Question

The stock KZ has an equity beta of 1.8. The market risk premium is 5% and the current risk-free rate is 3%. The company

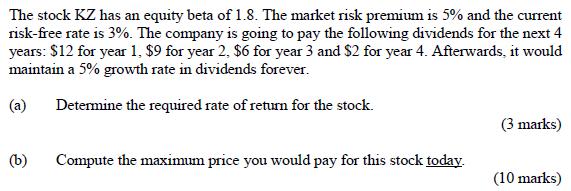

The stock KZ has an equity beta of 1.8. The market risk premium is 5% and the current risk-free rate is 3%. The company is going to pay the following dividends for the next 4 years: $12 for year 1, $9 for year 2, $6 for year 3 and $2 for year 4. Afterwards, it would maintain a 5% growth rate in dividends forever. (a) Determine the required rate of return for the stock. (b) Compute the maximum price you would pay for this stock today. (3 marks) (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the required rate of return for the stock KZ in part a you can use the Capital Asset Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford, David A. Stangeland, Andras Marosi

1st canadian edition

978-0133400694

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App