Answered step by step

Verified Expert Solution

Question

1 Approved Answer

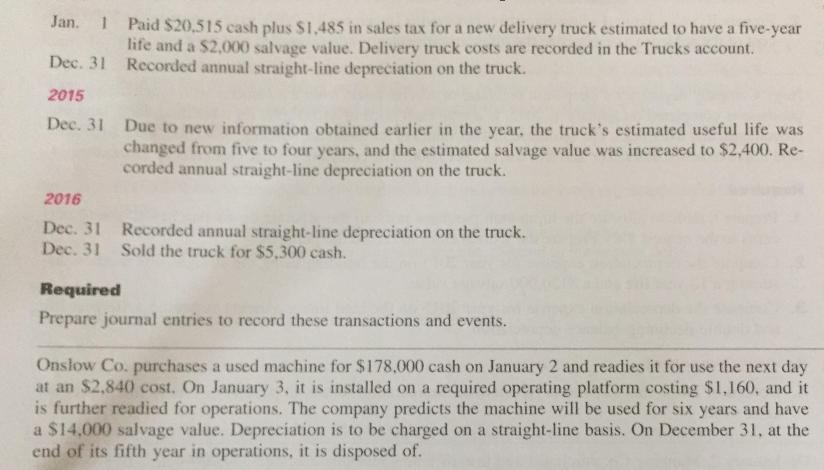

Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estimated to have a five-year life and a $2,000 salvage value.

Paid $20,515 cash plus $1,485 in sales tax for a new delivery truck estimated to have a five-year life and a $2,000 salvage value. Delivery truck costs are recorded in the Trucks account. Recorded annual straight-line depreciation on the truck. Jan. 1 Dec. 31 2015 Dec. 31 Due to new information obtained earlier in the year, the truck's estimated useful life was changed from five to four years, and the estimated salvage value was increased to $2,400. Re- corded annual straight-line depreciation on the truck. 2016 Dec. 31 Recorded annual straight-line depreciation on the truck. Dec. 31 Sold the truck for $5,300 cash. Required Prepare journal entries to record these transactions and events. Onslow Co. purchases a used machine for $178,000 cash on January 2 and readies it for use the next day at an $2,840 cost. On January 3, it is installed on a required operating platform costing $1,160, and it is further readied for operations. The company predicts the machine will be used for six years and have a $14,000 salvage value. Depreciation is to be charged on a straight-line basis. On December 31, at the end of its fifth year in operations, it is disposed of.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Required Date 010116 In the books of youshi eo Journal Entquies LF particulars Deliver...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started