Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amman Company has three production lines, Production Line 1, Production Line 2 and Production Line 3. The management of the company has decided to

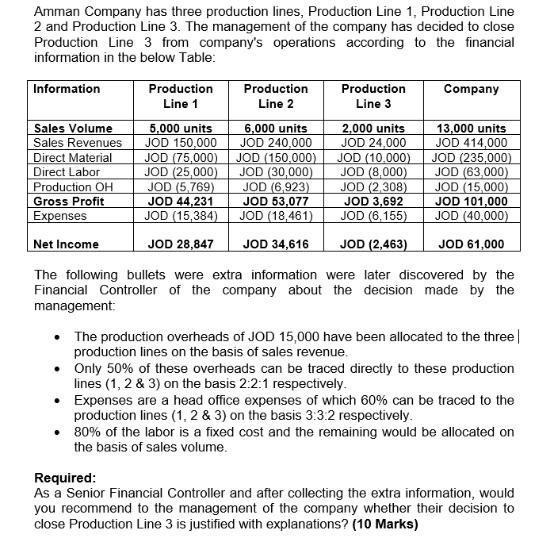

Amman Company has three production lines, Production Line 1, Production Line 2 and Production Line 3. The management of the company has decided to close Production Line 3 from company's operations according to the financial information in the below Table: Information Production Line 1 Production Line 2 Company Sales Volume Sales Revenues Direct Material Direct Labor Production OH 5,000 units JOD 150,000 JOD (75,000) JOD (25,000) JOD (5,769) Gross Profit Expenses JOD 44,231 JOD (15,384) 6,000 units JOD 240,000 JOD (150,000) JOD (30,000) JOD (6,923) JOD 53,077 JOD (18,461) JOD 3,692 JOD (6,155) Production Line 3 2,000 units JOD 24,000 JOD (10,000) JOD (8,000) JOD (2,308) 13,000 units JOD 414,000 JOD (235,000) JOD (63,000) JOD (15,000) JOD 101,000 JOD (40,000) Net Income JOD 28,847 JOD 34,616 JOD (2,463) JOD 61,000 The following bullets were extra information were later discovered by the Financial Controller of the company about the decision made by the management: The production overheads of JOD 15,000 have been allocated to the three | production lines on the basis of sales revenue. Only 50% of these overheads can be traced directly to these production lines (1,2 & 3) on the basis 2:2:1 respectively. Expenses are a head office expenses of which 60% can be traced to the production lines (1, 2 & 3) on the basis 3:3:2 respectively. 80% of the labor is a fixed cost and the remaining would be allocated on the basis of sales volume. Required: As a Senior Financial Controller and after collecting the extra information, would you recommend to the management of the company whether their decision to close Production Line 3 is justified with explanations? (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started