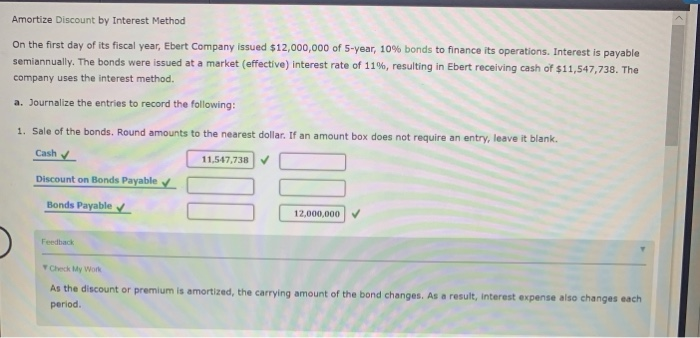

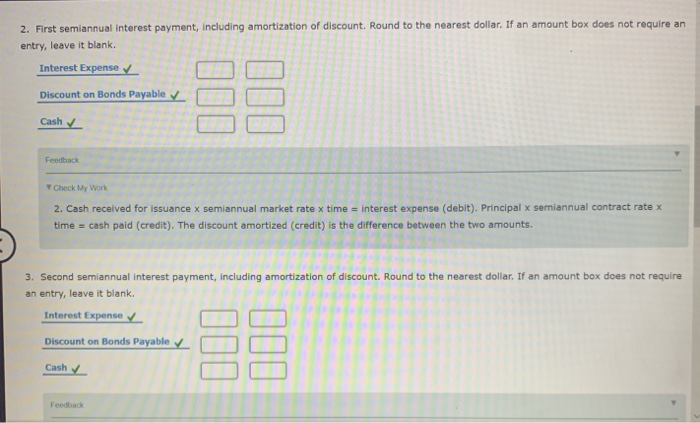

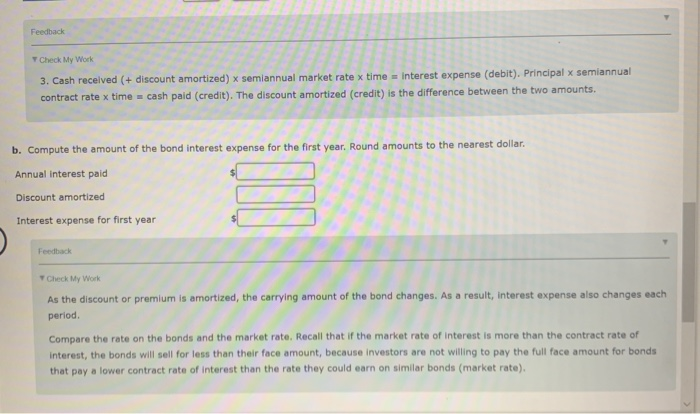

Amortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $12,000,000 of 5-year, 10 % bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 11%, resulting in Ebert receiving cash of $11,547,738. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round amounts to the nearest dollar. If an amount box does not require an entry,, leave it blank. Cash 11,547,738 Discount on Bonds Payable Bonds Payable 12,000,000 Feedback Y Check My Work As the discount or premium is amortized, the carrying amount of the bond changes. As a result, interest expense also changes each period. 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense Discount on Bonds Payable Cash Feedback Check My Work interest expense (debit). Principal x semiannual contract rate x 2. Cash received for issuance x semiannual market rate x time time cash paid (credit). The discount amortized (credit) is the difference between the two amounts. 3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense Discount on Bonds Payable Cash Feedback O00 O00 Feedback Check My Work interest expense (debit). Principal x semiannual 3. Cash recelved (+ discount amortized) x semiannual market rate x time cash paid (credit). The discount amortized (credit) is the difference between the two amounts. contract rate x time b. Compute the amount of the bond interest expense for the first year. Round amounts to the nearest dollar. Annual interest paid Discount amortized Interest expense for first year Feedback Check My Work As the discount or premium is amortized, the carrying amount of the bond changes. As a result, interest expense also changes each period. Compare the rate on the bonds and the market rate. Recall that if the market rate of interest is more than the contract rate of interest, the bonds will sell for less than their face amount, because investors are not willing to pay the full face amount for bonds that pay a lower contract rate of interest than the rate they could earn on similar bonds (market rate)