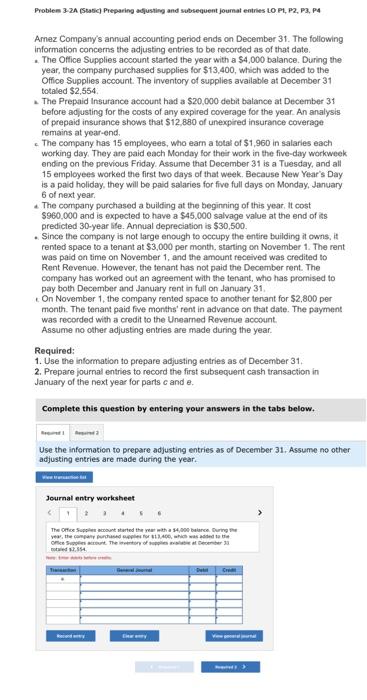

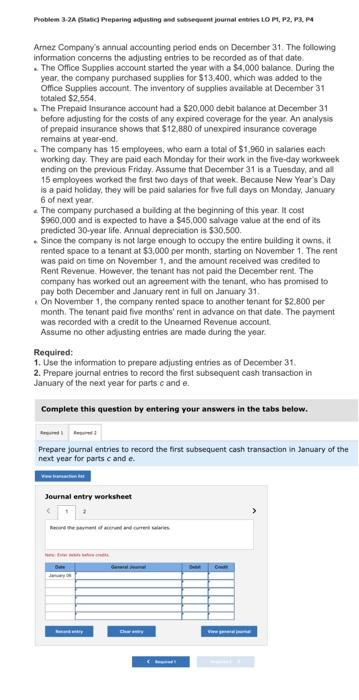

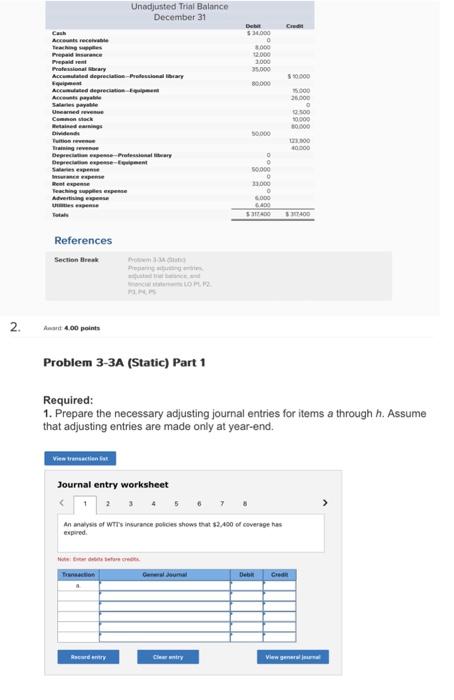

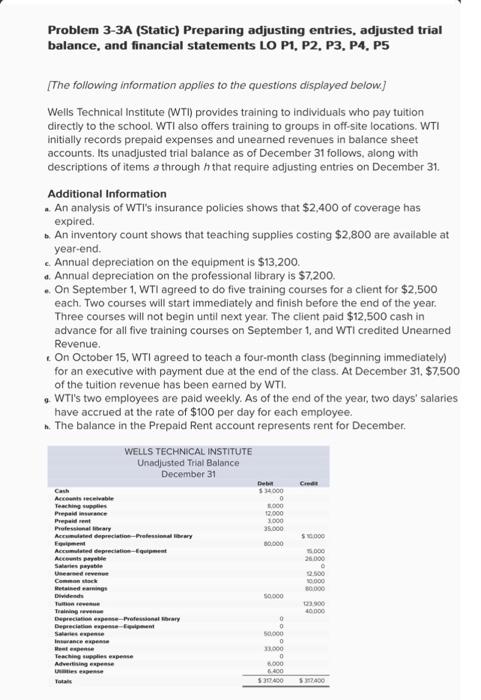

Amez Company's annual accounting period ends on December 31. The following information concerns the adjusting entries to be recorded as of that date. *. The Office Supplies account started the year with a $4,000 balance. During the year, the company purchased supplies for $13,400, which was added to the Office Supplies account. The inventory of supplies available at December 31 totaled $2,554 2. The Prepaid Insurance account had a $20,000 debit balance at December 31 before ad/usting for the costs of any expired coverage for the year. An analysis of prepaid insurance shows that $12,880 of unexpired insurance coverage remains at year-end. . The company has 15 employees, who eam a total of $1,960 in salaries each working day. They are paid each Monday for their work in the five-day workweek ending on the previous Friday. Assume that December 31 is a Tuesday, and all 15 employees worked the first two days of that week. Because New Year's Day is a paid holiday, they will be paid salaries for five full days on Monday, Jaruary 6 of next year. 4. The company purchased a building at the beginning of this year, It cost $960,000 and is expected to have a $45,000 salvage value at the end of as predicted 30-year lile. Annual depreciation is $30,500. - Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,000 per month, starting on November 1. The rent was paid on time on November 1, and the amount received was credited to Rent Revenue. However, the tenant has not paid the Decomber rent. The company has worked out an agreement with the tenant, who has promised to pay both December and January rent in full on danuary 31 . . On November 1, the company rented space to another tenant for $2,800 per month. The tenant paid five monthis' rent in advance on that date. The payment was recorded with a credit to the Unearned Revenue acocunt. Assume no other adjusting entries are made during the year. Required: 1. Use the information to prepare adjusting entries as of December 31 . 2. Prepare journal entries to record the first subsecuent cash transaction in January of the next year for parts c and . Complete this question by entering your answers in the tabs below. Use the information to prepare adjusting entries as of December 31. Assume no other adjusting entries are made during the year. Journal entry worksheet motared 1+354 Arnez Company's annual acoounting period ends on December 31 . The following information concerns the adjusting entries to be recorded as of that date. * The Otfice Supplies account started the year with a $4,000 balance. Duriog the year, the company purchased supplies for 513,400 , which was added to the Office Supplies account. The irwentory of supplies arvailable at December 31 botaled $2,554 1. The Prepaid lnsurance account had a $20,000 debit balance at December 31 before adjusting for the costs of any expired coverage for the year. An analysis of prepaid insurance shows that $12.880 of unexpired insurance cowerage remains at year-end. 2. The company has 15 employees, who eam a iotal of $1,960 in salaries each working day. They are paid each Monday for their work in the five-day workweek ending on the previcus Friday. Assume that December 31 is a Tuesday, and all 15 employees worked the first hwo days of that week. Because New Year's Day is a paid holiday, they will be paid salaries for five full days on Monday, Jamuary 6 of next year. a. The company purchased a building at the beginning of this year. It cost $960,000 and is expected to have a $45,000 salvage value at the end of its predicted 30-year life. Annual depreciation is 330,500 . - Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,000 per month, starting on November 1 . The rent was paid on time cn November 1 , and the amount recelved was credied to Rent Reevenue. However, the tenant has not paid the December rent. The company has worked out an Agreement with the tenant, who has promised to pay both December and January rent in full on January 31. - On November 1, the company ronted space to another tenant for $2.800 per month. The tenant paid five months' rent in advance on that date. The payment was recorded with a credit to the Uneamed Revenue account. Assume no other adyusting entries are made during the year. Required: 1. Use the information to propare adjusting entries as of Docember 31 . 2. Prepare journal entries to record the first subsequent cash transaction in January of the next year for parts c and e. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the first subsequent cash transaction in january of the neat year for parts c and e. Required: 1. Prepare the necessary adjusting journal entries for items a through h. Assume that adjusting entries are made only at year-end. balance, and financial statements LO P1, P2, P3, P4, P5 [The following information applies to the questions displayed below.] Wells Technical Institute (WTI) provides training to individuals who pay tuition directly to the school. WTI also offers training to groups in off-site locations. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Its unadjusted trial balance as of December 31 follows, along with descriptions of items a through h that require adjusting entries on December 31. Additional Information 2. An analysis of WTI's insurance policies shows that $2,400 of coverage has expired. b. An inventory count shows that teaching supplies costing $2,800 are available at year-end. c. Annual depreciation on the equipment is $13,200. a. Annual depreciation on the professional library is $7,200. -. On September 1, WTI agreed to do five training courses for a client for $2,500 each. Two courses will start immediately and finish before the end of the year. Three courses will not begin until next year. The client paid $12,500 cash in advance for all five training courses on September 1 , and WTI credited Unearned Revenue. 2. On October 15, WTI agreed to teach a four-month ciass (beginning immediately) for an executive with payment due at the end of the class. At December 31,$7,500 of the tuition revenue has been eamed by WTL. a. WTi's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per day for each employee. h. The balance in the Prepaid Rent account represents rent for December