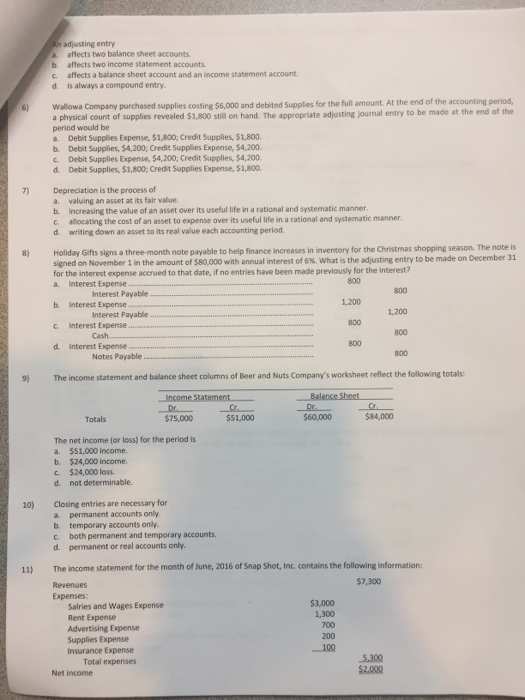

An adjusting entry a. affects two balance sheet accounts b. affects two income statement accounts. c affects a balance sheet account and an income statement account d. is always a compound entry Wallowa Company purchased supplies costing $6,000 and debited Supplies for the full amount. At the end of the accounting period a physical count of supplies revealed $1,800 still on hand. The appropriate adjusting journal entry to be made at the end of the period would be a. Debit Supplies Expense, $1,800; Credit Supplies, $1,800 b. Debit Supplies, $4,200, Credit Supplies Expense, $4,200 c Debit Supplies Expense, $4,200; Credit Supplies, $4,200 d. Debit Supplies, $1,800, Credit Supplies Expense, $1,800. 7) Depreciation is the process of a. valuing an asset at its fair value b. increasing the value of an asset over its useful life in a rational and systematic manner c allocating the cost of an asset to expense over its useful life in a rational and systematic manner d. writing down an asset to its real value each accounting period 8) Holiday Gifts signs a three-month note payable to help finance increases in inventory for the Christmas shopping season. The note is signed on November 1 in the amount of S80.000 with annual interest of 6%, what isthe a usting entry to be made on December 31 for the interest expense accrued to that date, if no entries have been made previously for the interest? a. Interest Expense 800 800 Interest Payable b. interest Expense c. Interest Expense d. Interest Expense Interest Payable 800 800 800 Notes Payable 9) The income statement and balance sheet columns of Beer and Nuts Company's worksheet reflect the following totals: 551,000 $60,000 Totals $75,000 The net income (or loss) for the period is a. $$1,000 income. b. $24,000 income. c $24,000 loss. d. not determinable. 10) Closing entries are necessary for a permanent accounts only. b. temporary accounts only. c. both permanent and temporary accounts. d. permanent or real accounts only. 11) The income statement for the month of lune, 2016 of Snap Shot, Inc. contains the following information $7,300 Revenues Expenses: Salries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense 53,000 1,300 700 200 Total expenses Net income