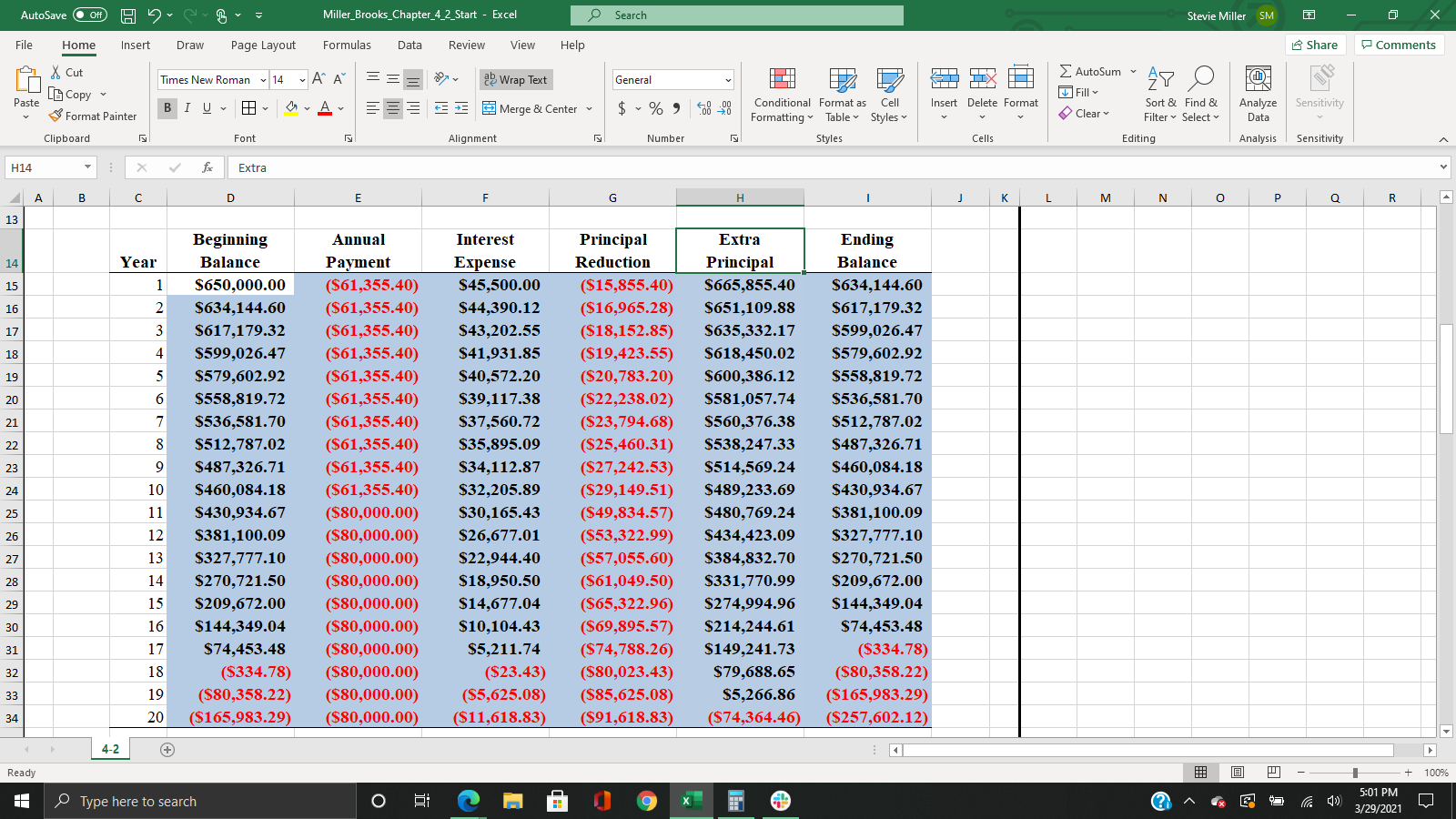

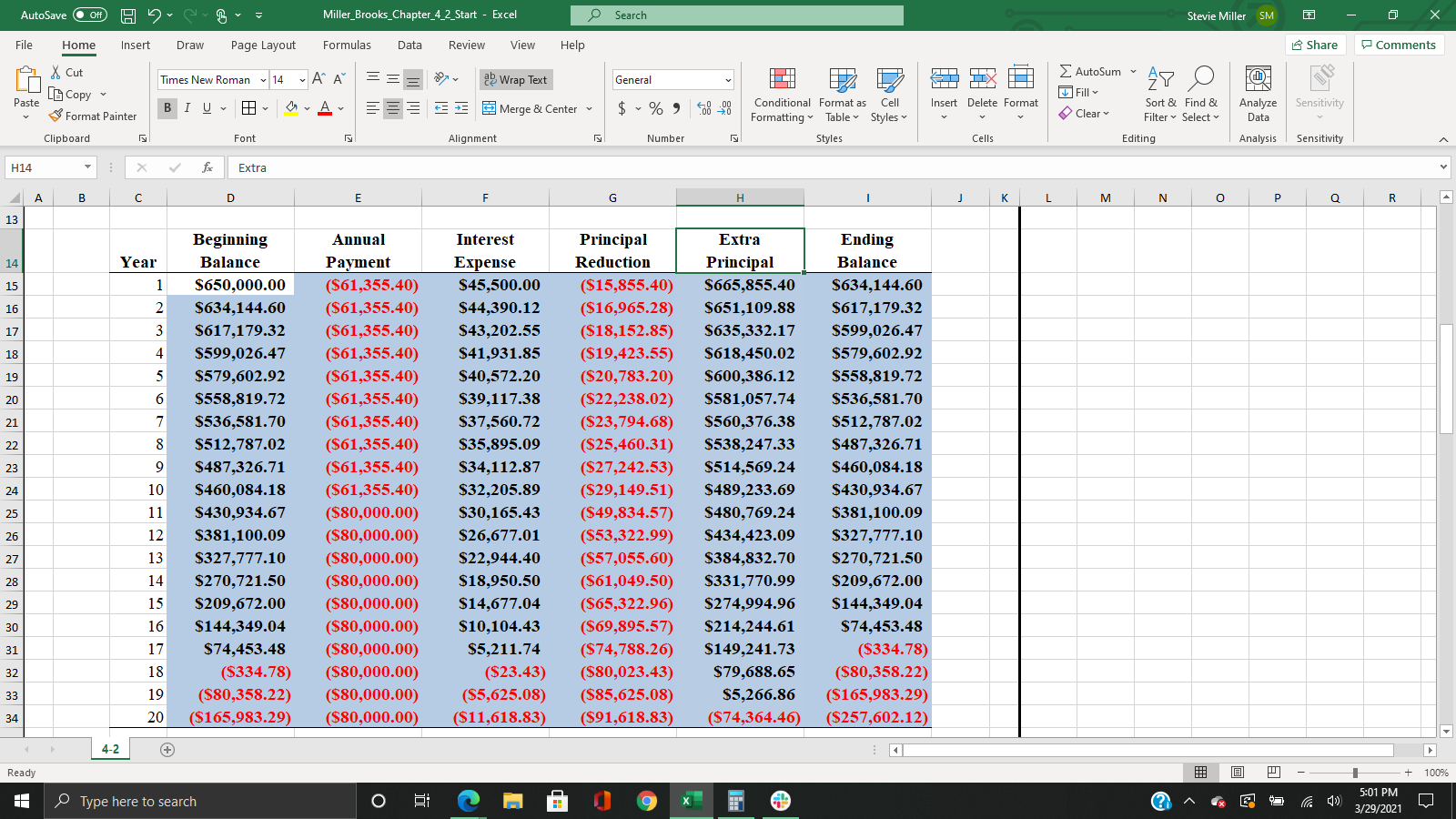

Amortization schedule. Sherry and Sam want to purchase a condo at the coast. They will spend $650,000 on the condo and are taking out a $650,000 loan for the condo for twenty years at 7.0% interest. What is the annual payment on the mortgage? Construct the amortization schedule of the loan for the twenty years in a spreadsheet to show the annual interest costs, the principal reduction, and the ending balance each year. Then change the amortization schedule to reflect that after ten years Sherry and Sam will increase their annual payment to $80,000 per year. When will they fully repay the mortgage with this increased payment if they apply all the extra dollars above the original payment to the principal?

I am confused on #5 & #6 in the directions. Can someone explain?

My "Extra Principal" section is just a guess on what this is supposed to be, but I am not sure how to incorporate this into the remainder of the ending balance.

HELP!

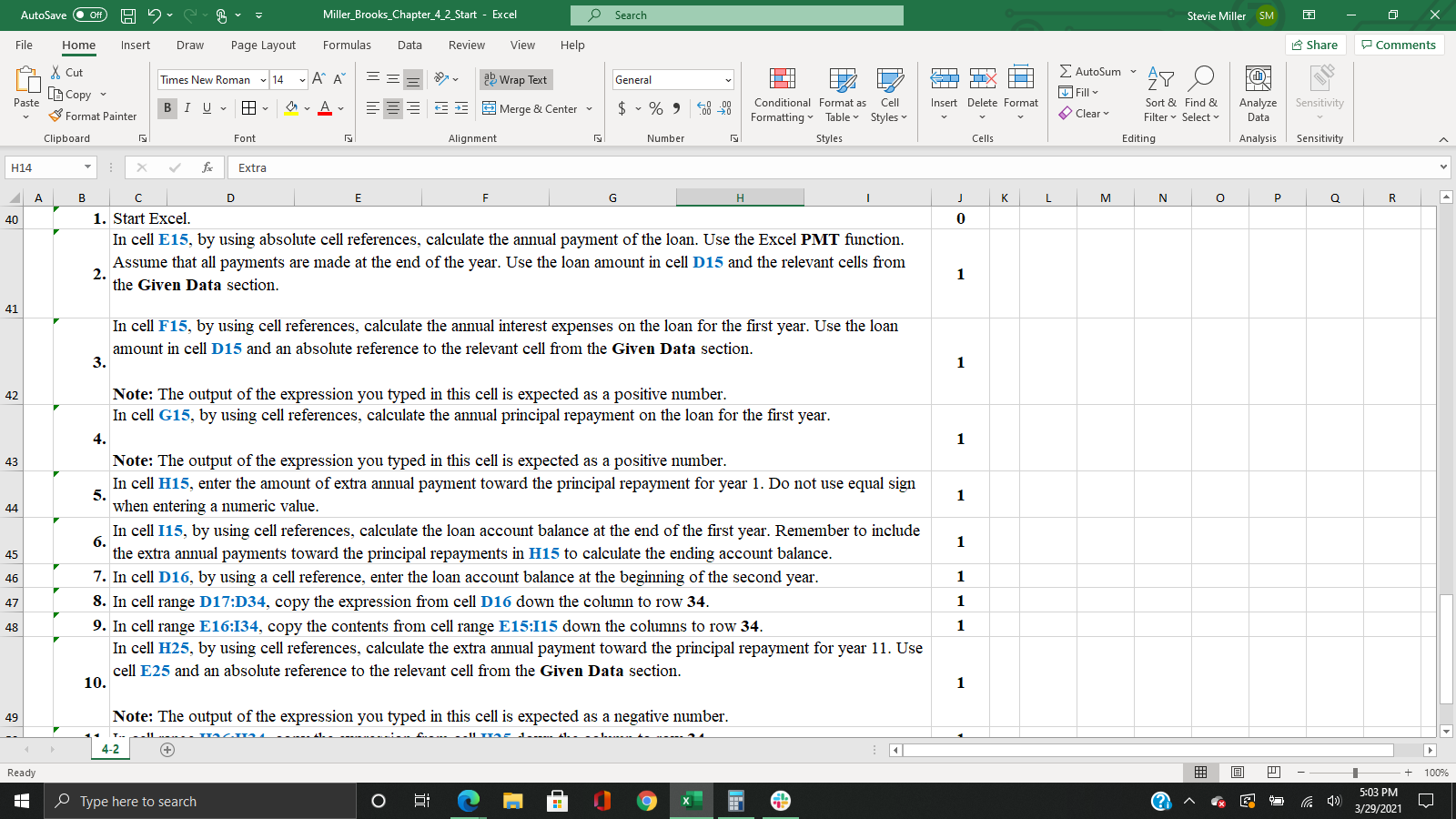

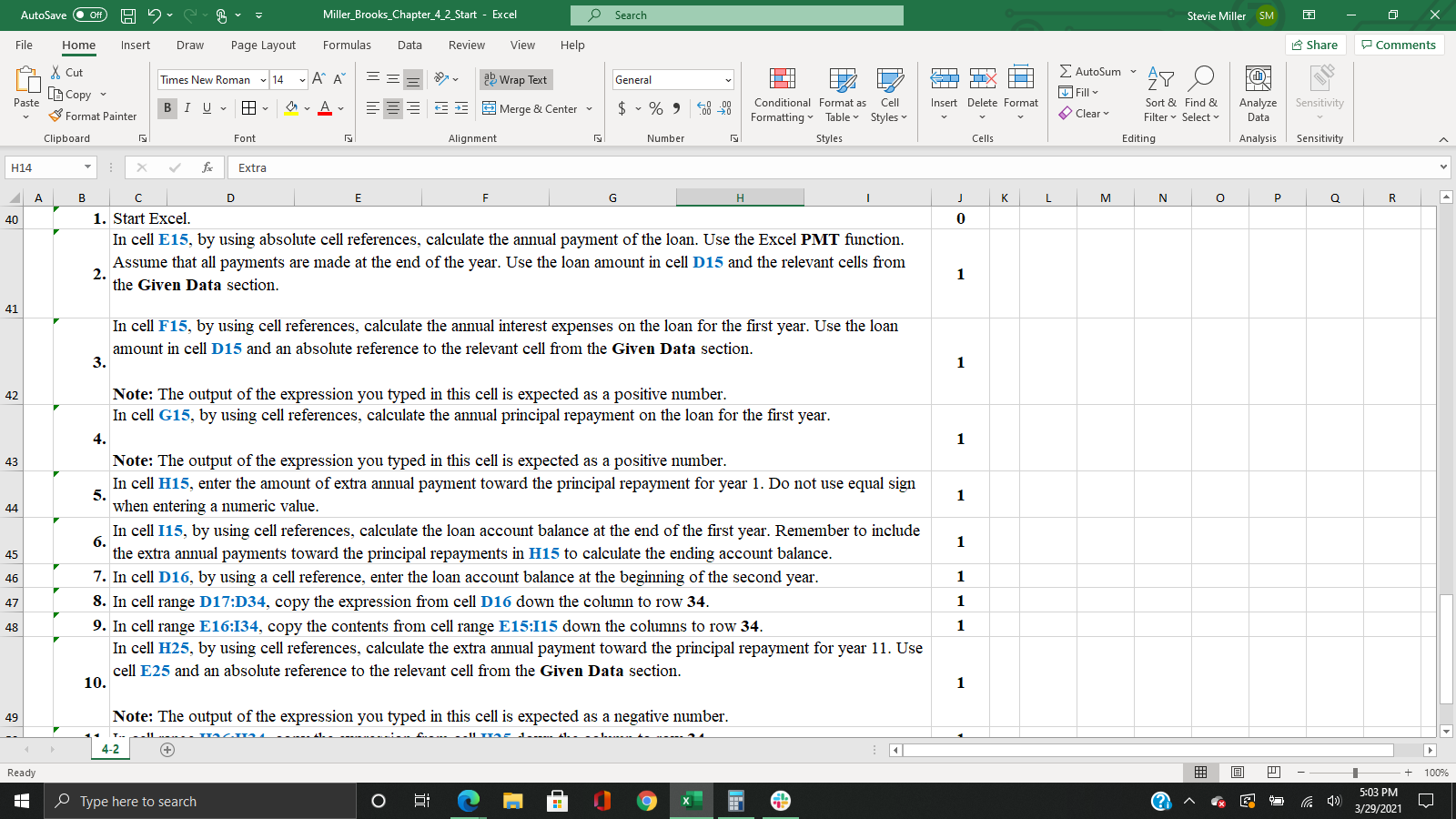

AutoSave Miller_Brooks_Chapter_4_2_Start - Excel Search Stevie Miller SM File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments Times New Roman 14 A A General 1 TIX AY FO X Cut LECopy Format Painter === Ouv a Wrap Text === Merge & Center AutoSum Fill Clear Paste BIU ~ A $ %) Insert Delete Format Analyze Sensitivity Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Data Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity H14 fac Extra B E H 1 J K L M N O P Q R 40 0 D G 1. Start Excel. In cell E15, by using absolute cell references, calculate the annual payment of the loan. Use the Excel PMT function. Assume that all payments are made at the end of the year. Use the loan amount in cell D15 and the relevant cells from 2. the Given Data section. 1 41 In cell F15, by using cell references, calculate the annual interest expenses on the loan for the first year. Use the loan amount in cell D15 and an absolute reference to the relevant cell from the Given Data section. 3. 1 42 Note: The output of the expression you typed in this cell is expected as a positive number. In cell G15, by using cell references, calculate the annual principal repayment on the loan for the first year. 4. 1 43 1 44 6. 1 45 Note: The output of the expression you typed in this cell is expected as a positive number. In cell H15, enter the amount of extra annual payment toward the principal repayment for year 1. Do not use equal sign 5. when entering a numeric value. In cell 115, by using cell references, calculate the loan account balance at the end of the first year. Remember to include the extra annual payments toward the principal repayments in H15 to calculate the ending account balance. 7. In cell D16, by using a cell reference, enter the loan account balance at the beginning of the second year. 8. In cell range D17:D34, copy the expression from cell D16 down the column to row 34. 9. In cell range E16:134, copy the contents from cell range E15:115 down the columns to row 34. In cell H25, by using cell references, calculate the extra annual payment toward the principal repayment for year 11. Use cell E25 and an absolute reference to the relevant cell from the Given Data section. 10. 46 1 47 1 48 1 1 49 Note: The output of the expression you typed in this cell is expected as a negative number. ...11 AC 1. 1.. 4-2 Ready 100% H Type here to search O (1) 5:03 PM 3/29/2021 AutoSave Miller_Brooks_Chapter_4_2_Start - Excel Search Stevie Miller SM File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments Times New Roman 14 A A General 1 TIX AY FO X Cut LECopy Format Painter === Ouv a Wrap Text === Merge & Center AutoSum Fill Clear Paste BIU ~ MA $ %) Insert Delete Format Analyze Sensitivity Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Data Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity H14 for Extra B C D E G H 1 J K L M N o P Q R 2A 13 14 15 Year 1 2 16 17 3 18 4 19 5 20 6 21 22 8 23 9 Beginning Balance $650,000.00 $634,144.60 $617,179.32 $599,026.47 $579,602.92 $558,819.72 $536,581.70 $512,787.02 S487,326.71 S460,084.18 $430,934.67 $381,100.09 $327,777.10 $270,721.50 S209,672.00 $144,349.04 $74,453.48 ($334.78) ($80,358.22) ($165,983.29) Annual Payment ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($61,355.40) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) ($80,000.00) Interest Expense $45,500.00 $44,390.12 S43,202.55 $41,931.85 $40,572.20 $39,117.38 $37,560.72 $35,895.09 $34,112.87 $32,205.89 $30,165.43 $26,677.01 $22,944.40 $18,950.50 $14,677.04 $10,104.43 $5,211.74 ($23.43) ($5,625.08) ($11,618.83) Principal Reduction ($15,855.40) ($16,965.28) ($18,152.85) ($19,423.55) ($20,783.20) ($22,238.02) ($23,794.68) ($25,460.31) ($27,242.53) ($29,149.51) ($49,834.57) ($53,322.99) ($57,055.60) ($61,049.50) ($65,322.96) ($69,895.57) ($74,788.26) ($80,023.43) ($85,625.08) ($91,618.83) Extra Principal $665,855.40 $651,109.88 $635,332.17 $618,450.02 $600,386.12 $581,057.74 $560,376.38 $538,247.33 $514,569.24 $489,233.69 S480,769.24 S434,423.09 $384,832.70 $331,770.99 $274,994.96 $214,244.61 $149,241.73 $79,688.65 $5,266.86 ($74,364.46) Ending Balance S634,144.60 S617,179.32 $599,026.47 $579,602.92 $558,819.72 $536,581.70 $512,787.02 $487,326.71 $460,084.18 $430,934.67 $381,100.09 $327,777.10 $270,721.50 $209,672.00 $144,349.04 $74,453.48 ($334.78) ($80,358.22) ($165,983.29) ($257,602.12) 24 10 25 11 26 12 13 27 28 14 29 15 30 16 31 17 32 18 33 19 34 20 4-2 (+ Ready 100% H Type here to search O X (1) 5:01 PM 3/29/2021