Answered step by step

Verified Expert Solution

Question

1 Approved Answer

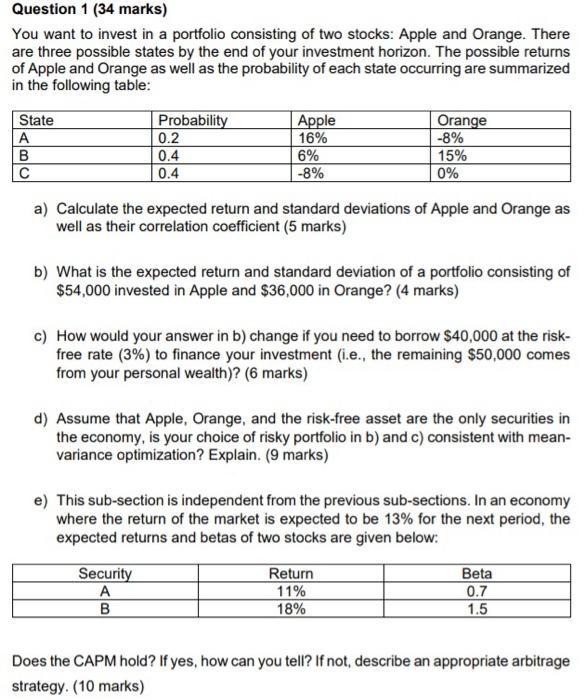

Question 1 (34 marks) You want to invest in a portfolio consisting of two stocks: Apple and Orange. There are three possible states by

Question 1 (34 marks) You want to invest in a portfolio consisting of two stocks: Apple and Orange. There are three possible states by the end of your investment horizon. The possible returns of Apple and Orange as well as the probability of each state occurring are summarized in the following table: State A B C Probability 0.2 0.4 0.4 Apple 16% 6% -8% a) Calculate the expected return and standard deviations of Apple and Orange as well as their correlation coefficient (5 marks) Orange -8% 15% 0% b) What is the expected return and standard deviation of a portfolio consisting of $54,000 invested in Apple and $36,000 in Orange? (4 marks) Security A B c) How would your answer in b) change if you need to borrow $40,000 at the risk- free rate (3%) to finance your investment (i.e., the remaining $50,000 comes from your personal wealth)? (6 marks) d) Assume that Apple, Orange, and the risk-free asset are the only securities in the economy, is your choice of risky portfolio in b) and c) consistent with mean- variance optimization? Explain. (9 marks) e) This sub-section is independent from the previous sub-sections. In an economy where the return of the market is expected to be 13% for the next period, the expected returns and betas of two stocks are given below: Return 11% 18% Beta 0.7 1.5 Does the CAPM hold? If yes, how can you tell? If not, describe an appropriate arbitrage strategy. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the expected return and standard deviations of Apple and Orange as well as their correlation coefficient we can use the given data Expected Return The expected return of a security is c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started