Answered step by step

Verified Expert Solution

Question

1 Approved Answer

amerly Company (a Utah employer) wants to give a holiday bonus check of $325 to each employee. Since it wants the check amount to be

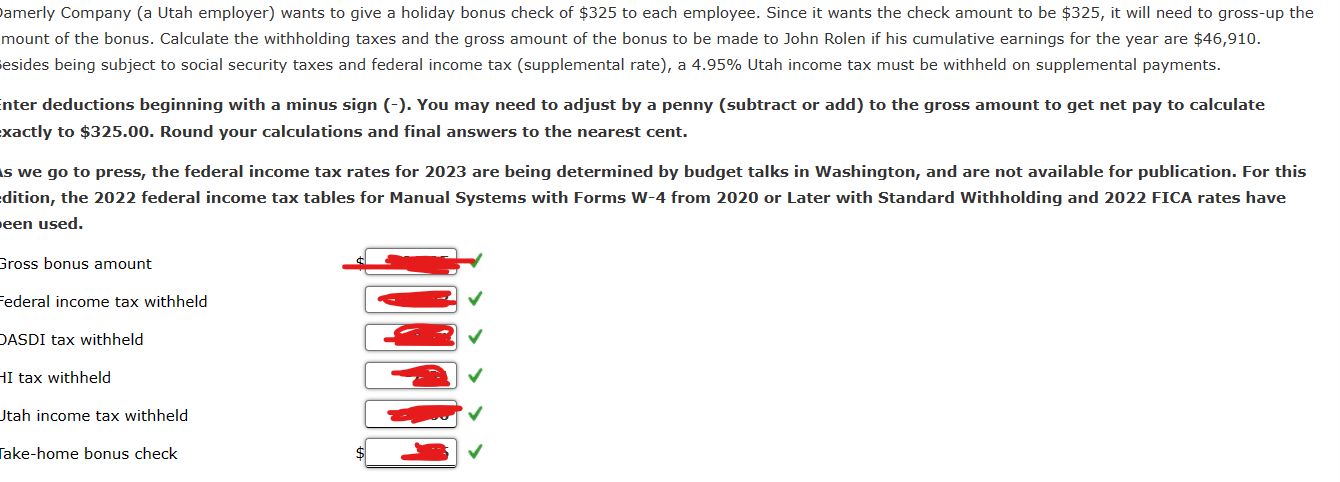

amerly Company (a Utah employer) wants to give a holiday bonus check of $325 to each employee. Since it wants the check amount to be $325, it will need to gross-up the mount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. esides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments. nter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate xactly to $325.00. Round your calculations and final answers to the nearest cent. s we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this dition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have amerly Company (a Utah employer) wants to give a holiday bonus check of $325 to each employee. Since it wants the check amount to be $325, it will need to gross-up the mount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. esides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments. nter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate xactly to $325.00. Round your calculations and final answers to the nearest cent. s we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this dition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have

amerly Company (a Utah employer) wants to give a holiday bonus check of $325 to each employee. Since it wants the check amount to be $325, it will need to gross-up the mount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. esides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments. nter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate xactly to $325.00. Round your calculations and final answers to the nearest cent. s we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this dition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have amerly Company (a Utah employer) wants to give a holiday bonus check of $325 to each employee. Since it wants the check amount to be $325, it will need to gross-up the mount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. esides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments. nter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate xactly to $325.00. Round your calculations and final answers to the nearest cent. s we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this dition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started