Question

Aminah, Beatrice and Chandra are in a business partnership, sharing profits and losses in the ratio of the amount of capital contributed. Their net

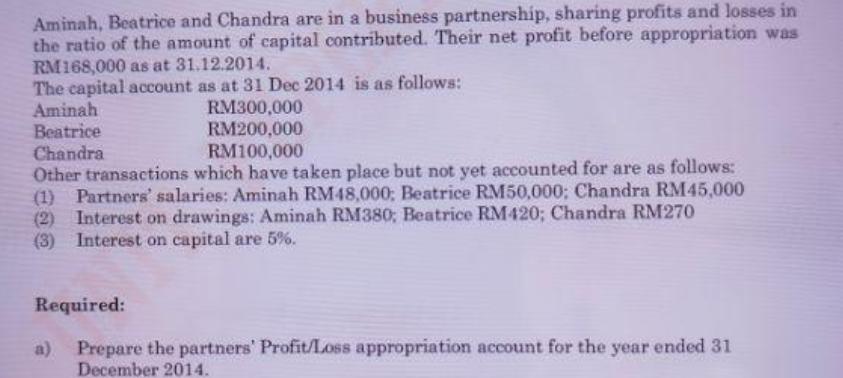

Aminah, Beatrice and Chandra are in a business partnership, sharing profits and losses in the ratio of the amount of capital contributed. Their net profit before appropriation was RM168,000 as at 31.12.2014. The capital account as at 31 Dec 2014 is as follows: RM300,000 RM200,000 Aminah Beatrice Chandra RM100,000 Other transactions which have taken place but not yet accounted for are as follows: (1) Partners' salaries: Aminah RM48,000; Beatrice RM50,000; Chandra RM45,000 (2) Interest on drawings: Aminah RM380; Beatrice RM420; Chandra RM270 (3) Interest on capital are 5%. Required: Prepare the partners' Profit/Loss appropriation account for the year ended 31 December 2014.

Step by Step Solution

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Preparation of profit and loss appropriation account P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App