Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An activist fund (i.e. an institutional investor which seeks to change aspects of a company's operations) has taken a 5% shareholding in Sleepy plc

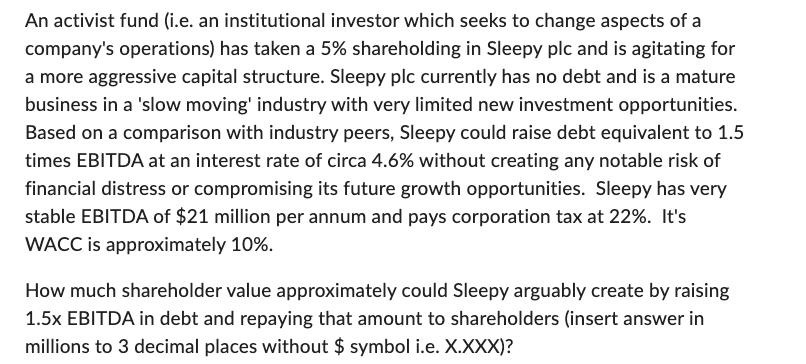

An activist fund (i.e. an institutional investor which seeks to change aspects of a company's operations) has taken a 5% shareholding in Sleepy plc and is agitating for a more aggressive capital structure. Sleepy plc currently has no debt and is a mature business in a 'slow moving' industry with very limited new investment opportunities. Based on a comparison with industry peers, Sleepy could raise debt equivalent to 1.5 times EBITDA at an interest rate of circa 4.6% without creating any notable risk of financial distress or compromising its future growth opportunities. Sleepy has very stable EBITDA of $21 million per annum and pays corporation tax at 22%. It's WACC is approximately 10%. How much shareholder value approximately could Sleepy arguably create by raising 1.5x EBITDA in debt and repaying that amount to shareholders (insert answer in millions to 3 decimal places without $ symbol i.e. X.XXX)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started