Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An airline considers purchasing a new airplane. The purchase requires the company to pay $10 million today. Once taken, the new airplane is expected

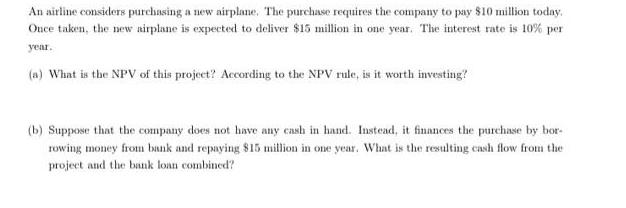

An airline considers purchasing a new airplane. The purchase requires the company to pay $10 million today. Once taken, the new airplane is expected to deliver $15 million in one year. The interest rate is 10% per year. (a) What is the NPV of this project? According to the NPV rule, is it worth investing? (b) Suppose that the company does not have any cash in hand. Instead, it finances the purchase by bor- rowing money from bank and repaying $15 million in one year. What is the resulting cash flow from the project and the bank loan combined?

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the Net Present Value NPV of the project we need to discount the future cash inflow 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started