Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An agribusiness firm is faced with price risk in a contract to deliver a shipment of corn gluten feed for which there is not futures

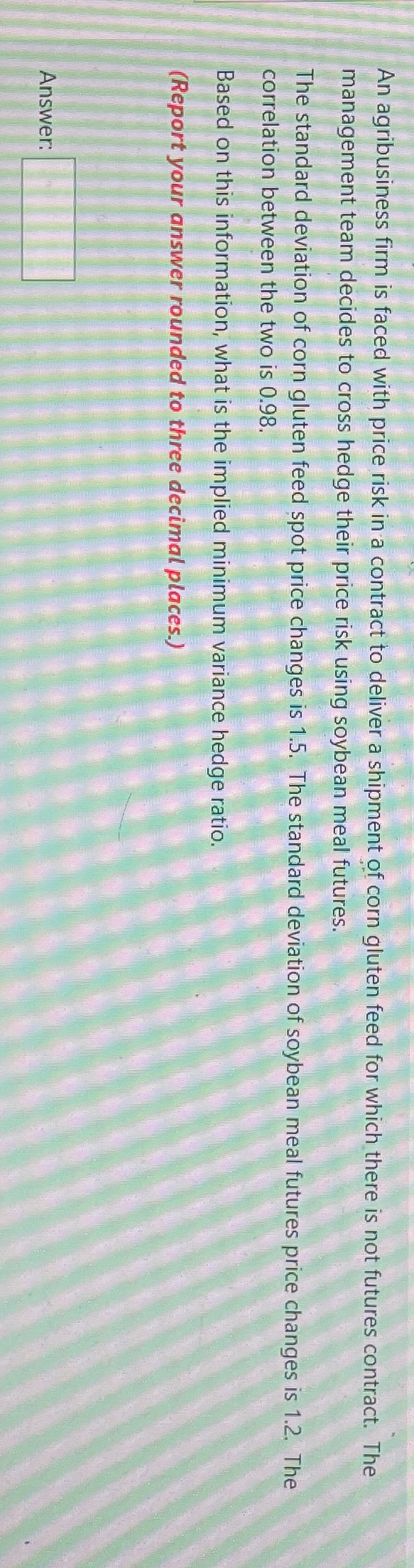

An agribusiness firm is faced with price risk in a contract to deliver a shipment of corn gluten feed for which there is not futures contract. The management team decides to cross hedge their price risk using soybean meal futures.

The standard deviation of corn gluten feed spot price changes is The standard deviation of soybean meal futures price changes is The correlation between the two is

Based on this information, what is the implied minimum variance hedge ratio.

Report your answer rounded to three decimal places.

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started