amswer all

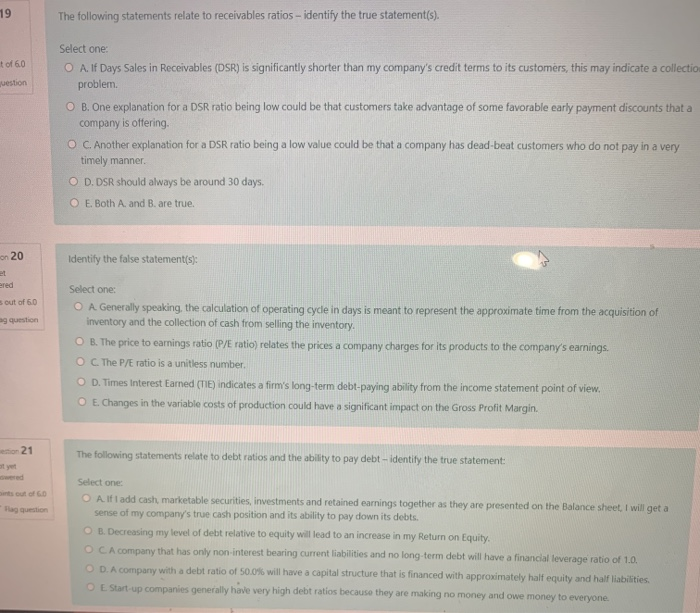

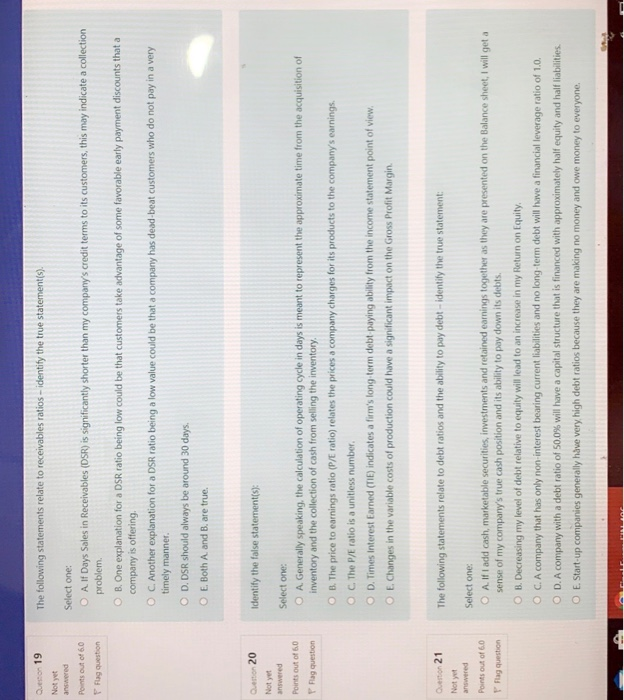

The following statements relate to receivables ratios - identify the true statement(s). Question 19 Not yet avered Points out of 6.0 Flag question Select one: O A If Days Sales in Receivables (DSR) is significantly shorter than my company's credit terms to its customers, this may indicate a collection problem. OB. One explanation for a DSR ratio being low could be that customers take advantage of some favorable early payment discounts that a company is offering O C. Another explanation for a DSR ratio being a low value could be that a company has dead-beat customers who do not pay in a very timely manner. O D. DSR should always be around 30 days. E. Both A. and B. are true. Questo 20 Identify the false statement(s); Not yet answered Points out of 60 Flag question Select one: O A. Generally speaking, the calculation of operating cycle in days is meant to represent the approximate time from the acquisition of inventory and the collection of cash from selling the inventory. OB. The price to earnings ratio (P/E ratio) relates the prices a company charges for its products to the company's earnings. OC. The P/E ratio is a unitless number, OD. Times Interest Earned (TIE) indicates a firm's long-term debt paying ability from the income statement point of view. E. Changes in the variable costs of production could have a significant impact on the Gross Profit Margin. Question 21 The following statements relate to debt ratios and the ability to pay debt - identify the true statement: Not yet answered Points out of 6.0 Flag question Select one: O A If I add cash, marketable securities, investments and retained earnings together as they are presented on the Balance sheet, I will get a sense of my company's true cash position and its ability to pay down its debts. OB. Decreasing my level of debt relative to equity will lead to an increase in my Return on Equity O C. A company that has only non-interest bearing current liabilities and no long-term debt will have a financial leverage ratio of 1,0. OD. A company with a debt ratio of 50,0% will have a capital structure that is financed with approximately half equity and half liabilities. O E. Start-up companies generally have very high debt ratios because they are making no money and owe money to everyone. 19 The following statements relate to receivables ratios - identify the true statement(s). t of 60 uestion Select one O A. If Days Sales in Receivables (DSR) is significantly shorter than my company's credit terms to its customers, this may indicate a collectio problem. O B. One explanation for a DSR ratio being low could be that customers take advantage of some favorable early payment discounts that a company is offering O C. Another explanation for a DSR ratio being a low value could be that a company has dead-beat customers who do not pay in a very timely manner O D. DSR should always be around 30 days. O E. Both A. and B. are true. on 20 Identify the false statement(s); et ered Sout of 60 ng question Select one: O A Generally speaking, the calculation of operating cycle in days is meant to represent the approximate time from the acquisition of inventory and the collection of cash from selling the inventory. O B. The price to earnings ratio (P/E ratio) relates the prices a company charges for its products to the company's earnings. O C The P/E ratio is a unitless number. D. Times Interest Earned (IE) indicates a firm's long-term debt-paying ability from the income statement point of view, O E. Changes in the variable costs of production could have a significant impact on the Gross Profit Margin. no 21 The following statements relate to debt ratios and the ability to pay debt - identify the true statement: out of 60 Mag question Select one O Alfi add cash, marketable securities, investments and retained earnings together as they are presented on the Balance sheet, I will get a sense of my company's true cash position and its ability to pay down its debts. B. Decreasing my level of debt relative to equity will lead to an increase in my Return on Equity OCA company that has only non-interest bearing current liabilities and no long-term debt will have a financial leverage ratio of 1.0. D. A company with a debt ratio of 50.0% will have a capital structure that is financed with approximately half equity and half liabilities. O E Start-up companies generally have very high debt ratios because they are making no money and owe money to everyone