Answered step by step

Verified Expert Solution

Question

1 Approved Answer

American school Business math, I have a deadline so Thank you in advance!! BUSINESS MATH Exam-Continued his week Gary, who is single and claims one

American school Business math, I have a deadline so Thank you in advance!!

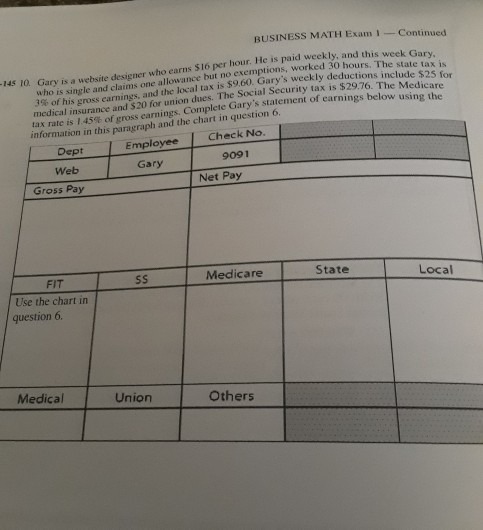

BUSINESS MATH Exam-Continued his week Gary, who is single and claims one allowance but no exemptions, worked 30 hours. Thtato 3% of his gross earnings, and the local tax is $960 Gary's weekly deductions include medical insurance and $20 for union dues. The Social Security tax is $29.76. The Med state tax is 145 10. Ga cy is a website designer who earn a $25 for are tax rate is 1.45% ofgross earnings. Complete Gary's statement of earnings below usi anformation in this paragraph and the chart in question 6. Employee Check No. Dept Web Gross Pay 9091 Gary Net Pay FIT 5s Medicare State Local Use the chart in question 6. Medical Union Others

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started