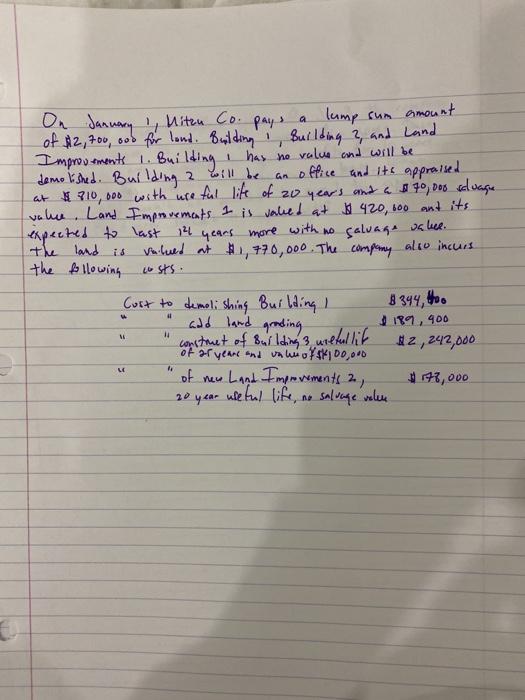

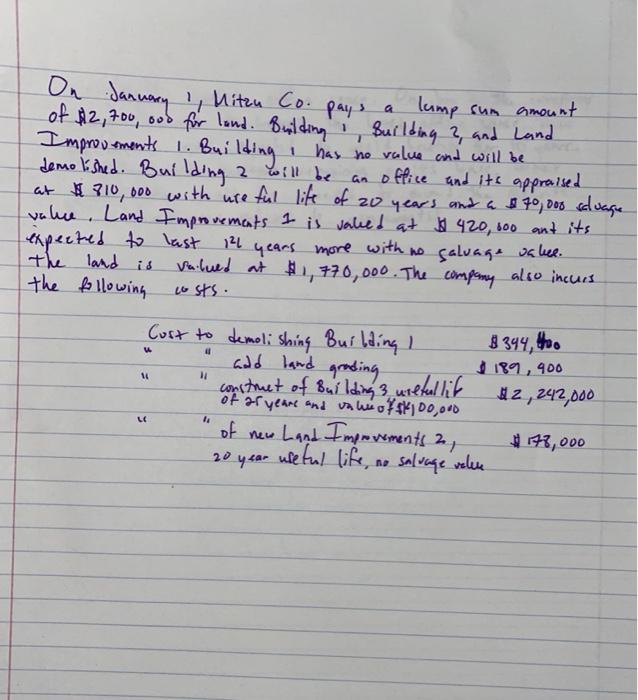

amount lump sum On January 1, Miten Co. pays a of $2,700,ood for land. Building building 2, and hand Improvements 1. Building I has no value and will be demolished. Building a be an office and its appraised at $810,000 with ureful life of 20 years and a $40,000 sluague. vahe Land Improvements I is valued at $420, 600 and its expected to last 14 years more with no salvage waleee. the land is valued at $1,770,000. The company also incurs. the following costs Cost to demolishing Building I 189,400 construct of Building 3 uretallit 12,242,000 of ar years and an off4100,000 of new Land Improvements 2, 43,000 20 year weetul life, no salvage velen 8344, 4. 41 and land grading 16 11 1 1 On January ! Miten Co. pays a lump sum amount of $2,700,ood for land. Building Building 2, and hand Improvements 1. Building has no value and will be demolished. Building a will be will be an office and its appraised. at $810,000 with useful life of 20 years and a $70,000 calvague value. Land Improvements I is valed at $420,000 and its expected to last 12 years more with no alvage salice. the land is valued at $1,770,000. The company also incurs the following to sts. Cost to demolishing Building I add land grading 189,900 construct of Building 3 uretallit 12,242,000 of ar years and value of $4100,000 of new Land Improvements 2, #173,000 20 year useful life, no salvage value 8344, 4o 14 LC amount lump sum On January 1, Miten Co. pays a of $2,700,ood for land. Building building 2, and hand Improvements 1. Building I has no value and will be demolished. Building a be an office and its appraised at $810,000 with ureful life of 20 years and a $40,000 sluague. vahe Land Improvements I is valued at $420, 600 and its expected to last 14 years more with no salvage waleee. the land is valued at $1,770,000. The company also incurs. the following costs Cost to demolishing Building I 189,400 construct of Building 3 uretallit 12,242,000 of ar years and an off4100,000 of new Land Improvements 2, 43,000 20 year weetul life, no salvage velen 8344, 4. 41 and land grading 16 11 1 1 On January ! Miten Co. pays a lump sum amount of $2,700,ood for land. Building Building 2, and hand Improvements 1. Building has no value and will be demolished. Building a will be will be an office and its appraised. at $810,000 with useful life of 20 years and a $70,000 calvague value. Land Improvements I is valed at $420,000 and its expected to last 12 years more with no alvage salice. the land is valued at $1,770,000. The company also incurs the following to sts. Cost to demolishing Building I add land grading 189,900 construct of Building 3 uretallit 12,242,000 of ar years and value of $4100,000 of new Land Improvements 2, #173,000 20 year useful life, no salvage value 8344, 4o 14 LC