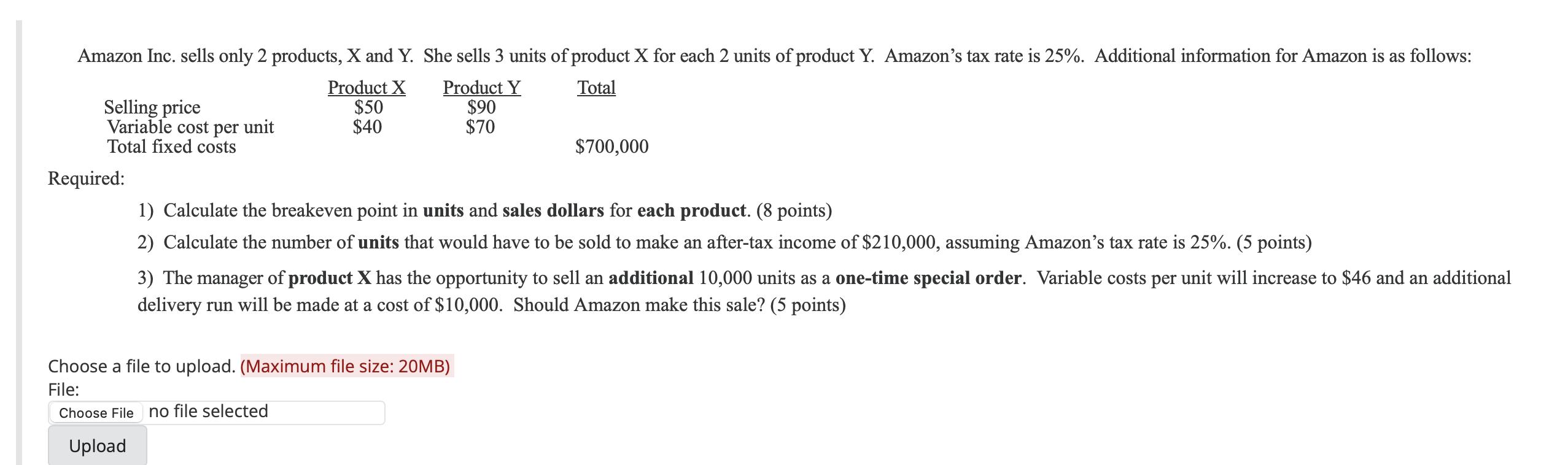

Amazon Inc. sells only 2 products, X and Y. She sells 3 units of product X for each 2 units of product Y. Amazon's tax rate is 25%. Additional information for Amazon is as follows: Product Y Total Product X $50 $90 $70 $40 Selling price Variable cost per unit Total fixed costs Required: $700,000 1) Calculate the breakeven point in units and sales dollars for each product. (8 points) 2) Calculate the number of units that would have to be sold to make an after-tax income of $210,000, assuming Amazon's tax rate is 25%. (5 points) 3) The manager of product X has the opportunity to sell an additional 10,000 units as a one-time special order. Variable costs per unit will increase to $46 and an additional delivery run will be made at a cost of $10,000. Should Amazon make this sale? (5 points) Choose a file to upload. (Maximum file size: 20MB) File: Choose File no file selected Upload

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Id be happy to help you with these calculations Lets start with the first question 1 Breakeven point ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started