Answered step by step

Verified Expert Solution

Question

1 Approved Answer

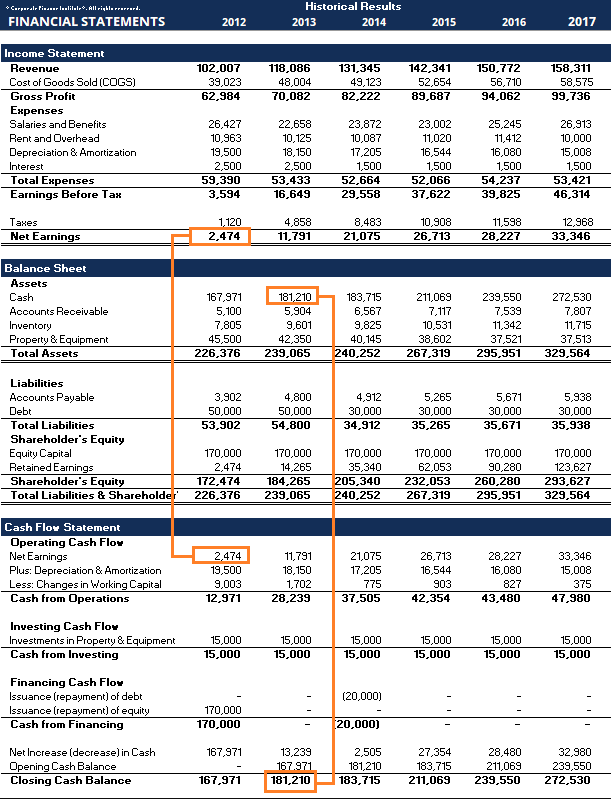

Amazon's financial statement Perform the following: a. horizontal analysis b. vertical analysis c. ratio analysis d. interpret the results Corporal-Fi.... l-lil.l. All righl rurard. FINANCIAL

Amazon's financial statement

Perform the following:

a. horizontal analysis

b. vertical analysis

c. ratio analysis

d. interpret the results

Corporal-Fi.... l-lil.l. All righl rurard. FINANCIAL STATEMENTS Historical Results 2013 2014 2012 2015 2016 2017 102,007 39,023 62,984 118,086 48,004 70,082 131,345 49,123 82,222 142,341 52,654 89,687 150,772 56,710 94,062 158,311 58,575 99,736 Income Statement Revenue Cost of Goods Sold (COGS) Gross Profit Expenses Salaries and Benefits Rent and Overhead Depreciation & Amortization Interest Total Expenses Earnings Before Tax 26,427 10,963 19,500 2,500 59,390 3,594 22,658 10,125 18,150 2,500 53,433 16,649 23,872 10,087 17,205 1,500 52,664 29,558 23,002 11,020 16,544 1,500 52,066 37,622 25,245 11,412 16,080 1,500 54,237 39,825 26,913 10,000 15,008 1,500 53,421 46,314 Tages Net Earnings 1,120 2,474 4,858 11,791 8,483 21,075 10,908 26,713 11,598 28,227 12,968 33,346 Balance Sheet Assets Cash Accounts Receivable Inventory Property & Equipment Total Assets 167,971 5,100 7,805 45,500 226,376 181,210 5,904 9,601 42,350 239,065 183,715 6,567 9,825 40,145 240,252 211,069 7.117 10,531 38,602 267,319 239,550 7,539 11,342 37,521 295,951 272,530 7,807 11,715 37,513 329,564 3,902 50,000 53,902 4,800 50,000 54,800 4,912 30,000 34,912 5,265 30,000 35,265 5,671 30,000 35,671 5,938 30,000 35,938 Liabilities Accounts Payable Debt Total Liabilities Shareholder's Equity Equity Capital Retained Earnings Shareholder's Equity Total Liabilities & Shareholder 170,000 2,474 172,474 226,376 170,000 14,265 184,265 239,065 170,000 35,340 205,340 240,252 170,000 62,053 232,053 267,319 170,000 90,280 260,280 295,951 170,000 123,627 293,627 329,564 Cash Floy Statement Operating Cash Flow Net Earnings Plus: Depreciation & Amortization Less: Changes in Working Capital Cash from Operations 2,474 19,500 9,003 12,971 11,791 18,150 1,702 28,239 21,075 17,205 775 37,505 26,713 16,544 903 42,354 28,227 16,080 827 43,480 33,346 15,008 375 47,980 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 Investing Cash Floy Investments in Property & Equipment Cash from Investing Financing Cash Flow Issuance (repayment) of debt Issuance (repayment) of equity Cash from Financing (20,000) 170,000 170,000 20,000) 167,971 Net Increase (decrease) in Cash Opening Cash Balance Closing Cash Balance 13,239 167.971 181,210 2,505 181,210 183,715 27,354 183,715 211,069 28,480 211,069 239,550 32,980 239,550 272,530 167,971 Corporal-Fi.... l-lil.l. All righl rurard. FINANCIAL STATEMENTS Historical Results 2013 2014 2012 2015 2016 2017 102,007 39,023 62,984 118,086 48,004 70,082 131,345 49,123 82,222 142,341 52,654 89,687 150,772 56,710 94,062 158,311 58,575 99,736 Income Statement Revenue Cost of Goods Sold (COGS) Gross Profit Expenses Salaries and Benefits Rent and Overhead Depreciation & Amortization Interest Total Expenses Earnings Before Tax 26,427 10,963 19,500 2,500 59,390 3,594 22,658 10,125 18,150 2,500 53,433 16,649 23,872 10,087 17,205 1,500 52,664 29,558 23,002 11,020 16,544 1,500 52,066 37,622 25,245 11,412 16,080 1,500 54,237 39,825 26,913 10,000 15,008 1,500 53,421 46,314 Tages Net Earnings 1,120 2,474 4,858 11,791 8,483 21,075 10,908 26,713 11,598 28,227 12,968 33,346 Balance Sheet Assets Cash Accounts Receivable Inventory Property & Equipment Total Assets 167,971 5,100 7,805 45,500 226,376 181,210 5,904 9,601 42,350 239,065 183,715 6,567 9,825 40,145 240,252 211,069 7.117 10,531 38,602 267,319 239,550 7,539 11,342 37,521 295,951 272,530 7,807 11,715 37,513 329,564 3,902 50,000 53,902 4,800 50,000 54,800 4,912 30,000 34,912 5,265 30,000 35,265 5,671 30,000 35,671 5,938 30,000 35,938 Liabilities Accounts Payable Debt Total Liabilities Shareholder's Equity Equity Capital Retained Earnings Shareholder's Equity Total Liabilities & Shareholder 170,000 2,474 172,474 226,376 170,000 14,265 184,265 239,065 170,000 35,340 205,340 240,252 170,000 62,053 232,053 267,319 170,000 90,280 260,280 295,951 170,000 123,627 293,627 329,564 Cash Floy Statement Operating Cash Flow Net Earnings Plus: Depreciation & Amortization Less: Changes in Working Capital Cash from Operations 2,474 19,500 9,003 12,971 11,791 18,150 1,702 28,239 21,075 17,205 775 37,505 26,713 16,544 903 42,354 28,227 16,080 827 43,480 33,346 15,008 375 47,980 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 Investing Cash Floy Investments in Property & Equipment Cash from Investing Financing Cash Flow Issuance (repayment) of debt Issuance (repayment) of equity Cash from Financing (20,000) 170,000 170,000 20,000) 167,971 Net Increase (decrease) in Cash Opening Cash Balance Closing Cash Balance 13,239 167.971 181,210 2,505 181,210 183,715 27,354 183,715 211,069 28,480 211,069 239,550 32,980 239,550 272,530 167,971Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started