Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kankam Ghana Ltd. Currently operates a long working capital cycle. Management is considering an initiative to reduce the cash cycle in order to manage

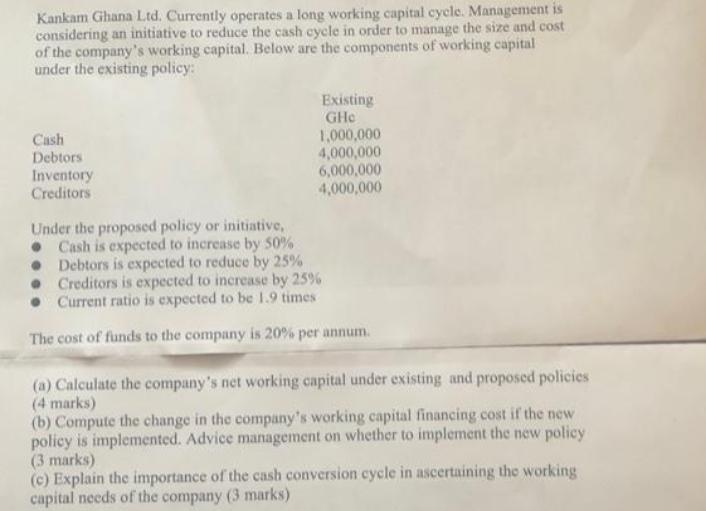

Kankam Ghana Ltd. Currently operates a long working capital cycle. Management is considering an initiative to reduce the cash cycle in order to manage the size and cost of the company's working capital. Below are the components of working capital under the existing policy: Cash Debtors Inventory Creditors Existing GHe 1,000,000 4,000,000 6,000,000 4,000,000 Under the proposed policy or initiative, Cash is expected to increase by 50% Debtors is expected to reduce by 25% Creditors is expected to increase by 25% Current ratio is expected to be 1.9 times The cost of funds to the company is 20% per annum. (a) Calculate the company's net working capital under existing and proposed policies (4 marks) (b) Compute the change in the company's working capital financing cost if the new policy is implemented. Advice management on whether to implement the new policy (3 marks) (c) Explain the importance of the cash conversion cycle in ascertaining the working capital needs of the company (3 marks)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Calculate the companys net working ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started