Answered step by step

Verified Expert Solution

Question

1 Approved Answer

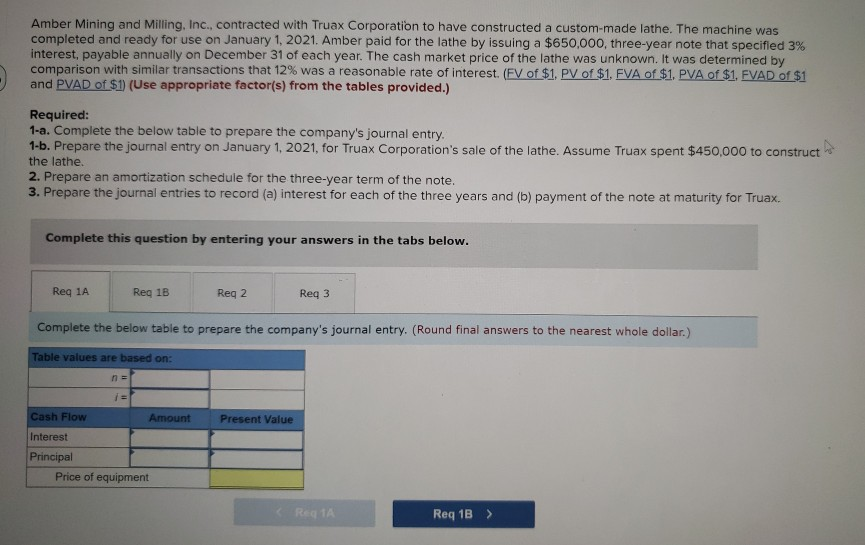

Amber Mining and Milling, Inc., contracted with Truax Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January

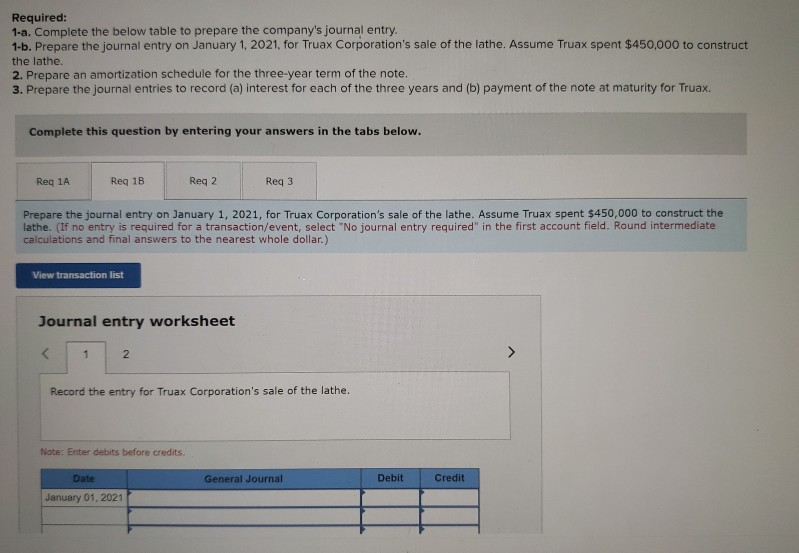

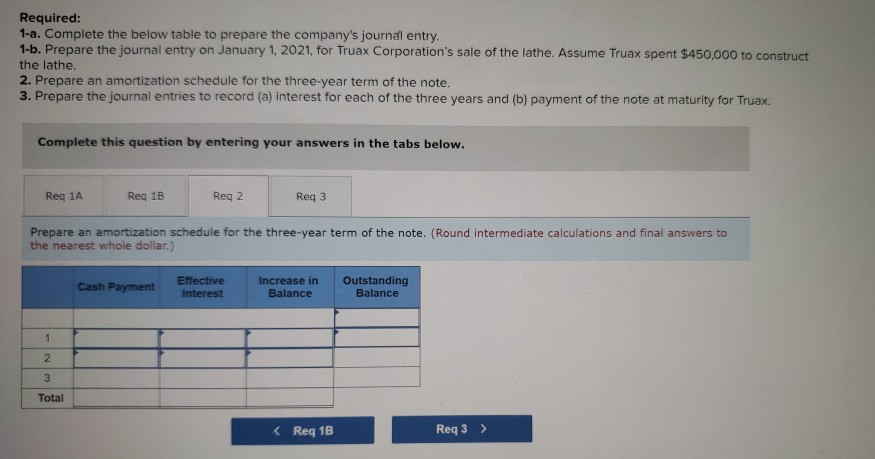

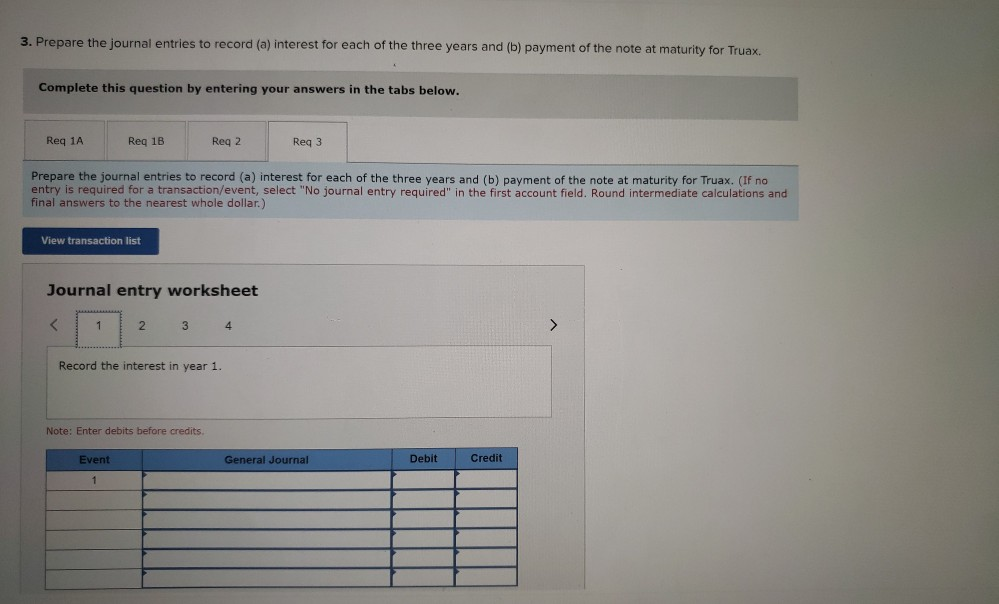

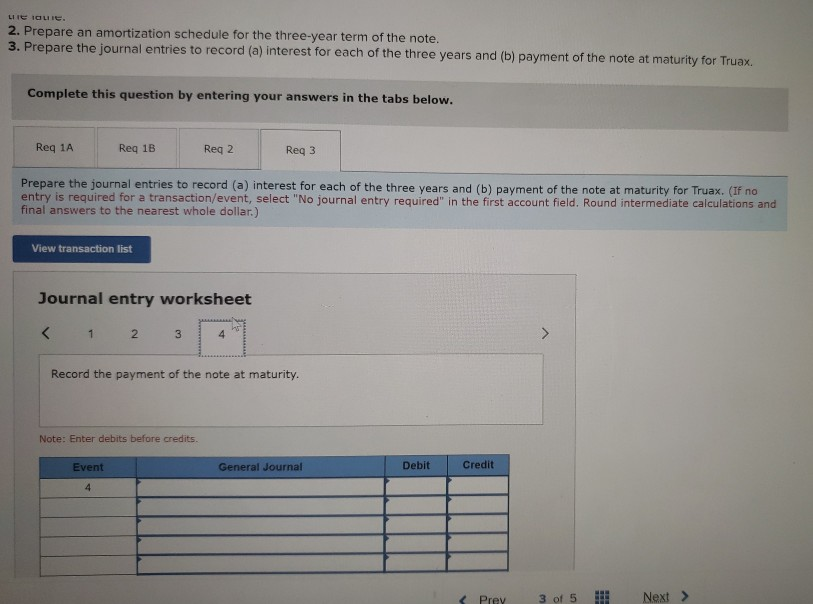

Amber Mining and Milling, Inc., contracted with Truax Corporation to have constructed a custom-made lathe. The machine was completed and ready for use on January 1, 2021. Amber paid for the lathe by issuing a $650,000, three-year note that specified 3% interest, payable annually on December 31 of each year. The cash market price of the lathe was unknown. It was determined by comparison with similar transactions that 12% was a reasonable rate of interest. (FV of $1, PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1-a. Complete the below table to prepare the company's journal entry. 1-b. Prepare the journal entry on January 1, 2021, for Truax Corporation's sale of the lathe. Assume Truax spent $450,000 to construct the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Reg 3 Complete the below table to prepare the company's journal entry. (Round final answers to the nearest whole dollar.) Table values are based on: n = 1 = Present Value Cash Flow Amount Interest Principal Price of equipment RegTA Req 1B > Required: 1-a. Complete the below table to prepare the company's journal entry. 1-b. Prepare the journal entry on January 1, 2021. for Truax Corporation's sale of the lathe. Assume Truax spent $450,000 to construct the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Req 2 Reg 3 Prepare the journal entry on January 1, 2021, for Truax Corporation's sale of the lathe. Assume Truax spent $450,000 to construct the lathe. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 Record the entry for Truax Corporation's sale of the lathe. Note: Enter debits before credits Date General Journal Debit Credit January 01, 2021 Required: 1-a. Complete the below table to prepare the company's journal entry. 1-b. Prepare the journal entry on January 1, 2021, for Truax Corporation's sale of the lathe. Assume Truax spent $450,000 to construct the lathe. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Req3 Prepare an amortization schedule for the three-year term of the note. (Round intermediate calculations and final answers to the nearest whole dollar.) Cash Payment Effective Interest Increase in Balance Outstanding Balance 1 N 3 Total 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Reg 2 Reg 3 Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar) View transaction list Journal entry worksheet Record the interest in year 1. Note: Enter debits before credits Event General Journal Debit Credit 1 BLOCK 2 AND 3 ARE TO RECORD INTEREST FOR THEIR RESPECTIVE YEARS. LIETOLIE. 2. Prepare an amortization schedule for the three-year term of the note. 3. Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Reg 3 Prepare the journal entries to record (a) interest for each of the three years and (b) payment of the note at maturity for Truax. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started