Answered step by step

Verified Expert Solution

Question

1 Approved Answer

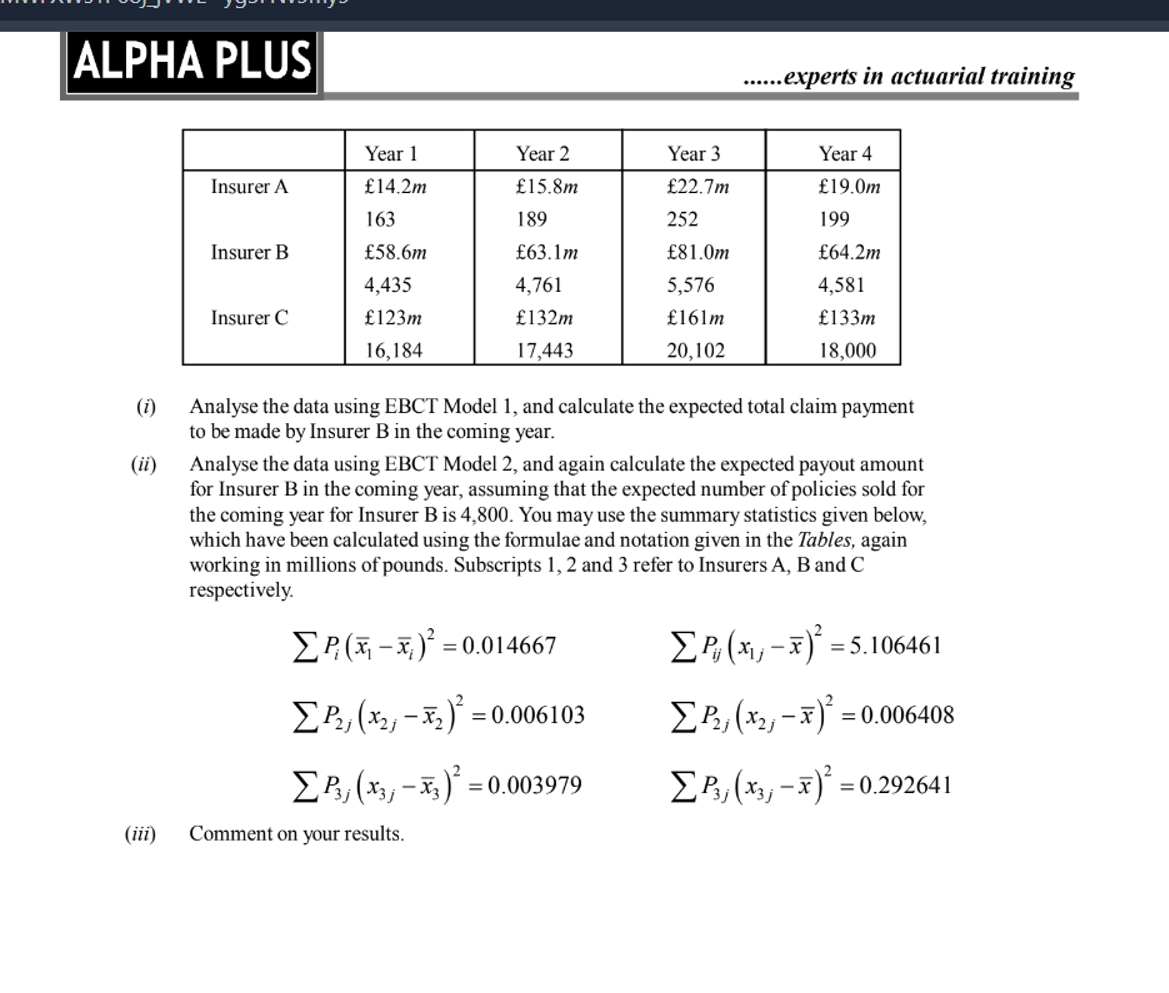

An actuary wishes to analyse the amounts paid by a group of insurers on their respective portfolios of com - mercial property insurance policies using

An actuary wishes to analyse the amounts paid by a group of insurers on their respective portfolios of com

mercial property insurance policies using the models of Empirical Bayes Credibility Theory.

The actuary obtains the following information about the amounts of claim payments made and the number of

policies sold for each of three different insurers. The data obtained are as follows.

Insurer A m m m m

Insurer B m m m m

Insurer C m m m m

i Analyse the data using EBCT Model and calculate the expected total claim payment

to be made by Insurer B in the coming year.

ii Analyse the data using EBCT Model and again calculate the expected payout amount

for Insurer B in the coming year, assuming that the expected number of policies sold for

the coming year for Insurer B is You may use the summary statistics given below,

which have been calculated using the formulae and notation given in the Tables, again

working in millions of pounds. Subscripts and refer to Insurers A B and C

respectively.

P x x i i

P x x ij j

P x x j j

P x x j j

P x x j j

P x x j j

iii Comment on your results.i Analyse the data using EBCT Model and calculate the expected total claim payment

to be made by Insurer B in the coming year.

ii Analyse the data using EBCT Model and again calculate the expected payout amount

for Insurer B in the coming year, assuming that the expected number of policies sold for

the coming year for Insurer B is You may use the summary statistics given below,

which have been calculated using the formulae and notation given in the Tables, again

working in millions of pounds. Subscripts and refer to Insurers A B and C

respectively.

iii Comment on your results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started