Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An actuarial student is using Empirical Bayes Credibility Theory Model 2 to calculate credibility premiums for a group of insurers. The student has analysed

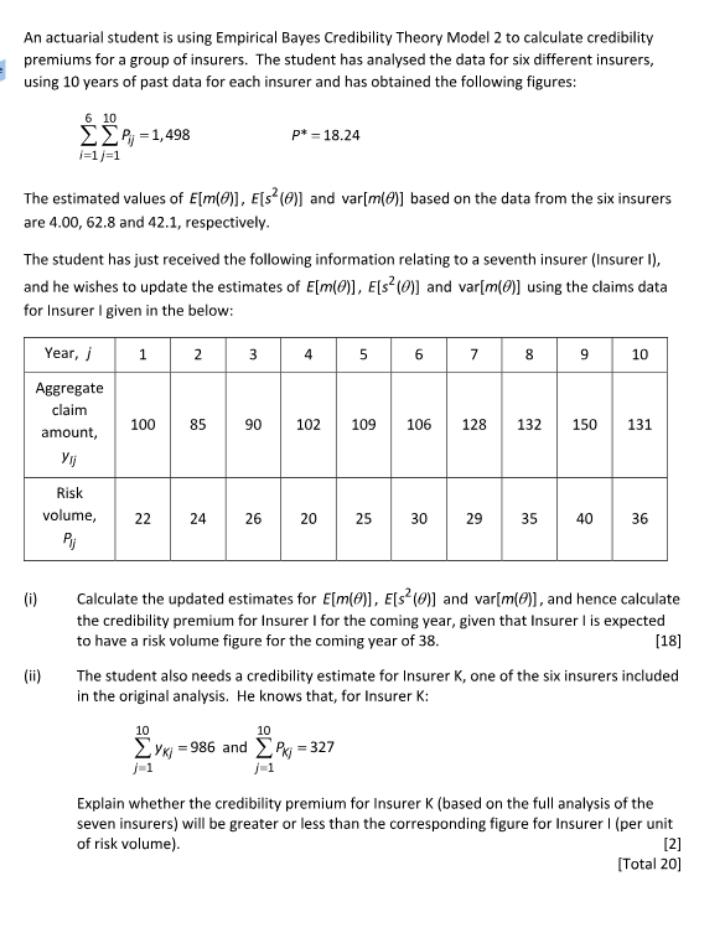

An actuarial student is using Empirical Bayes Credibility Theory Model 2 to calculate credibility premiums for a group of insurers. The student has analysed the data for six different insurers, using 10 years of past data for each insurer and has obtained the following figures: 6 10 =1,498 1=1 /=1 The estimated values of E[m(0)], E[s (0)] and var[m()] based on the data from the six insurers are 4.00, 62.8 and 42.1, respectively. The student has just received the following information relating to a seventh insurer (Insurer I), and he wishes to update the estimates of E[m(0)], E[s (0)] and var[m(0)] using the claims data for Insurer I given in the below: Year, j Aggregate claim amount, Yij (i) Risk volume, Pj (ii) 1 2 22 100 85 90 3 24 p*= 18.24 26 4 20 5 102 109 106 10 10 =986 and = 327 j-1 6 25 30 7 128 29 8 00 132 35 9 150 10 131 40 36 Calculate the updated estimates for E[m(0)], E[S (0)] and var[m(0)], and hence calculate the credibility premium for Insurer I for the coming year, given that Insurer I is expected to have a risk volume figure for the coming year of 38. [18] The student also needs a credibility estimate for Insurer K, one of the six insurers included in the original analysis. He knows that, for Insurer K: Explain whether the credibility premium for Insurer K (based on the full analysis of the seven insurers) will be greater or less than the corresponding figure for Insurer I (per unit of risk volume). [2] [Total 20]

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

i To update the estimates of the hyperparameters Let n number of insurers 7 Let T ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started