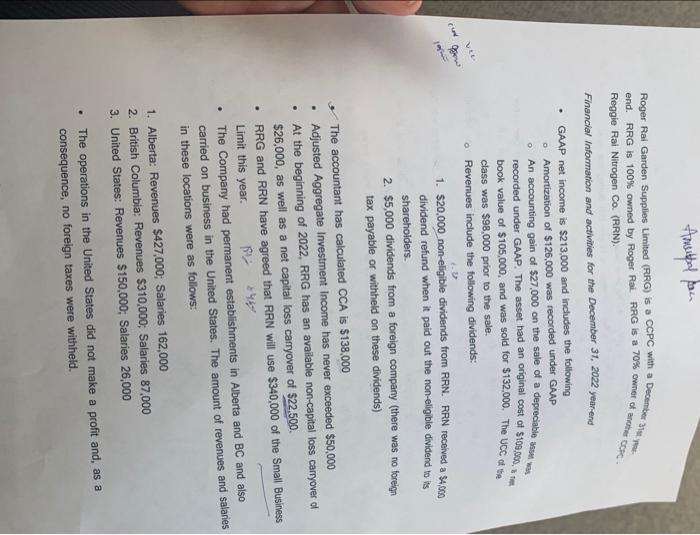

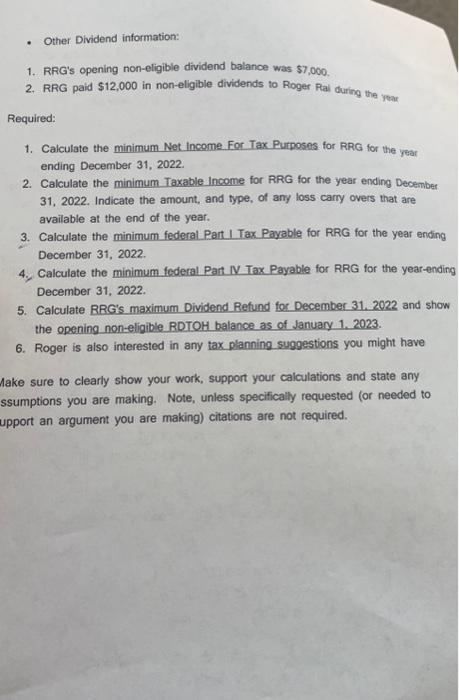

Amutpol par end. RRG is 100% owned by Roger Rai. RRG is a 70% owner of another Coffe. Reggie Rai Nitrogen Co. (RRN). Financial Information and activities for the December 31, 2022 year-end - GAAP net income is $213,000 and includes the following - Amortization of $126,000 was recorded under GAAP - An accounting gain of $27,000 on the sale of a depreciable asten was recorded under GAAP. The asset had an original cost of $109,000, it ne book value of $105,000, and was sold for $132,000. The UCC of the class was $98,000 prior to the sale. Revenues include the following dividends: 1. $20,000 non-eligible dividends from RRN. RRN received a $4,000 dividend refund when it paid out the non-eligible dividend to is shareholders. 2. $5,000 dividends from a foreign company (there was no foreign tax payable or withheld on these dividends) - The accountant has calculated CCA is $138,000 - Adjusted Aggregate Investment Income has never exceeded $50,000 - At the beginning of 2022, RRG has an avallable non-capital loss carryover of $26,000, as well as a net capital loss carryover of $22,500. - RRG and RRN have agreed that RRN will use $340,000 of the Small Business Limit this year. - The Company had permanent establishments in Alberta and BC and also carried on business in the United States. The amount of revenues and salarie in these locations were as follows: 1. Alberta: Revenues $427,000; Salaries 162,000 2. British Columbia: Revenues $310,000; Salaries 87,000 3. United States: Revenues $150,000; Salaries 26,000 - The operations in the United States did not make a profit and, as a consequence, no foreign taxes were withheld. 2. RRG paid $12,000 in non-eligible dividents to Rioger Rai during the Your Required: 1. Calculate the minimum Net income For Tax Purposes for RRG for the year ending December 31, 2022. 2. Calculate the minimum Taxable Income for RRG for the year ending Decentber 31, 2022. Indicate the amount, and type, of any loss carry overs that are available at the end of the year. 3. Calculate the minimum federal Part I Tax Payable for RRG for the year ending December 31, 2022. 4. Calculate the minimum federal Part IV Tax Payable for RRG for the year-ending December 31, 2022. 5. Calculate RRG's maximum Dividend Refund for December 31.2022 and show the opening non-eligible RDTOH balance as of January 1. 2023. 6. Roger is also interested in any tax planning suggestions you might have Make sure to clearly show your work, support your calculations and state any ssumptions you are making. Note, unless specifically requested (or needed to upport an argument you are making) citations are not required