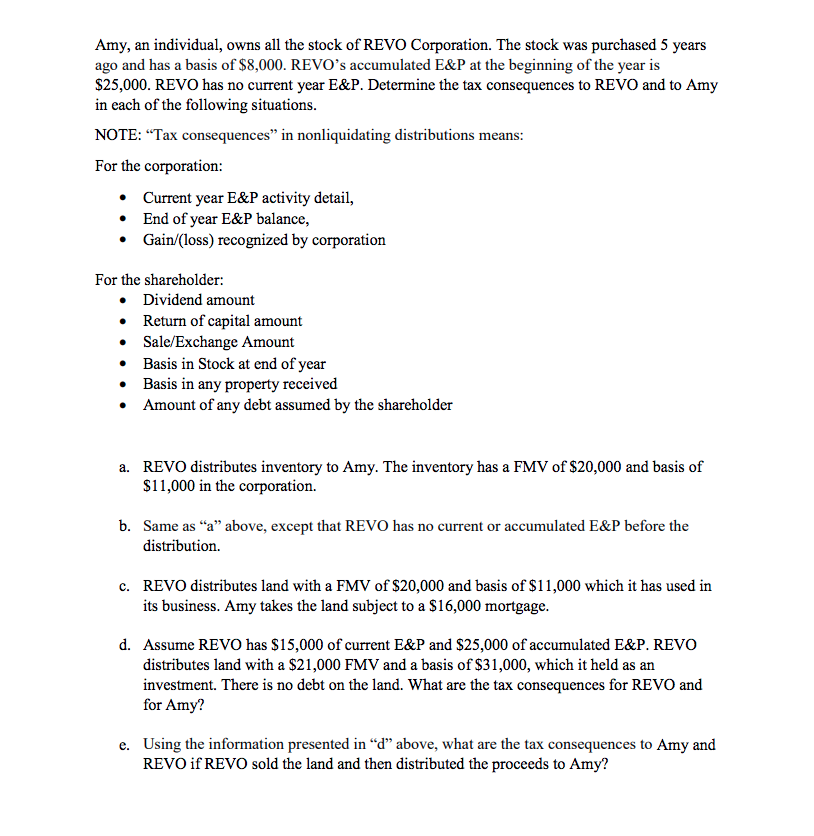

Amy, an individual, owns all the stock of REVO Corporation. The stock was purchased 5 years ago and has a basis of $8,000. REVO's accumulated E&P at the beginning of the year is $25,000. REVO has no current year E&P. Determine the tax consequences to REVO and to Amy in each of the following situations. NOTE: Tax consequences in nonliquidating distributions means: For the corporation: Current year E&P activity detail, End of year E&P balance, Gain/(loss) recognized by corporation For the shareholder: Dividend amount Return of capital amount Sale/Exchange Amount Basis in Stock at end of year Basis in any property received Amount of any debt assumed by the shareholder a. REVO distributes inventory to Amy. The inventory has a FMV of $20,000 and basis of $11,000 in the corporation. b. Same as a above, except that REVO has no current or accumulated E&P before the distribution. C. REVO distributes land with a FMV of $20,000 and basis of $11,000 which it has used in its business. Amy takes the land subject to a $16,000 mortgage. d. Assume REVO has $15,000 of current E&P and $25,000 of accumulated E&P. REVO distributes land with a $21,000 FMV and a basis of $31,000, which it held as an investment. There is no debt on the land. What are the tax consequences for REVO and for Amy? e. Using the information presented in dabove, what are the tax consequences to Amy and REVO if REVO sold the land and then distributed the proceeds to Amy? Amy, an individual, owns all the stock of REVO Corporation. The stock was purchased 5 years ago and has a basis of $8,000. REVO's accumulated E&P at the beginning of the year is $25,000. REVO has no current year E&P. Determine the tax consequences to REVO and to Amy in each of the following situations. NOTE: Tax consequences in nonliquidating distributions means: For the corporation: Current year E&P activity detail, End of year E&P balance, Gain/(loss) recognized by corporation For the shareholder: Dividend amount Return of capital amount Sale/Exchange Amount Basis in Stock at end of year Basis in any property received Amount of any debt assumed by the shareholder a. REVO distributes inventory to Amy. The inventory has a FMV of $20,000 and basis of $11,000 in the corporation. b. Same as a above, except that REVO has no current or accumulated E&P before the distribution. C. REVO distributes land with a FMV of $20,000 and basis of $11,000 which it has used in its business. Amy takes the land subject to a $16,000 mortgage. d. Assume REVO has $15,000 of current E&P and $25,000 of accumulated E&P. REVO distributes land with a $21,000 FMV and a basis of $31,000, which it held as an investment. There is no debt on the land. What are the tax consequences for REVO and for Amy? e. Using the information presented in dabove, what are the tax consequences to Amy and REVO if REVO sold the land and then distributed the proceeds to Amy