Question

Amy and Bob are forming an S corp each with 50% ownership interest. Amy will work 2000 hours and Bob will work 1000. Amy will

Amy and Bob are forming an S corp each with 50% ownership interest. Amy will work 2000 hours and Bob will work 1000. Amy will invest $10,000 in cash and Bob will invest $100,000. Amy's father is willing to give them a $100,000 loan and does not want to be an owner. Reasonable salary for Amy is 75,000 and for Bob 60,000.

Amy has no other outside income, she rents an apartment at $800 a month and donates $100 per month total to her favorite charities.

Bob's taxable income other than any earnings from the business will be: salary of 75,000 from another job, interest income of $3,000, dividends (qualified) of $6,000 and a net capital loss carry over of $32,500. He recently purchased a house and has $100,000 mortgage at 5% interest and real estate taxes of $4,500 annually.

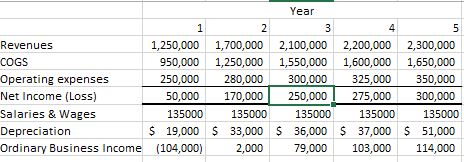

Revenues, COGS, Operating Expenses and Net Income were given to us. We were told the equipment purchases and I calculated depreciation from there.

Revenues, COGS, Operating Expenses and Net Income were given to us. We were told the equipment purchases and I calculated depreciation from there.

How would we calculate both of their personal AGI, Taxable Income, etc.?

Year Revenues 1,250,000 COGS 950,000 Operating expenses 250,000 Net Income (Loss) 50,000 Salaries & Wages 135000 Depreciation $ 19,000 Ordinary Business Income (104,000) 1,700,000 1,250,000 280,000 170,000 135000 $ 33,000 2,000 2,100,000 2,200,000 1,550,000 1,600,000 300,000 325,000 250,000! 275,000 135000 135000 $ 36,000 $ 37,000 79,000 103,000 2,300,000 1,650,000 350,000 300,000 135000 $ 51,000 114,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started