Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering buying a new guitar worth $10,000. The dealer offers you a financing package. You need to make a deposit of 20%

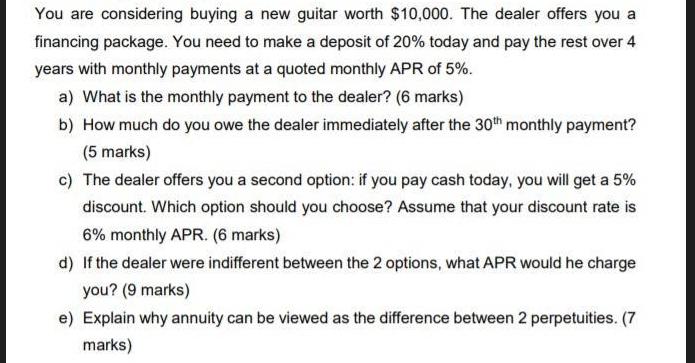

You are considering buying a new guitar worth $10,000. The dealer offers you a financing package. You need to make a deposit of 20% today and pay the rest over 4 years with monthly payments at a quoted monthly APR of 5%. a) What is the monthly payment to the dealer? (6 marks) b) How much do you owe the dealer immediately after the 30th monthly payment? (5 marks) c) The dealer offers you a second option: if you pay cash today, you will get a 5% discount. Which option should you choose? Assume that your discount rate is 6% monthly APR. (6 marks) d) If the dealer were indifferent between the 2 options, what APR would he charge you? (9 marks) e) Explain why annuity can be viewed as the difference between 2 perpetuities. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the monthly payment we can use the formula for installment loans M P 1 rn 1 rn 1 where M is the monthly payment P is the principal amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started