Answered step by step

Verified Expert Solution

Question

1 Approved Answer

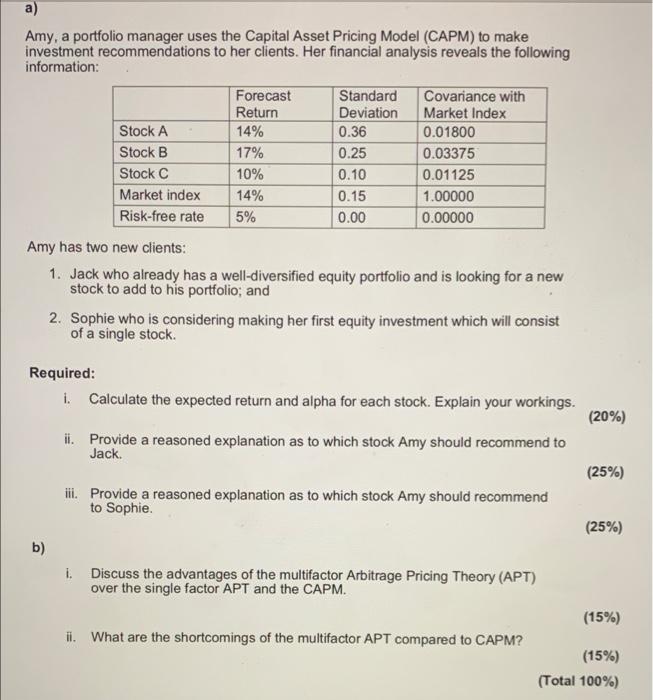

Amy, a portfolio manager uses the Capital Asset Pricing Model (CAPM) to make investment recommendations to her clients. Her financial analysis reveals the following

Amy, a portfolio manager uses the Capital Asset Pricing Model (CAPM) to make investment recommendations to her clients. Her financial analysis reveals the following information: Forecast Standard Covariance with Return Deviation Market Index Stock A 14% 0.36 0.01800 Stock B 17% 0.25 0.03375 Stock C 10% 0.10 0.01125 Market index 14% 0.15 1.00000 Risk-free rate 5% 0.00 0.00000 Amy has two new clients: 1. Jack who already has a well-diversified equity portfolio and is looking for a new stock to add to his portfolio; and 2. Sophie who is considering making her first equity investment which will consist of a single stock. Required: i. Calculate the expected return and alpha for each stock. Explain your workings. b) (20%) ii. Provide a reasoned explanation as to which stock Amy should recommend to Jack. (25%) iii. Provide a reasoned explanation as to which stock Amy should recommend to Sophie. (25%) i. Discuss the advantages of the multifactor Arbitrage Pricing Theory (APT) over the single factor APT and the CAPM. (15%) ii. What are the shortcomings of the multifactor APT compared to CAPM? (15%) (Total 100%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly lets complete the calculations and explanations for each part of the question a i Expected return and alpha for each stock For Stock A ERA 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started