Answered step by step

Verified Expert Solution

Question

1 Approved Answer

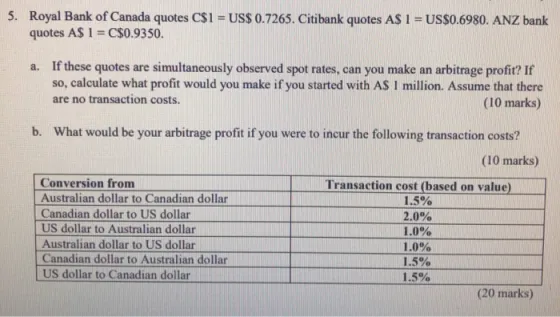

5. Royal Bank of Canada quotes C$1 = US$ 0.7265. Citibank quotes A$ 1 = US$0.6980, ANZ bank quotes A$ 1=C$0.9350. a. If these

5. Royal Bank of Canada quotes C$1 = US$ 0.7265. Citibank quotes A$ 1 = US$0.6980, ANZ bank quotes A$ 1=C$0.9350. a. If these quotes are simultaneously observed spot rates, can you make an arbitrage profit? If so, calculate what profit would you make if you started with AS 1 million. Assume that there are no transaction costs. (10 marks) b. What would be your arbitrage profit if you were to incur the following transaction costs? (10 marks) Conversion from Australian dollar to Canadian dollar Canadian dollar to US dollar US dollar to Australian dollar Australian dollar to US dollar Canadian dollar to Australian dollar US dollar to Canadian dollar Transaction cost (based on value) 1.5% 2.0% 1.0% 1.0% 1.5% 1.5% (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Arbitrage Calculation with and without Transaction Costs a Without Transaction Costs Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started