Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An additional standard deduction is allowed for: Lesson 4 ASSI Best Solutions is a retail merchandiser selling computer equipment. Best uses the gross method of

An additional standard deduction is allowed for:

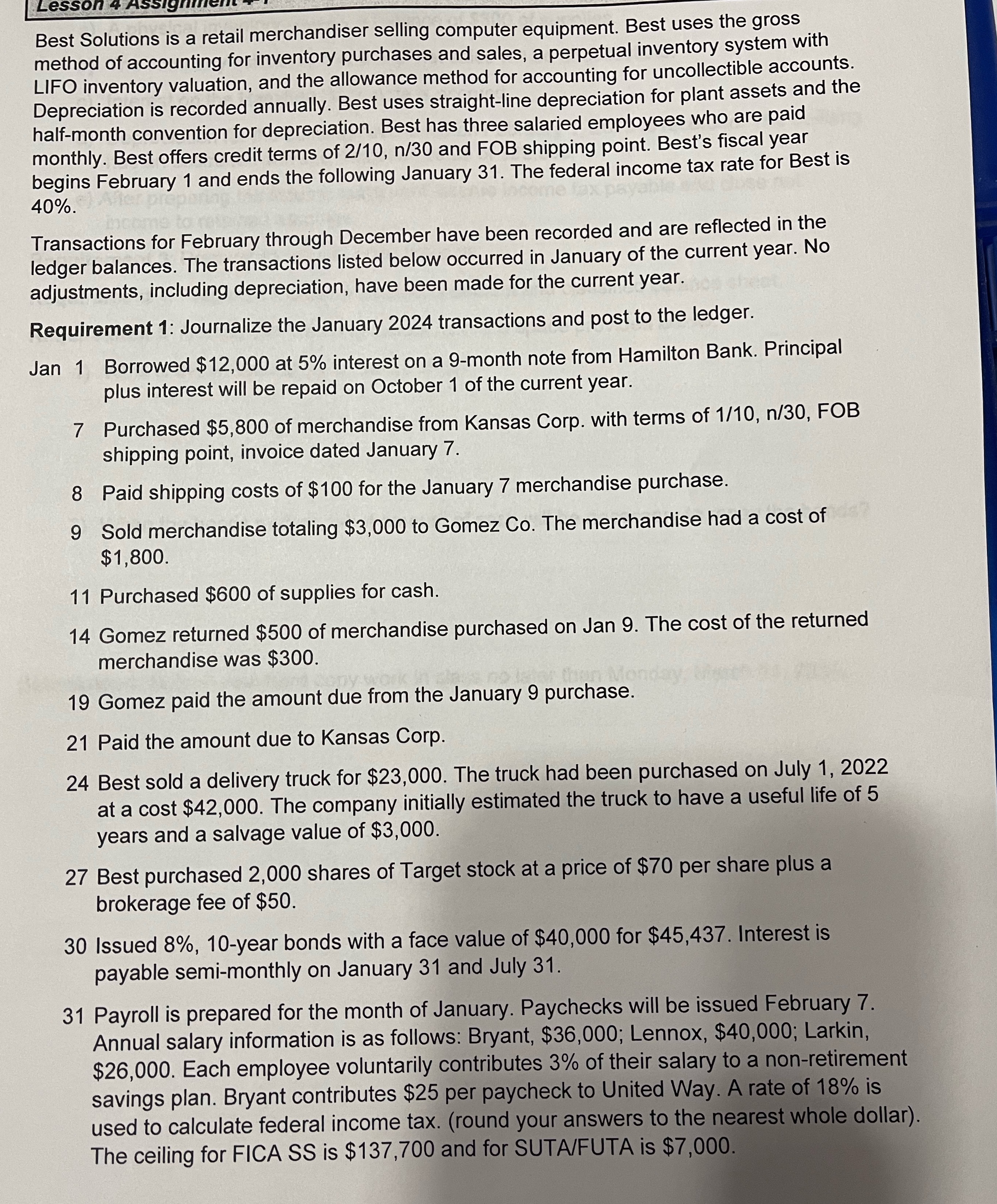

Lesson 4 ASSI Best Solutions is a retail merchandiser selling computer equipment. Best uses the gross method of accounting for inventory purchases and sales, a perpetual inventory system with LIFO inventory valuation, and the allowance method for accounting for uncollectible accounts. Depreciation is recorded annually. Best uses straight-line depreciation for plant assets and the half-month convention for depreciation. Best has three salaried employees who are paid monthly. Best offers credit terms of 2/10, n/30 and FOB shipping point. Best's fiscal year begins February 1 and ends the following January 31. The federal income tax rate for Best is 40%. Transactions for February through December have been recorded and are reflected in the ledger balances. The transactions listed below occurred in January of the current year. No adjustments, including depreciation, have been made for the current year. Requirement 1: Journalize the January 2024 transactions and post to the ledger. Jan 1 Borrowed $12,000 at 5% interest on a 9-month note from Hamilton Bank. Principal plus interest will be repaid on October 1 of the current year. 7 Purchased $5,800 of merchandise from Kansas Corp. with terms of 1/10, n/30, FOB shipping point, invoice dated January 7. 8 Paid shipping costs of $100 for the January 7 merchandise purchase. 9 Sold merchandise totaling $3,000 to Gomez Co. The merchandise had a cost of $1,800. 11 Purchased $600 of supplies for cash. 14 Gomez returned $500 of merchandise purchased on Jan 9. The cost of the returned merchandise was $300. er than Mo 19 Gomez paid the amount due from the January 9 purchase. 21 Paid the amount due to Kansas Corp. 24 Best sold a delivery truck for $23,000. The truck had been purchased on July 1, 2022 at a cost $42,000. The company initially estimated the truck to have a useful life of 5 years and a salvage value of $3,000. 27 Best purchased 2,000 shares of Target stock at a price of $70 per share plus a brokerage fee of $50. 30 Issued 8%, 10-year bonds with a face value of $40,000 for $45,437. Interest is payable semi-monthly on January 31 and July 31. 31 Payroll is prepared for the month of January. Paychecks will be issued February 7. Annual salary information is as follows: Bryant, $36,000; Lennox, $40,000; Larkin, $26,000. Each employee voluntarily contributes 3% of their salary to a non-retirement savings plan. Bryant contributes $25 per paycheck to United Way. A rate of 18% is used to calculate federal income tax. (round your answers to the nearest whole dollar). The ceiling for FICA SS is $137,700 and for SUTA/FUTA is $7,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started