Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amber Corporation, a publicly held corporation, currently pays its president an annual salary of $900,000. As a means of increasing company profitability, the board

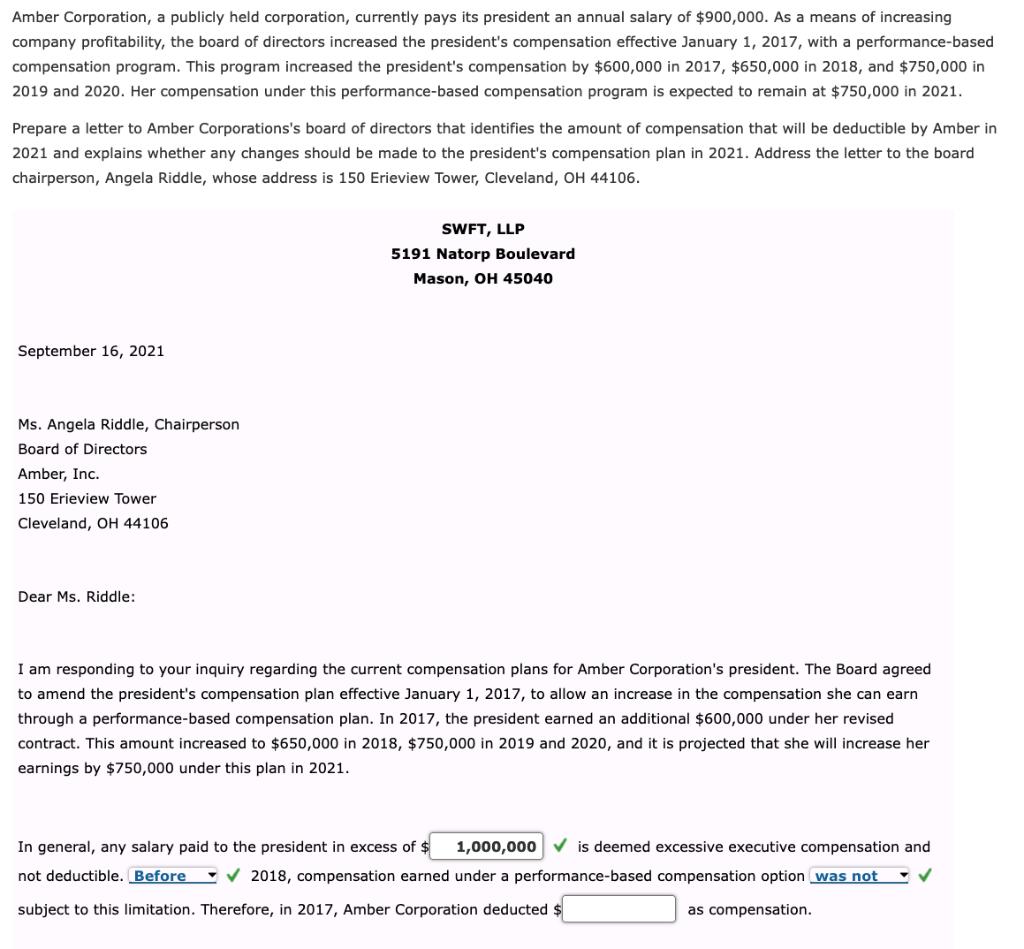

Amber Corporation, a publicly held corporation, currently pays its president an annual salary of $900,000. As a means of increasing company profitability, the board of directors increased the president's compensation effective January 1, 2017, with a performance-based compensation program. This program increased the president's compensation by $600,000 in 2017, $650,000 in 2018, and $750,000 in 2019 and 2020. Her compensation under this performance-based compensation program is expected to remain at $750,000 in 2021. Prepare a letter to Amber Corporations's board of directors that identifies the amount of compensation that will be deductible by Amber in 2021 and explains whether any changes should be made to the president's compensation plan in 2021. Address the letter to the board chairperson, Angela Riddle, whose address is 150 Erieview Tower, Cleveland, OH 44106. SWFT, LLP 5191 Natorp Boulevard Mason, OH 45040 September 16, 2021 Ms. Angela Riddle, Chairperson Board of Directors Amber, Inc. 150 Erieview Tower Cleveland, OH 44106 Dear Ms. Ridle: I am responding to your inquiry regarding the current compensation plans for Amber Corporation's president. The Board agreed to amend the president's compensation plan effective January 1, 2017, to allow an increase in the compensation she can earn through a performance-based compensation plan. In 2017, the president earned an additional $600,000 under her revised contract. This amount increased to $650,000 in 2018, $750,000 in 2019 and 2020, and it is projected that she will increase her earnings by $750,000 under this plan in 2021. In general, any salary paid to the president in excess of $ 1,000,000 V is deemed excessive executive compensation and not deductible. Before 2018, compensation earned under a performance-based compensation option was not subject to this limitation. Therefore, in 2017, Amber Corporation deducted $ as compensation.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep solution Step 1 of 2 A Income tax Income tax is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started