Question

AMC Limited issued five-year, 5% bonds for their par value of $830,000 on 1 January 20X1. Interest is paid annually. The bonds are convertible to

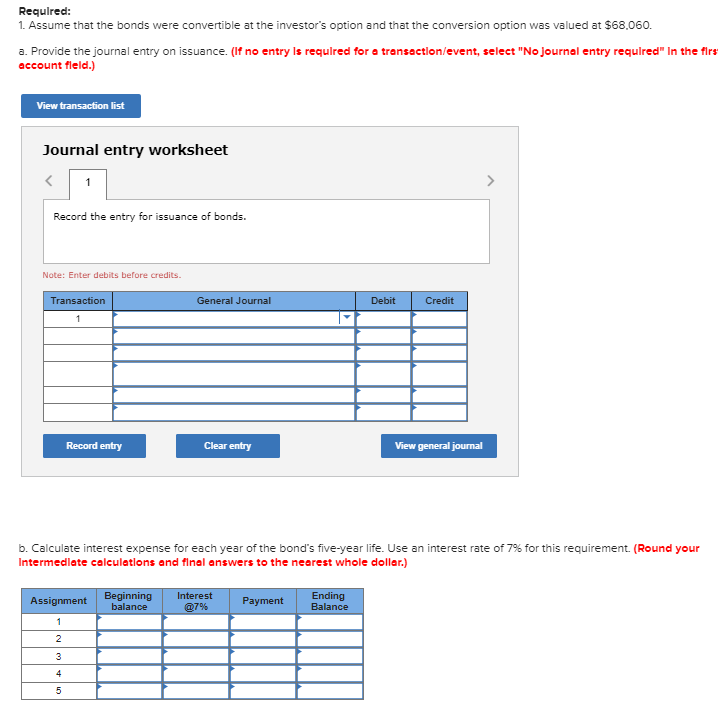

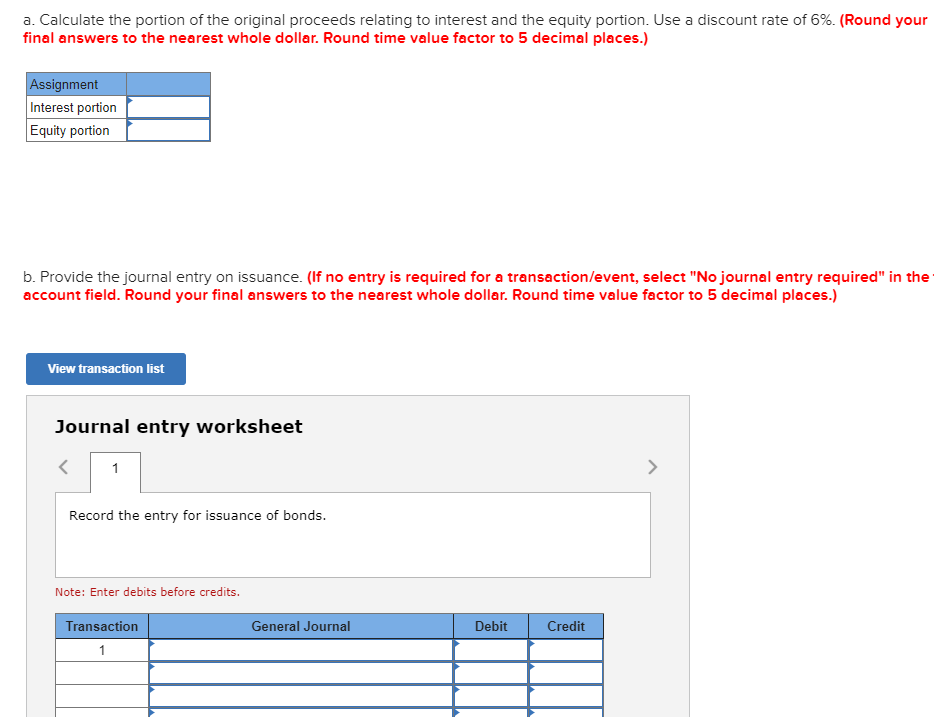

AMC Limited issued five-year, 5% bonds for their par value of $830,000 on 1 January 20X1. Interest is paid annually. The bonds are convertible to common shares at a rate of 50 common shares for every $1,000 bond. (PV of $1, PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Assume that the bonds were convertible at the investors option and that the conversion option was valued at $68,060.

c. Provide the journal entry to record maturity of the bond assuming shareholders convert their bonds to common shares.

d. Assume instead that the bonds were repaid for $879,300 after interest was paid in Year 3. Provide the journal entry for retirement, assuming $67,360 of the payment related to the option and the rest related to the bond.

Record the entry for repayment of bonds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started