Question

An accounting firm uses activity-based costing. The firm has to drop one of the following three customers, which consume the following activities. Direct costs

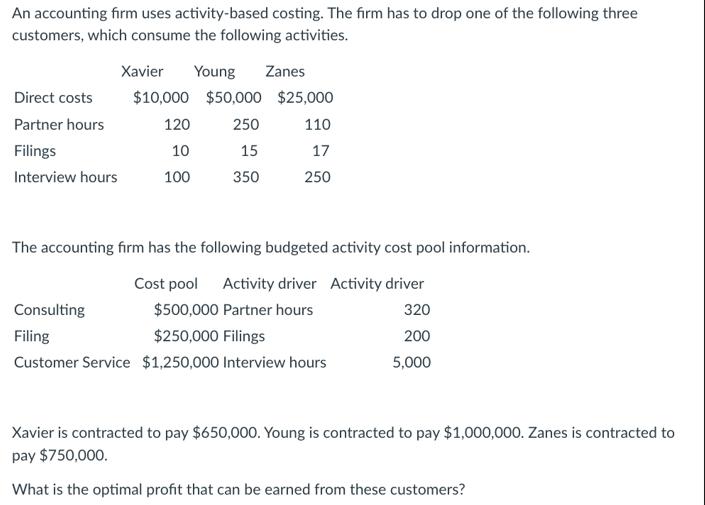

An accounting firm uses activity-based costing. The firm has to drop one of the following three customers, which consume the following activities. Direct costs Partner hours Filings Interview hours Xavier Young Zanes $10,000 $50,000 $25,000 250 110 15 17 350 250 120 10 100 The accounting firm has the following budgeted activity cost pool information. Cost pool Activity driver Activity driver Consulting $500,000 Partner hours 320 Filing $250,000 Filings 200 Customer Service $1,250,000 Interview hours 5,000 Xavier is contracted to pay $650,000. Young is contracted to pay $1,000,000. Zanes is contracted to pay $750,000. What is the optimal profit that can be earned from these customers?

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

6th Canadian edition

013257084X, 1846589207, 978-0132570848

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App