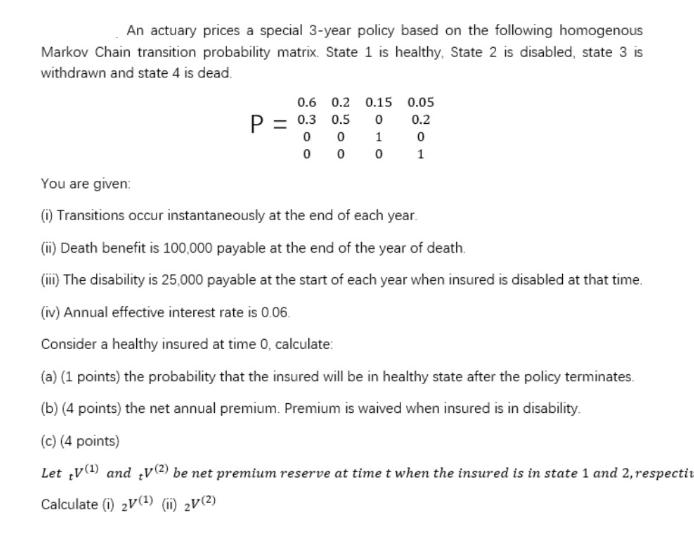

An actuary prices a special 3-year policy based on the following homogenous Markov Chain transition probability matrix. State 1 is healthy, State 2 is

An actuary prices a special 3-year policy based on the following homogenous Markov Chain transition probability matrix. State 1 is healthy, State 2 is disabled, state 3 is withdrawn and state 4 is dead. 0.6 0.2 0.15 0.05 0.2 0 P = 0.3 0.5 0 0 0 1 0 0 0 1 You are given: (i) Transitions occur instantaneously at the end of each year (ii) Death benefit is 100,000 payable at the end of the year of death. (iii) The disability is 25,000 payable at the start of each year when insured is disabled at that time. (iv) Annual effective interest rate is 0.06. Consider a healthy insured at time 0, calculate: (a) (1 points) the probability that the insured will be in healthy state after the policy terminates (b) (4 points) the net annual premium. Premium is waived when insured is in disability. (c) (4 points) Let V and V(2) be net premium reserve at time t when the insured is in state 1 and 2, respectiv Calculate (1) 2V(1) (11) 2V (2) An actuary prices a special 3-year policy based on the following homogenous Markov Chain transition probability matrix. State 1 is healthy, State 2 is disabled, state 3 is withdrawn and state 4 is dead. 0.6 0.2 0.15 0.05 0.2 0 P = 0.3 0.5 0 0 0 1 0 0 0 1 You are given: (i) Transitions occur instantaneously at the end of each year (ii) Death benefit is 100,000 payable at the end of the year of death. (iii) The disability is 25,000 payable at the start of each year when insured is disabled at that time. (iv) Annual effective interest rate is 0.06. Consider a healthy insured at time 0, calculate: (a) (1 points) the probability that the insured will be in healthy state after the policy terminates (b) (4 points) the net annual premium. Premium is waived when insured is in disability. (c) (4 points) Let V and V(2) be net premium reserve at time t when the insured is in state 1 and 2, respectiv Calculate (1) 2V(1) (11) 2V (2) An actuary prices a special 3-year policy based on the following homogenous Markov Chain transition probability matrix. State 1 is healthy, State 2 is disabled, state 3 is withdrawn and state 4 is dead. 0.6 0.2 0.15 0.05 0.2 0 P = 0.3 0.5 0 0 0 1 0 0 0 1 You are given: (i) Transitions occur instantaneously at the end of each year (ii) Death benefit is 100,000 payable at the end of the year of death. (iii) The disability is 25,000 payable at the start of each year when insured is disabled at that time. (iv) Annual effective interest rate is 0.06. Consider a healthy insured at time 0, calculate: (a) (1 points) the probability that the insured will be in healthy state after the policy terminates (b) (4 points) the net annual premium. Premium is waived when insured is in disability. (c) (4 points) Let V and V(2) be net premium reserve at time t when the insured is in state 1 and 2, respectiv Calculate (1) 2V(1) (11) 2V (2)

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the requested values well use the Markov Chain and actuarial principles Lets break down ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started