Answered step by step

Verified Expert Solution

Question

1 Approved Answer

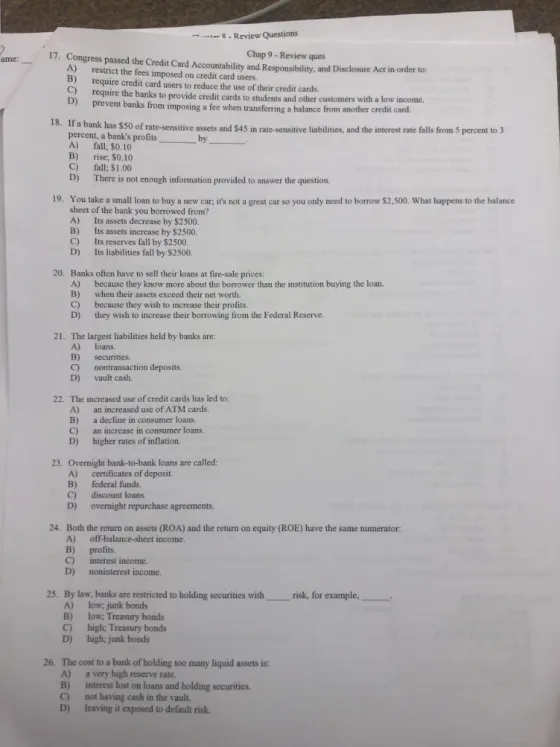

ame: Chap 9-Review ques 17. Congress passed the Credit Card Accountability and Responsibility, and Disclosure Act in order to: restrict the fees imposed on

ame: Chap 9-Review ques 17. Congress passed the Credit Card Accountability and Responsibility, and Disclosure Act in order to: restrict the fees imposed on credit card users. require credit card users to reduce the use of their credit cards. require the banks to provide credit cards to students and other customers with a low income. prevent banks from imposing a fee when transferring a balance from another credit card. A) B) C) D) 18. If a bank has $50 of rate-sensitive assets and $45 in rate-sensitive liabilities, and the interest rate falls from 5 percent to 3 percent, a bank's profits, by fall; $0.10 A) B) rise; $0.10 fall; $1.00 There is not enough information provided to answer the question. C) D) 19. You take a small loan to buy a new car, it's not a great car so you only need to borrow $2,500. What happens to the balance sheet of the bank you borrowed from? A) Its assets decrease by $2500. B) Its assets increase by $2500. C) D) 20. Banks often have to sell their loans at fire-sale prices: A) B) C) D) B) C) D) 21. The largest liabilities held by banks are: A) loans. securities A) B) C) D) Its reserves fall by $2500. Its liabilities fall by $2500. 22. The increased use of credit cards has led to: an increased use of ATM cards. a decline in consumer loans. A) B) C) D) because they know more about the borrower than the institution buying the loan. when their assets exceed their net worth. because they wish to increase their profits. they wish to increase their borrowing from the Federal Reserve. nontransaction deposits. vault cash. 23. Overnight bank-to-bank loans are called: certificates of deposit. federal funds. discount loans overnight repurchase agreements. Review Questions an increase in consumer loans. higher rates of inflation. A) zaca 24. Both the return on assets (ROA) and the return on equity (ROE) have the same numerator. A) off-balance-sheet income. B) profits. C) interest income. D) noninterest income. 25. By law, banks are restricted to holding securities with A) low; junk bonds B) C) D) low, Treasury bonds high Treasury bonds high, junk bonds 26. The cost to a bank of holding too many liquid assets is: a very high reserve rate. interest lost on loans and holding securities. not having cash in the vault. leaving it exposed to default risk. risk, for example,

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Congress passed the Credit Card Account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started